A Market without HFT?

How choices in market design affect the fortunes of various types of investors.

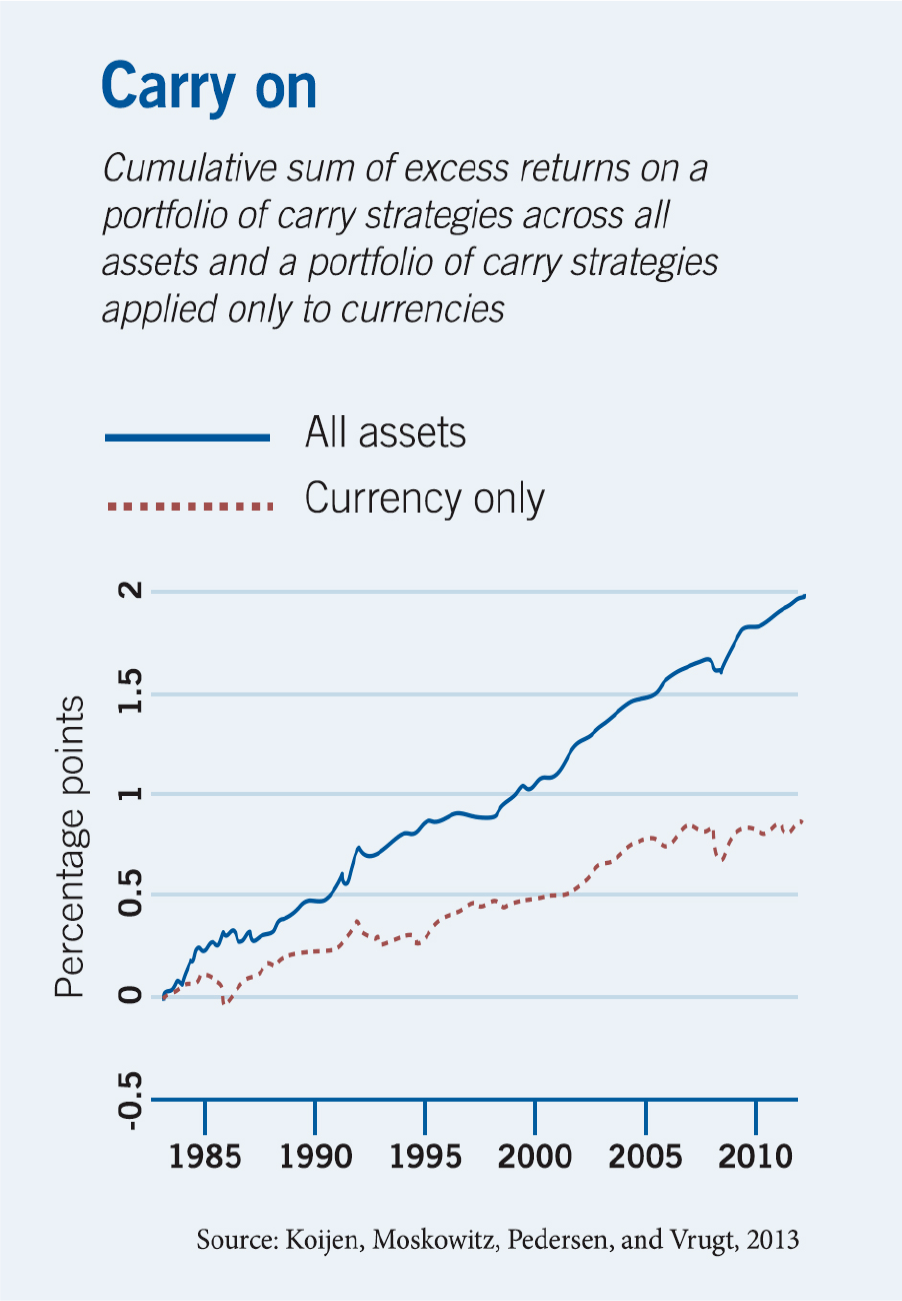

A Market without HFT?Why the carry trade is not just for currencies

Applying the practice to a diversified portfolio results in much-improved returns.

Investors can use carry to compare return predictors that were previously difficult to weigh against each other.

Ralph S.J. Koijen, Tobias J. Moskowitz, Lasse Heje Pedersen, and Evert B. Vrugt, “Carry,” Working paper, August 2013.

How choices in market design affect the fortunes of various types of investors.

A Market without HFT?

The growth of privately held businesses has some regulators and policy makers pondering whether to push for more financial transparency.

Is the US Economy ‘Going Dark’?

Doing business with suppliers in another country can expose a US company to increased risks, but it can also provide a buffer against local shocks.

Global Supply Chains Can Hurt a Company’s CreditYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.