Does Targeting Aid Help Poorer Regions?

Turkey’s experience suggests ‘place-based policies’ can have unintended effects.

Does Targeting Aid Help Poorer Regions?

Edmon de Haro

Globalization has changed.

The globalization we knew and understood for most of the 20th century resembled more the globalization that emerged from the Industrial Revolution than it did the globalization we experience today. That globalization was based on the movement of goods across borders—measurable, limited by physical infrastructure, and parried by policies such as tariffs. But globalization today is about more than trading goods; it’s about trading ideas and, increasingly, services. Our 20th-century paradigms of globalization are ill-equipped to understand what cross-border trade means for the present and near future. Globalization has changed, but the way we think about it hasn’t.

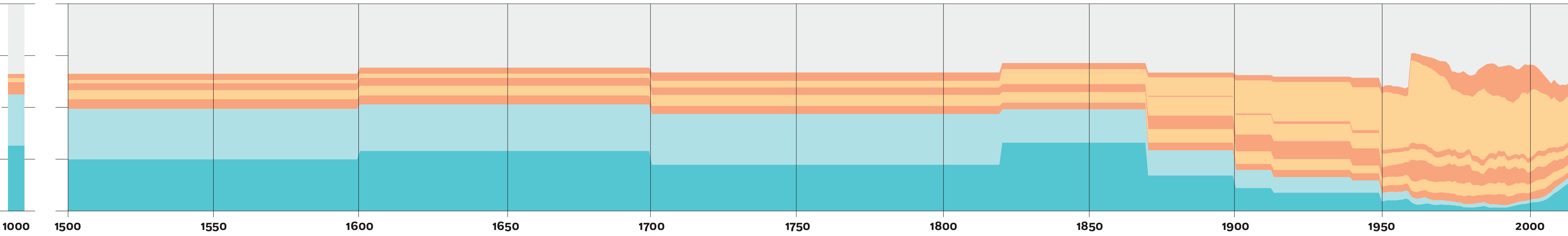

The one thing that hasn’t changed about globalization is that it is a phenomenon with the power to change the world. If you trace the share of world income going to two groups of countries—India and China in one group and the G7 countries in the other group—back to the year 1000, you’ll see that back then, India and China had about half the world’s GDP, and the G7 had less than 10 percent of it. That makes sense: back then, basically everybody was poor and agrarian. India and China had half the world’s people, pretty much as they do now, and the G7 had only about 11 percent.

Keep tracing for eight centuries, up to 1820, and not much changes. The G7 share goes up a little bit because Canada and the United States appeared and were populated, but the change is modest. I like to call that period the Great Stagnation, and of course it was stagnated because there was no modern growth.

Starting around the 1820s—the decade economists Kevin H. O’Rourke of Oxford and Jeffrey G. Williamson of Harvard have pegged as the start of modern globalization—the G7 share starts to swell. Over the course of about 170 years, it goes from about one-fifth up to about two-thirds of world income. That’s how powerful globalization—the movement of goods across borders—was.

A millennium of global wealth

Click below to see how the global balance of wealth has shifted over the centuries, including a marked decline in the G7's share in recent decades

The Great Stagnation

1000–1820

Modern Globalization

1820–1990

New Globalization

1990–present

Baldwin 2016

The conventional understanding of globalization really dates back to around the time of this momentous swing in the fortunes of the G7. The British classical economist David Ricardo described the theory of comparative advantage in 1817. His theory, and the paradigms of globalization that have succeeded it, did a nice job of explaining why the G7’s share of global income kept going up. But as I point out in my 2016 book, The Great Convergence, something changed.

Starting around 1990, the G7’s share of world GDP fell to under 50 percent in two decades, back to the level it was at in the 1900s. And the ideas we used to understand globalization while the G7’s income share was growing don’t work as well to explain it while that share is shrinking. Something fundamental changed around 1990, and that’s what I call the new globalization. It requires a whole new way of thinking about globalization, one attuned to the 21st century rather than the 20th or 19th.

Globalization is arbitrage. What is arbitrage? It’s taking advantage of a variation in price between two markets. When the relative prices of some goods are cheap in Mexico, that’s what they sell to us, and when other goods are relatively cheap in the US, that’s what we sell to them. A two-way, buy-low/sell-high deal—that’s arbitrage, and trade theory is all about what the direction of arbitrage, and especially arbitrage in goods, is.

But goods aren’t the only thing that can move across borders; there can also be an arbitrage in know-how, and there can be arbitrage in labor. The new globalization has to do with knowledge crossing borders. Future globalization will have to do with labor crossing borders—not people, but labor services.

Globalization as arbitrage is constrained by three costs: trade costs, or the cost of moving goods; communication costs, or the cost of moving ideas; and face-to-face costs, or the cost of moving people. In the preglobalized world, production and consumption were geographically bundled. In particular, people were tied to the land since the land was what provided most people’s living, and if they needed anything—candles, horseshoes, clothes, whatever—it had to be made within walking distance because it was too expensive and dangerous to move anything anywhere.

But with the advent of steam power, the cost of moving goods fell. Production and consumption could be spatially unbundled. It’s what I call the first unbundling, and when things are made in one place and consumed in another, we have trade. So that’s the classic old globalization: things started to be made in one place and consumed in another.

When everybody is tied to the land and production is tied to who or what is within walking distance, the whole world’s economic geography is very even. It’s dispersed, and that dispersion makes it hard to innovate. On the demand side of innovation, what use is it coming up with new, clever techniques when you’re only producing for two dozen families? And how easy is it to develop new techniques when you’re the only blacksmith in walking distance?

Once you could sell to the world market, it became profitable to adopt scale-intensive techniques, and those techniques were very complicated. To coordinate the complication and save on communication costs, all the stages of production were put within walking distance of each other. It became worthwhile to innovate, and for that reason, modern growth took off just about exactly the same time modern globalization took off.

But the growth stayed local. The innovations did not spread around the world because it was hard to move ideas, especially complex ideas such as manufacturing, and that’s how we got what historians call the Great Divergence, the disparity between developed economies and undeveloped ones.

On a visit to Nagoya, Japan, in 1987, I was invited to tour the Toyota factory there. It was huge—something like 24 football fields inside a single building. You needed a go-kart to get around the place, and all around it outside was what they called Nagoya city—all the suppliers who made the different components for the cars, and all basically within walking distance. Everyone whose work went into the cars had to be physically near the factory because communication costs made it so difficult to coordinate production.

Eventually, though, information and communication technology (ICT) lowered the cost of moving ideas. The ICT revolution made offshoring organizationally feasible, and vast wage differences between countries made it profitable.

There has been a sense of fragility, of vulnerability—an economic insecurity that’s been generalized, and this has been going on for two decades.

ICT allowed people to disaggregate spatially—a second unbundling, this time an unbundling of the stages of production. Now everyone who worked on any part of a Toyota didn’t have to be within walking distance of the plant in Nagoya. Now the stages of production could move to different countries, in particular low-wage countries. This has many names: offshoring, outsourcing, fragmentation, vertical specialization. It’s a widely discussed and studied phenomenon, but I think we tend to discuss and study the wrong things about it. We focus on the flows of jobs because that’s what we can measure, but that’s not what has changed the world.

What changed the world was the offshoring of know-how along with the jobs. Before the ICT revolution, knowledge stayed local. But once firm-specific know-how from manufacturing firms in G7 countries was taken to nearby emerging markets and combined with low-wage labor, the nature of competition in manufacturing was never the same.

At one time, if you were building, for instance, a truck, you had to choose between doing it with high-end technology in a high-wage environment such as Germany, or with low-end technology in a low-wage environment such as China. Now, American or German or Japanese companies can take their technology to China and combine high tech with low wages. That’s because knowledge is what economists call a nonrival factor, which means you don’t have to choose between either using it in Germany or using it in China. You can use it in Germany and China.

To really understand how this changed the nature of globalization, consider a sports analogy. Suppose we have two football teams, one that needs a quarterback but has too many linebackers, and one that needs a linebacker but has too many quarterbacks. If they sit down and trade players, both teams win. It’s arbitrage in players. Each team gets rid of players they need less of and gets players they need more of. That’s the old globalization: exchange of goods.

Now let’s take a different kind of exchange, where the coach of the better team goes to the field of the worse team and starts training those players in the off-season. This is very good for the coach because he gets to sell his knowledge in two places. You can be sure that the quality of the league will rise, all the games will get more competitive, and the team that’s being trained up will enjoy the whole thing. But it’s not at all certain that the players of the better team will benefit from this exchange because the source of their advantage is now being traded.

In this analogy, the better team is, of course, the G7, and not surprisingly this has led to some resentment of globalization in those countries. The new globalization breaks the monopoly that G7 labor had on G7 know-how, and apart from the fact that it undermines the comparative advantage in manufacturing that the US and other G7 countries had, it simply seems unfair. When your company, say GM, shuts down a stage of production and moves it to Mexico using the technology that justified your $24 per hour salary and starts paying somebody $24 per week, that just seems unfair.

But another, less obvious source of resentment is that the new globalization affects economies with a finer degree of resolution. International competition can reach inside the factory for an individual stage of production and offshore it. It’s not at all clear that what’s offshored lines up with high skill versus low skill. And yet labor unions and government policies are still organized by sector or skill group or both.

New globalization’s impact is more sudden than old globalization’s because it’s driven by ICT, not by tariff cuts or the construction of new ports and container ships. It’s more individual because it’s no longer felt across entire sectors and skill groups, but in individual stages of production. It’s more unpredictable. It’s hard to know which of these stages will disappear and why. And it’s more uncontrollable because governments have very good policies for controlling people and goods crossing borders, but they don’t have good policies for controlling firm-specific know-how crossing borders.

So there has been a generalized feeling in goods-producing sectors that no matter what job or skill set you have, you can’t really be sure whether your job won’t be next. There has been a sense of fragility, of vulnerability—an economic insecurity that’s been generalized, and this has been going on for two decades.

To date, the gains and pains of globalization and automation have been felt mostly by the manufacturing sector. In the future, the gains and pains will be felt by professional and service-sector jobs. That’s because digital technology is going to lower the third constraint to globalization as arbitrage: the cost of moving people around, or facilitating face-to-face interaction.

Service jobs have been shielded from globalization because they require people to be face-to-face, or at least near each other. For most services, you can’t put them into a container and ship them from China to New York. So global competition was deflected by the shield of high face-to-face costs.

Digital technology, however, is opening a pipeline for direct international wage competition. In other words, labor from countries such as Kenya, Nigeria, or the Philippines can come and work in G7 offices directly through telecommunications. There are a number of ideas and technologies that are making this increasingly feasible:

Telemigration. Many people work from home on a regular or semiregular basis. Does it matter if they’re working from home in Chicago or if they’re working from home in Beijing? As remote work becomes more technologically and culturally mainstream, perhaps we won’t be offshoring entire jobs, but rather the stages of production of white-collar jobs—specific tasks that can be done remotely for cheaper than they’re done locally.

Virtual globalization websites. With the growth of the gig economy, there’s been a corresponding growth in online hubs where people can say, “I’m a freelancer. I can make logos. I can design web sites. I can copyedit articles.” But the gig economy can also apply to what have been traditionally thought of as office jobs, so you might also see “I can do your accounting. I can process your expense forms.” Upwork, Freelancer, Amazon Mechanical Turk, and Fiverr are all in this business, and LinkedIn is getting into it as well.

In China, freelancing is a huge part of the employment picture because China overproduces university graduates—Chinese universities graduate 8 million people a year, but most of the jobs available locally are in manufacturing. So along with all the sites listed above, there’s also Zhubajie, a Chinese service that was recently branded Witmart for English speakers, and it’s offering its services internationally.

Machine translation. Many of us have become, or at least have the ability to be, multilingual, thanks to the computing power of our phones. An English speaker can sit down in a restaurant in France, Germany, China, Spain, and many other countries and order dinner using Siri as a translator. For more conversational applications, Skype Translator can provide real-time voice translation in eight languages.

Machine translation is going to transform global competition in services, creating a talent tsunami. Let’s suppose 1 percent of the world’s population is part of the talent pool for a particular occupation. That would mean there’s something like 144 million people who are truly fit for work in that field, but maybe only 40 million of them speak English—for now. This year or next year, the other 100 million will speak passable English, and the year after that they’ll speak perfect English, because these translation services continue to improve. The supply of people willing and able to offer their services in every major language will explode.

This technology will be felt beyond telemigration too. Linguistic differences are estimated to hinder trade by something like 150 percent. When language barriers go down, barriers to trade do as well.

Advanced telecommunication technologies. A final technology that’s helping to close the distance between collaborators in different countries is “telepresence”—immersive videoconferencing environments that use high-resolution, life-size screens, dozens of speakers and microphones, and often tables that look the same on both sides, so a group in New York and a group in Mumbai, India, could have the feeling that they’re almost in the same room. There are even telepresence robots, which make it possible for someone operating remotely to actually move around an office or other workspace and have a physical presence there. So far this hardware is pretty expensive, and therefore only used at the high end of industries such as consulting and banking—or, in the case of robots, medicine—but all it has to do is get cheaper, and it will change things.

Humans have brains that are built to think about things linearly—to understand motion in nature, to look at two points and calculate how long it would take to walk from one to the other. But technological growth is exponential. That mismatch gives rise to the cognitive pattern known as Amara’s law, which states that we have a tendency to first overestimate and then underestimate the significance of new technologies. For instance, we landed on the moon, and people assumed the next step would be colonizing Mars. We’ve still never set foot on Mars, but in the meantime, we’ve put countless technologies into space that have changed the experience of life on earth.

There’s a point at which the exponential path of technological growth crosses the straight line of human expectation, and it’s the point at which the real power of this technology that we’ve alternately over- and underestimated fully dawns on us. I call it the “holy cow” moment. We haven’t quite reached it yet with ICT and its meaning for globalization. When we do, it will not be the result of a single, sudden event.

In the old days, globalization came and shut down the big factory in town, and thousands of people were put out of work, and it was a great tragedy, but it was the result of someone’s conscious choice. I don’t think the next phase of globalization will happen that way.

I think it’ll happen more the way smartphones insinuated themselves into our lives. Now, think about the iPhone. Ten years ago, smartphones barely existed. Five years ago, they were mediocre phones, maybe good music players with short battery lives and not much else because the Wi-Fi was so bad everywhere you couldn’t do much with them. Today, everybody uses them to do everything. No one made that decision. No one said, “OK, now we’re going to let iPhones change our lives, disrupt our dinner conversations, and change the way we conduct business meetings.” It happened one convenience, one cost saving at a time, and it changed our societies.

That, to me, is how future globalization will occur: one convenience at a time, one job at a time—not being replaced in every variety of office. Nobody will ever decide to have a job apocalypse in which we replace all the service-sector workers or all the doctors or all the lawyers. But it’s already happening in media. It’s happening in law. It’s happening at the low end of medicine. And I think we’re getting close to the holy-cow moment.

Richard Baldwin is professor of international economics at the Graduate Institute of International and Development Studies, Geneva, as well as director of the Centre for Economic Policy Research and founder and editor-in-chief of VoxEU.org. This essay is adapted from a lecture hosted by Chicago Booth’s Initiative on Global Markets in March as part of its Myron Scholes Global Markets Forum.

Richard Baldwin, The Great Convergence: Information Technology and the New Globalization, Cambridge: Harvard University Press, 2016.||Kevin H. O'Rourke and Jeffrey G. Williamson, “When Did Globalisation Begin?” European Review of Economic History, April 2002.||David Ricardo, On the Principles of Political Economy and Taxation, London: John Murray, 1817.

Turkey’s experience suggests ‘place-based policies’ can have unintended effects.

Does Targeting Aid Help Poorer Regions?

Research examines two different types of labor-market policy designed to help displaced workers pivot to new jobs.

How Should We Help Workers Exposed to Offshoring?

How the excess savings of the US’s wealthiest households may be feeding a cycle of inequality and instability.

Who Is Fueling America’s Debt Binge?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.