Is Fed Intervention Effective?

The US Federal Reserve's attempts to boost economic growth through market intervention in recent years have prompted heated debate among economists and lawmakers.

Is Fed Intervention Effective?Unconventional monetary policies, such as the Federal Reserve’s quantitative-easing program, have played a large role in shaping world economies since the 2007–10 financial crisis set off global recession. Economists, however, have struggled to quantify the effects of these policies; traditional economic models used for research simply don’t capture them when key interest rates sit at or near zero, as they do in much of the developed world today.

But researchers have proposed a tool, a “shadow rate,” that shows the Fed’s easing—and can be used in established economic models to measure the economic effects.

In normal economic times, economists use the federal funds rate—the interest rate banks use to lend to each other overnight—in many economic models. But in 2009, the fed funds rate hit zero, and monetary policy entered the zone termed the “zero lower bound.” When that happened, the fed funds rate stopped working in models.

Chicago Booth’s Jing Cynthia Wu and Fan Dora Xia, now at the Bank of International Settlements, devised an alternate shadow fed funds rate that can be negative, reflecting the Fed’s additional easing through unconventional policies. When the Fed was pursuing easing, the shadow rate dropped 3 percent through mid-2014.

A versatile tool for economists

When the federal funds rate hovers near zero, many economic models stop working. Researchers developed a “shadow rate” that can stand in for the fed funds rate, drop into negative territory, and make those models functional again. The shadow rate tracks the movements of various benchmark data.

The US Federal Reserve's attempts to boost economic growth through market intervention in recent years have prompted heated debate among economists and lawmakers.

Is Fed Intervention Effective?And the researchers demonstrated it could substitute for the fed funds rate in an established economic model known as a vector autoregression, or VAR. By plugging the shadow rate into the VAR, they could see the effects of quantitative easing on economic aggregates such as the unemployment rate, industrial production, and housing starts.

Now Wu and Ji Zhang of Tsinghua PBCSF are extending the usefulness of the shadow rate, applying it to a New Keynesian model, a general equilibrium model that is popular in studying monetary policy. Once again, the researchers argue, the shadow rate proves a good substitute for the fed funds rate.

An equilibrium model is derived from the behavior of individual economic agents such as households or companies. These agents can’t borrow at a very negative rate, so the researchers collect evidence, both empirical and theoretical, to demonstrate what kind of monetary policy, and how large a policy, a central bank would need to implement to achieve a negative rate.

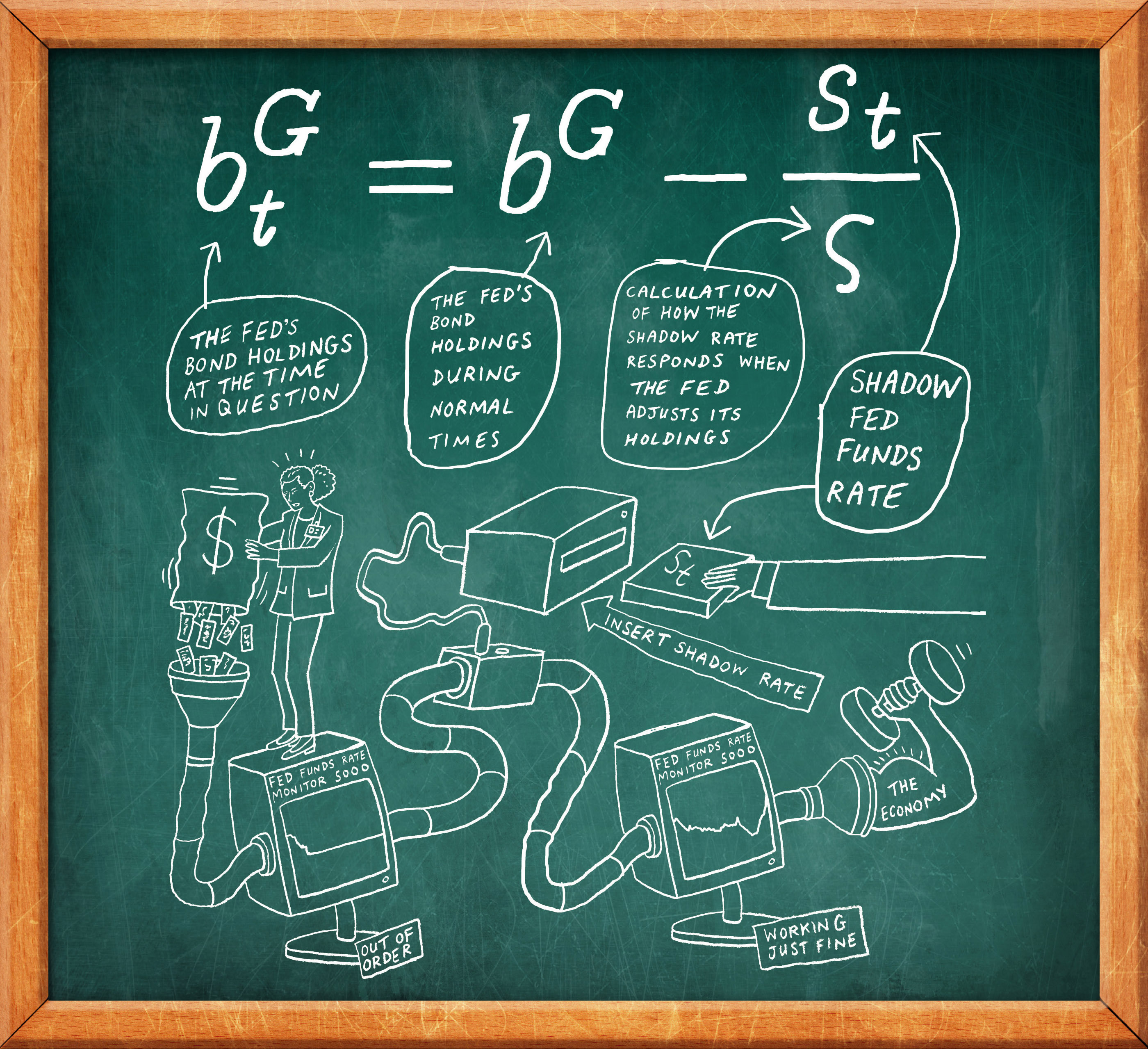

The Equation: How central banks can use the shadow rate

For example, they show that when the Fed increases its bond holdings by 1 percent, the shadow rate decreases by 0.0183 percent. They translate these numbers into a 2.5 percent decrease in the shadow rate for the Fed’s first round of quantitative easing, and a 0.9 percent decrease in the shadow rate for the third round of easing.

Moreover, they demonstrate that while the New Keynesian model produces counterfactual results at the zero lower bound, those disappear when the shadow rate is introduced. For example, the model with the fed funds rate predicts that a negative supply shock in times of near-zero interest rates—such as in the period following the earthquake and tsunami that hit Japan in 2011—stimulates the economy. But empirical research studies from 2015 and 2016 suggest that negative supply shocks actually contract the economy. When Wu and Zhang use the shadow rate in the New Keynesian model to look at the effects of such a shock, they find economic output (goods and services produced) falls at the zero lower bound, as well as in normal times. Thus the results using the shadow rate are more consistent with evidence.

In both models, using the shadow rate reveals that unconventional monetary policy did have some positive effect on the economy. However, more research is needed to determine whether those effects justify the costs.

New methods of measuring racism and sexism find a larger, systemic impact.

We’ve Been Underestimating Discrimination

Three experts in the theory and practice of hybrid work discuss its potential impact on the labor market.

How is WFH Shaping the Job Market?

Chicago Booth’s Raghuram G. Rajan joins hosts Bethany McLean and Luigi Zingales to explore risks in the financial system and possible solutions.

Capitalisn’t: Why the Banking Crisis Isn’t OverYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.