Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?

The agency has signaled increased scrutiny of nonreportable mergers in healthcare.

Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?What would happen if the Big Four became the Big Three?

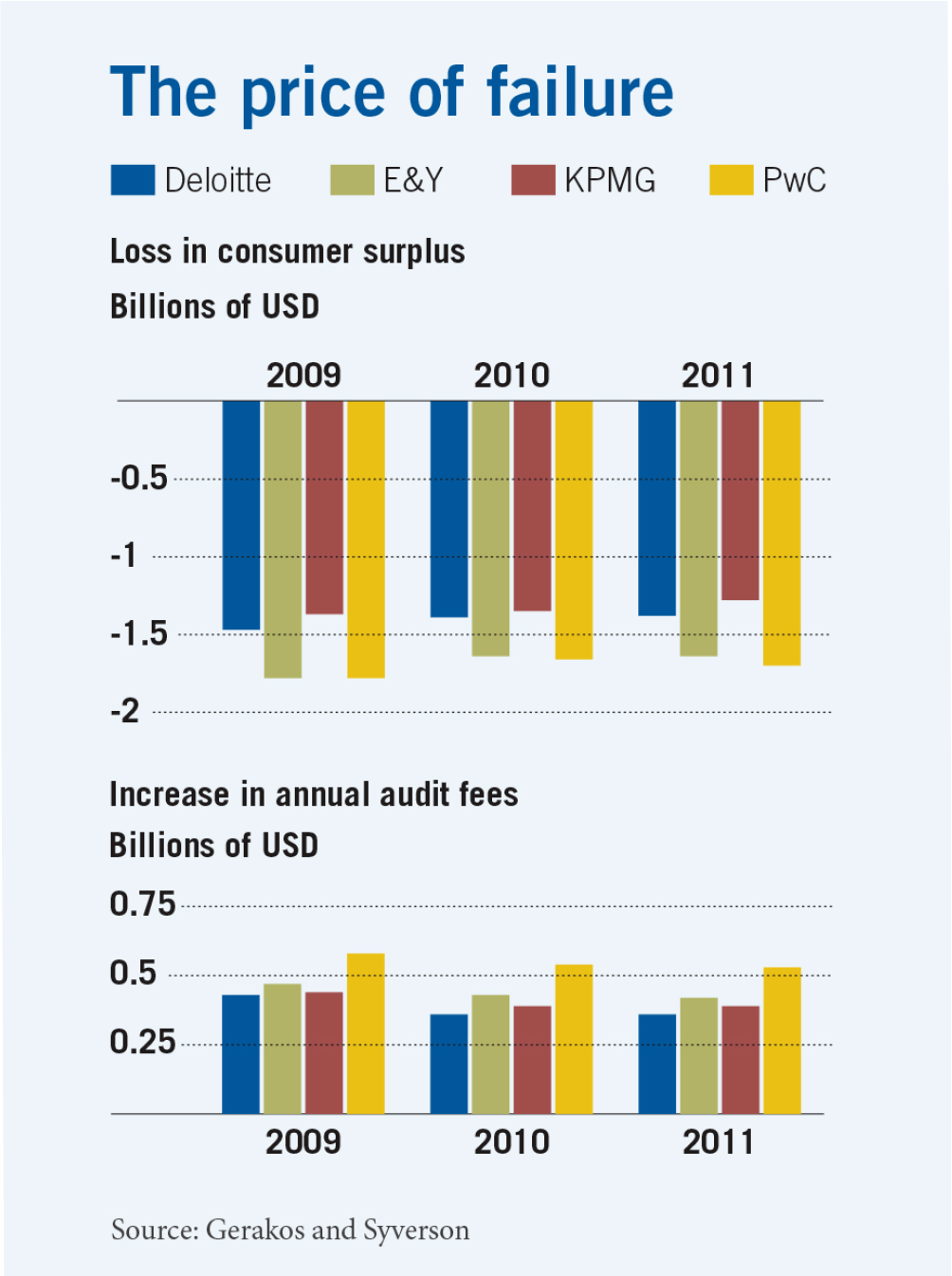

Less competition among global auditing firms could mean higher costs for companies.

A sudden exit by one of the Big Four could cost US clients of the disappearing firm up to $1.8 billion per year.

Joseph Gerakos and Chad Syverson, “Competition in the Audit Market: Policy Implications,” Journal of Accounting Research, forthcoming.

The agency has signaled increased scrutiny of nonreportable mergers in healthcare.

Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?

Economic experts consider what a nationwide ban on the app would mean for innovation and for the rest of the tech industry.

What Would Banning TikTok Mean for the US Economy?

A study looks at how parents react when they learn assistance for their children will end.

Do Government Benefits Really Have a ‘Discouragement Effect’?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.