Lopsided Innovation Causes Productivity Slowdowns

Bottlenecks can form when industries innovate at different paces.

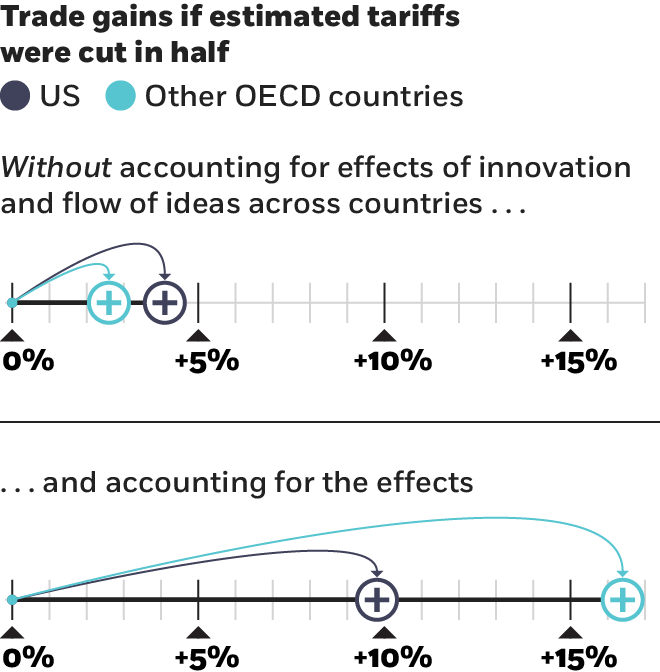

Lopsided Innovation Causes Productivity SlowdownsFree trade is a whipping boy for some politicians of late. US President Donald Trump has pulled out of trade partnerships, Britain has been negotiating its exit from the European Union, and a trade war is intensifying. But most economists argue that trade liberalization is a good thing that can benefit all parties. And research by Chicago Booth’s Chang-Tai Hsieh, Stanford’s Peter J. Klenow, and University of Chicago PhD candidate Ishan Nath finds the benefits of free trade could be even bigger than realized.

The researchers examined data from Canadian and US manufacturers before and after the 1988 US-Canada Free Trade Agreement, which was replaced by the North American Free Trade Agreement in 1994. They studied the relationship between changing tariffs and the rate of creative destruction—the late political economist Joseph Schumpeter’s term for the process of destroying one economic structure while creating a new one. Creative destruction is on display when companies shift resources from one area of production to another, or when competitors with a better product drive out incumbents. This is the process through which economic growth happens—although it also causes the sort of job reallocation that can be devastating to individuals and communities, which is what has made trade so controversial.

Hence, there’s an inherent trade-off. Say a country’s trade is limited and its computer-chip manufacturers dominate the domestic market. A freer approach to trade would give these chip companies more opportunity to sell in international markets but would also expose them to global competition. If they are competitive, their businesses could grow. If they aren’t, they could be knocked out of the market.

Most economic models describe what happens as a one-time shock to the economy—if domestic chip makers can’t compete, their workers lose jobs and hopefully shift into a more competitive industry. But Hsieh, Klenow, and Nath argue that trade causes long-term effects, not one-time shifts, as it exposes companies to innovation and ideas. Companies that innovate create jobs, while companies that are “innovated upon” do more firing than hiring, according to the researchers’ model. Domestic chip makers that face global competition might learn more about their competitors’ products and processes, and improve their own products and processes as a result. Those that don’t improve would go out of business.

The model demonstrates that less-innovative countries reap the largest share of the benefits involved from this process, gaining ideas from their more-innovative trading partners. “A country that innovates less benefits more from trade liberalization since it is now easier for the country to ‘import’ ideas,” the researchers write. But they also find that lower tariffs promote the introduction and eventual dominance of better-quality products on both sides of a border, which can be a catalyst for economic growth.

Hsieh et al., 2018

“Ideas do spread faster with lower tariffs, so that each country ascends to a higher TFP path than before the liberalization,” the researchers write. TFP (total factor productivity) is often seen as a proxy for efficiency gains—usually driven by technological improvements or other innovations—because it represents growth unaccounted for by a bigger labor force or more capital spending.

Granted, the researchers quantify the benefits of freer trade and not the costs, which would also likely be amplified. In Canada, as tariffs fell, job flows—a measure of creative destruction—increased significantly, with job creation and destruction both growing most in industries where the tariff cuts were biggest. And since less-innovative countries capture a large share of the benefits from innovation, this dampens the incentive for innovative countries such as the US to invest in research and development.

This latter observation has policy implications. If innovation is a catalyst for domestic growth, it makes sense to subsidize domestic R&D. But when ideas cross borders, perhaps a mechanism should exist to pay back governments when their subsidies fuel growth abroad, the researchers argue. “Just as we need global climate change agreements to internalize negative pollution externalities,” the researchers write, “the world might need a ‘Global Technical Change’ accord to internalize these positive externalities.” If US innovation were to help the Chinese economy grow, Beijing might benefit from contributing to funding the public good of American innovation.

Hsieh, Klenow, and Nath do not go so far as to suggest that such an arrangement would mollify US residents who feel victimized by the costs of free trade. But work by Harvard’s Philippe Aghion and Alexandra Roulet, Princeton’s Angus Deaton, and University of Chicago’s Ufuk Akcigit suggests it might—under the right conditions. Aghion, Akcigit, Deaton, and Roulet find in a 2016 paper that job destruction has a less negative impact on individuals’ sense of well-being in regions where unemployment benefits are more generous. Thus, if a technical-change pact were to deliver money back to the US, and if those funds helped individuals via a stronger social-safety net, free trade might—just might—start to shed its negative image among many American workers.

Philippe Aghion, Ufuk Akcigit, Angus Deaton, and Alexandra Roulet, “Creative Destruction and Subjective Well-Being,” American Economic Review, December 2016.

Chang-Tai Hsieh, Peter J. Klenow, and Ishan Nath, “A Global View of Creative Destruction,” Working paper, April 2018.

Bottlenecks can form when industries innovate at different paces.

Lopsided Innovation Causes Productivity Slowdowns

Princeton sociologist Matthew Desmond discusses the roots of and solutions to poverty in the US.

Capitalisn’t: Why America’s Poor Remain Poor

The depletion of the funds points to bigger fiscal issues.

Should We Worry That the Social Security Trust Funds Are Going Bust?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.