To Keep Students Focused, Try Paying Their Parents

A study of subsidized training programs and incentives explored who should be included.

To Keep Students Focused, Try Paying Their ParentsThe United States Federal Reserve is widely expected to raise its target interest rate for the first time in nearly a decade when its Federal Open Market Committee meets December 15–16. The Fed has left its target for the federal funds rate near zero since December 2008 as America’s economy has worked toward recovery from the 2007–10 financial crisis. The rate’s broad influence on the economy means that any adjustment could have implications for everything from mortgage applications to consumer confidence.

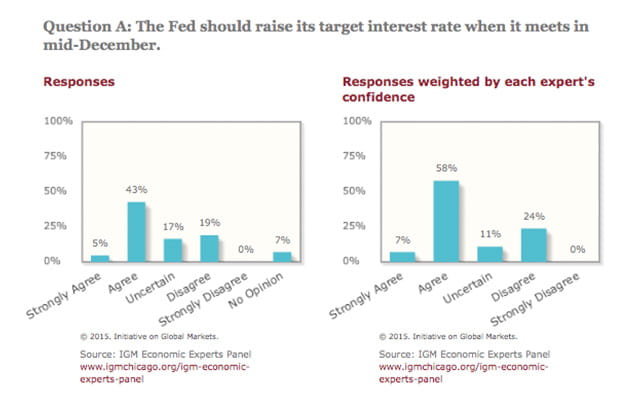

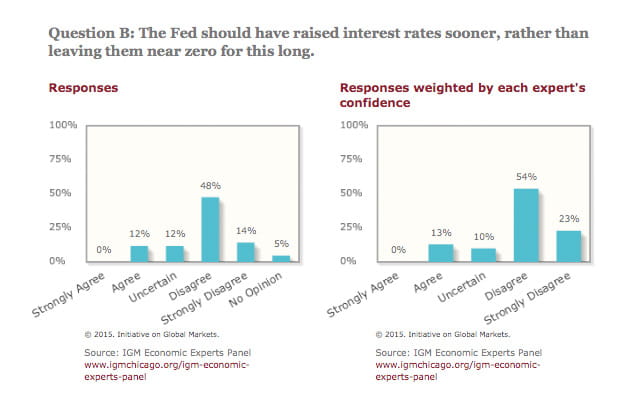

The Initiative on Global Markets at Chicago Booth polled its Economic Experts Panel about whether the time is right for what would be the first Fed rate hike since June 2006. Should the Fed raise its target rate next week? Only 19 percent of economists in the poll disagreed with the idea—but 62 percent said that raising the rate earlier would have been a mistake.

Anil Kashyap of Chicago Booth strongly agreed, invoking the former top economist of the International Monetary Fund in his answer: “As Mike Mussa once famously said, ‘If not now, when?’”

Robert Hall of Stanford University disagreed: “The Fed has somewhat overstated the current level of the natural unemployment rate and fails to understand that it is falling.”

Richard H. Thaler of Chicago Booth was uncertain: “.25 bps doesn't matter much either way. It is the slope that matters. Go slow I say.”

Eric Maskin of Harvard disagreed: “Inflation was low and the recovery was weak—low interest rates seemed indicated.”

Steve Kaplan of Chicago Booth agreed: “[The] delay in raising may have inflated asset prices.”

A study of subsidized training programs and incentives explored who should be included.

To Keep Students Focused, Try Paying Their Parents

A study of demolitions in Chicago finds they raised housing costs, hurting renters.

Infographic: How Demolishing Public Housing Increased Inequality

Economic experts consider what a nationwide ban on the app would mean for innovation and for the rest of the tech industry.

What Would Banning TikTok Mean for the US Economy?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.