To Keep Students Focused, Try Paying Their Parents

A study of subsidized training programs and incentives explored who should be included.

To Keep Students Focused, Try Paying Their ParentsHow faster foreclosures worsened the Great Recession

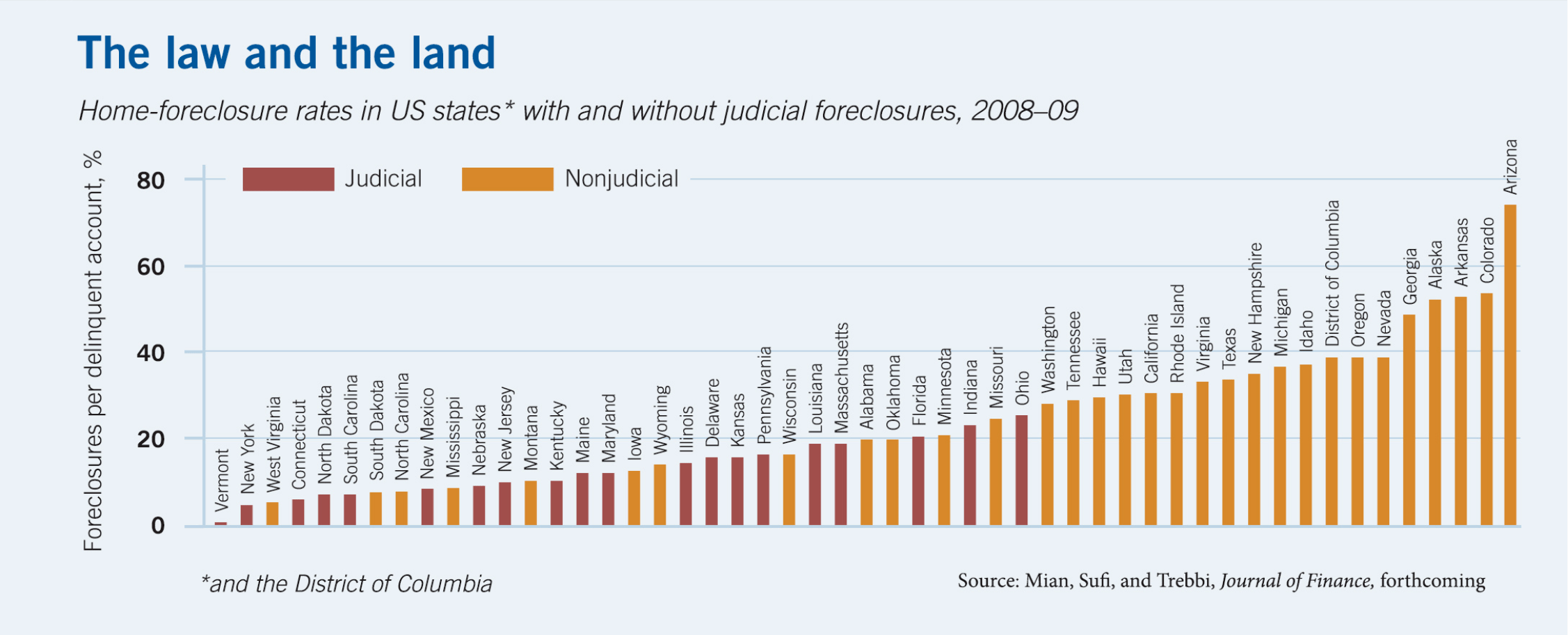

US states with quick foreclosures saw bigger plunges in home prices, new housing construction, and auto sales.

US states that don’t require foreclosures through courts suffered an inordinate amount of economic damage at the height of the recession.

Atif Mian, Amir Sufi, and Francesco Trebbi, “Foreclosures, House Prices, and the Real Economy,” Journal of Finance, forthcoming. Chart reprinted with permission from Wiley. Copyright 2014.

A study of subsidized training programs and incentives explored who should be included.

To Keep Students Focused, Try Paying Their Parents

Stating the payment amount in a different way could change behavior.

Why Many US Parents Fail to Collect Government Benefits

Lawyer Dina Srinivasan joins the Capitalisn’t podcast to discuss the US Department of Justice’s lawsuit against Google.

Capitalisn’t: Google—The New Vampire Squid?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.