Why Markets Need Not Fear Uncertainty

Volatility is evidence of contractionary economic conditions already in place.

Why Markets Need Not Fear UncertaintyUncertainty is a hot topic in economic circles, with some economists saying that policy makers should take steps to reduce uncertainty that could affect businesses, thus becoming a drag on economic activity and even causing a recession.

But some research has questioned this point. And evidence based on import-price data, from Northwestern University’s David Berger and Chicago Booth’s Joseph S. Vavra, supports the argument that fears about uncertainty may be overstated.

In recessions, economic outcomes that companies can control, such as their employment levels and the prices they charge for goods and services, become more volatile. This reflects increasing uncertainty about what the outcomes will be in coming days or weeks. (To economists, volatility and uncertainty are the same.)

Volatility is evidence of contractionary economic conditions already in place.

Why Markets Need Not Fear UncertaintyAbout this much, economists agree. The open question is what drives this increase in volatility. By one view, the increased uncertainty comes from a rise in the size of economic “shocks” that are outside of the companies’ control. Such shocks could include an uptick in the volatility of energy prices, or increasingly uncertain government policy. Under an alternate view, the size of these external shocks actually doesn’t vary much over time, so any changes in the volatility of economic outcomes is instead due to companies responding more strongly to shocks during recessions. For example, a company’s wholesale costs may be no more volatile during recessions, but that company might adjust its prices more aggressively anyway, in response to whatever change in costs it does observe.

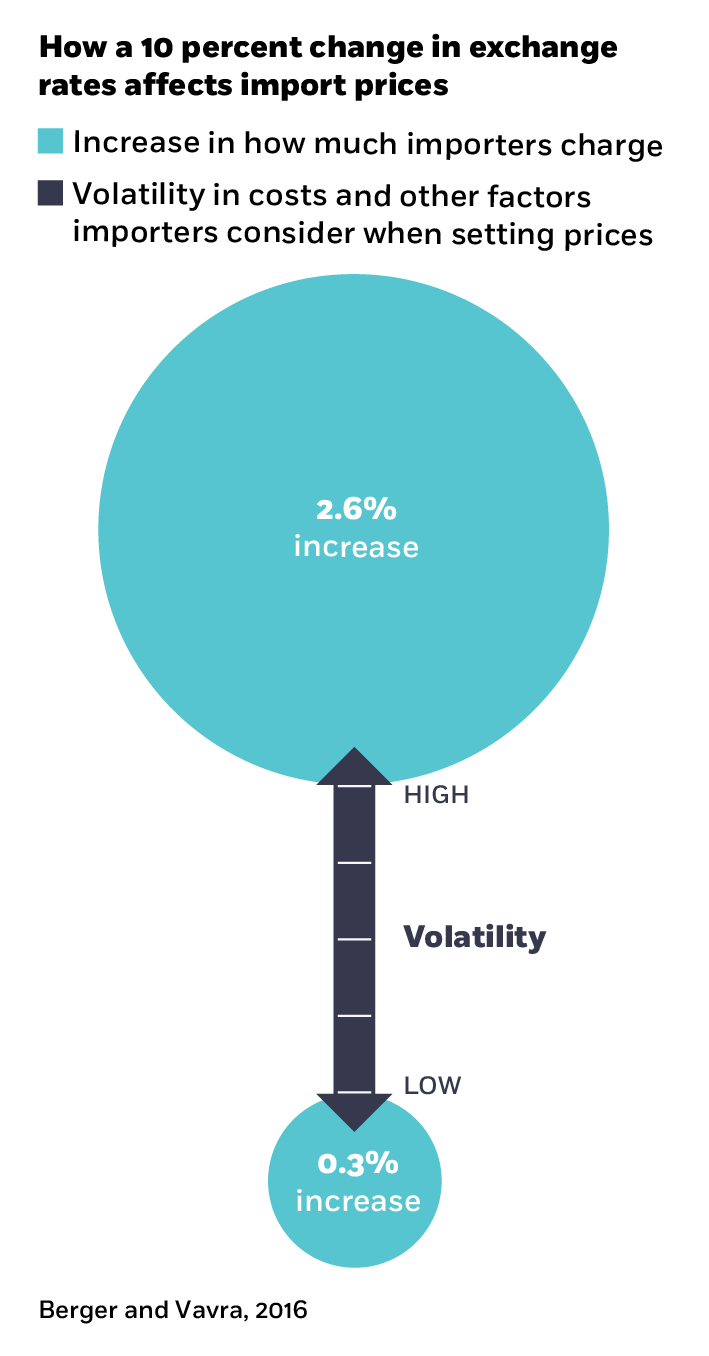

It’s difficult to measure economic shocks, making it hard to know whether more uncertainty in recessions reflects larger shocks, or simply larger responses to shocks that are essentially unchanged in size. However, Berger and Vavra took a deep dive into US import-price data, looking at how much importers charged for more than 10,000 items from 1993 to 2015. To importers, exchange-rate changes represent economic shocks that can be measured. And because importers’ responses to shocks are represented in the prices charged, the researchers used these data to track how businesses respond to shocks.

Berger and Vavra analyzed the relationship between monthly exchange-rate changes and price changes. As expected, they see that during recessions, there was more volatility in the prices importers charged customers. But the researchers also see that during those times, the pass-through rate of exchange rates into prices was higher than normal, showing that importers were responding more than they usually do to economic shocks.

In months when price variability was highest, the researchers find that a 10 percent change in exchange rates led import prices to rise by an average of 3 percent, while in months with the lowest price variability, the same 10 percent change in exchange rates caused essentially no change in import prices. The relationship between price variability and pass-through holds up across a variety of sectors and products. The research suggests that rather than responding to increased uncertainty, importers are responding more to essentially the same amount of uncertainty.

Berger and Vavra note that their work adds to a growing body of research that uses both external shock variables and responsiveness variables to arrive at a similar data-driven conclusion: external shocks do not by themselves drive volatility. Berger and Vavra’s research casts more doubt on the suggestion that policy makers should take steps to address uncertainty.

David Berger and Joseph S. Vavra, “Shocks vs. Responsiveness: What Drives Time-Varying Dispersion,” Working paper, December 2016.

Research finds China’s digital coupon programs were a cost-effective way to boost spending.

Why China’s Pandemic Stimulus Worked Better Than the US’s

Attitudes and expectations about remote work have shifted globally.

Infographic: How the WFH Picture Varies around the World

Most consumers support ‘private sanctions’—even if it costs them money.

On Russian Aggression, Americans Want Companies to Vote with Their FeetYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.