The Equation: The Community Ties That Count

How community membership affects the allocation of trade credit

The Equation: The Community Ties That CountHow regulation increases credibility

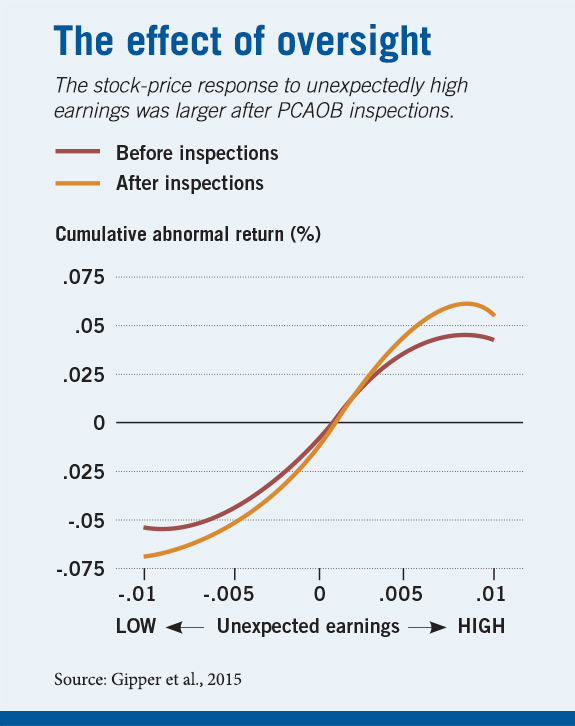

Public audit oversight enhances investor trust in financial reports.

Investors reacted more strongly to earnings surprises following government inspections of public companies’ audit firms.

Brandon Gipper, Christian Leuz, and Mark G. Maffett, “Public Audit Oversight and Reporting Credibility: Evidence from the PCAOB Inspection Regime,” Working paper, July 2015.

How community membership affects the allocation of trade credit

The Equation: The Community Ties That Count

SEC filings suggest the act's tax provisions were not material for most publicly traded US companies.

Who Benefited from CARES Tax Provisions?

Fewer audits of small- and medium-sized businesses may leave banks less willing to make loans.

Would More Corporate Tax Enforcement Lead to More Lending?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.