The Equation: The Community Ties That Count

How community membership affects the allocation of trade credit

The Equation: The Community Ties That CountHow banks monitor borrowers without financial statements

When financial statements aren’t mandatory in small commercial loans, banks also look to reputation, collateral, and tax returns to keep tabs on borrowers.

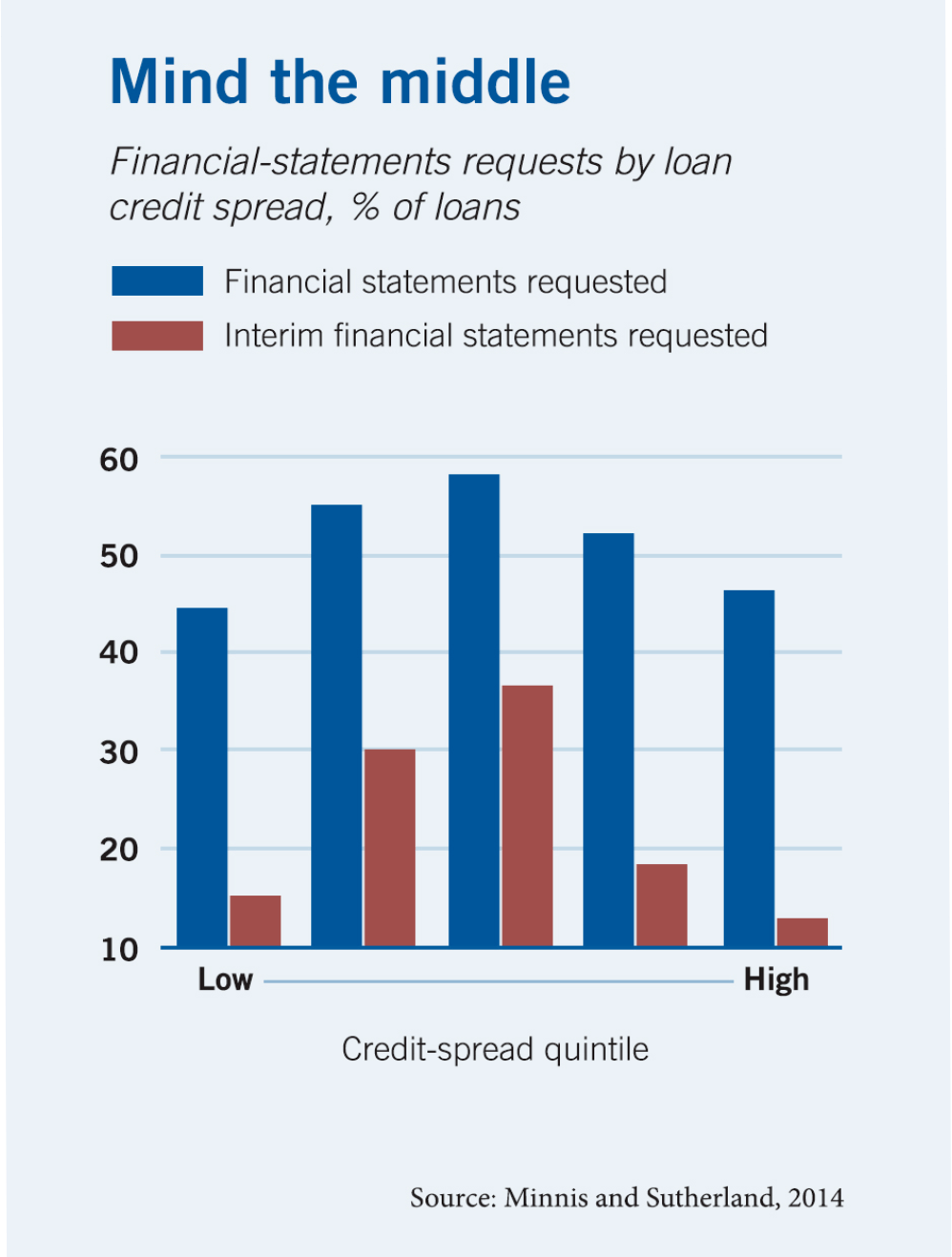

When lending to smaller companies, banks are 25% more likely to ask for financial statements from those whose risk is in the middle quintile.

Michael Minnis and Andrew Sutherland, “Financial Statements as Monitoring Mechanisms: Evidence from Small Commercial Loans,” Working paper, February 2014.

How community membership affects the allocation of trade credit

The Equation: The Community Ties That Count

SEC filings suggest the act's tax provisions were not material for most publicly traded US companies.

Who Benefited from CARES Tax Provisions?

Fewer audits of small- and medium-sized businesses may leave banks less willing to make loans.

Would More Corporate Tax Enforcement Lead to More Lending?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.