Has Capitalism Moved On from ‘American Psycho’?

Chicago Booth’s John Paul Rollert reflects on the continuing relevance of Bret Easton Ellis’s 1991 novel.

Has Capitalism Moved On from ‘American Psycho’?How private-equity firms lose when they manipulate returns

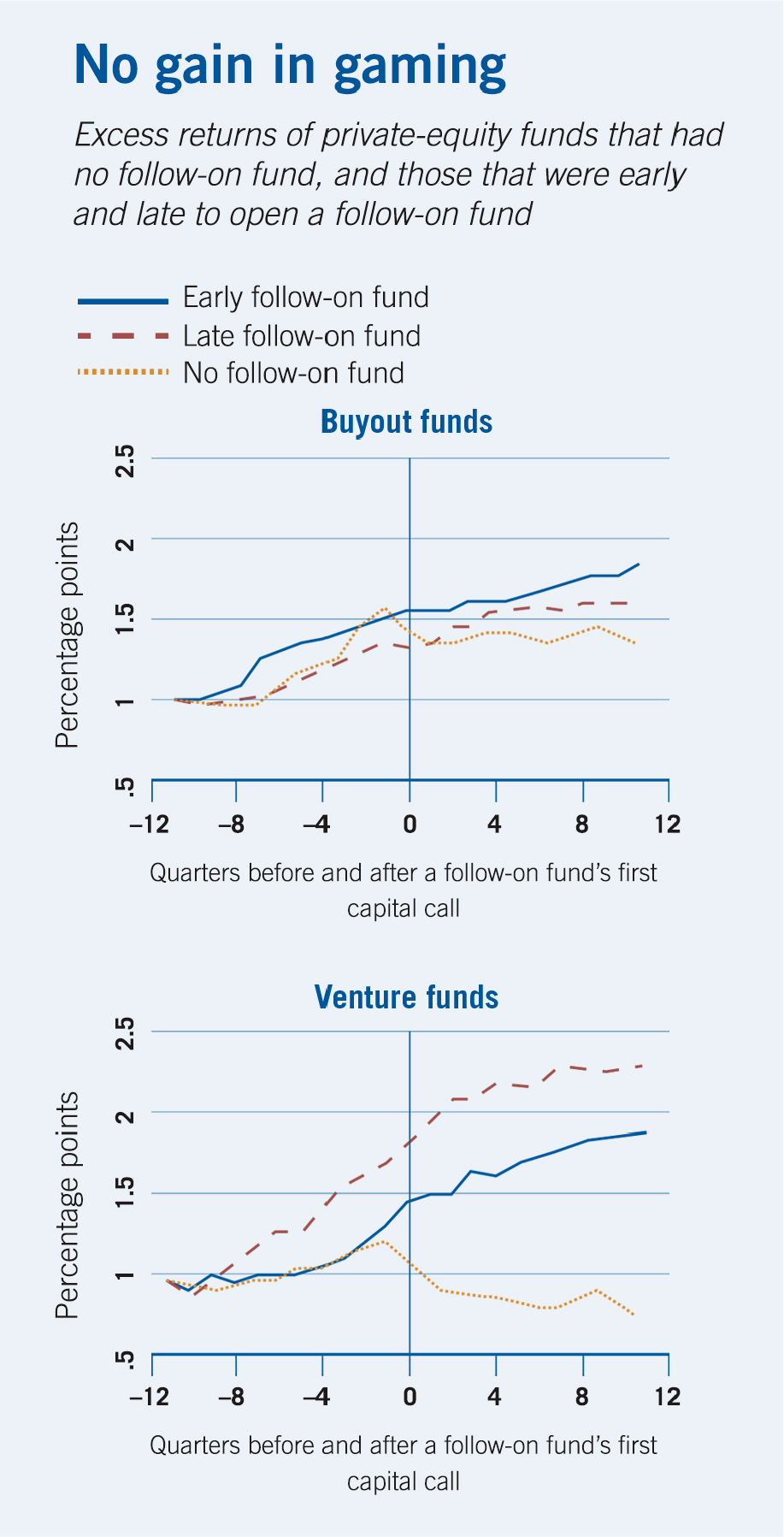

Private-equity firms trying to raise new capital sometimes overstate fund returns, but investors aren’t fooled.

Research suggests that while some underperforming private-equity fund managers overstate asset values, managers at the best-performing funds tend to understate returns.

Gregory W. Brown, Oleg R. Gredil, and Steve Kaplan, “Do Private Equity Funds Game Returns?” The University of Chicago Booth School of Business working paper, October 2013.

Chicago Booth’s John Paul Rollert reflects on the continuing relevance of Bret Easton Ellis’s 1991 novel.

Has Capitalism Moved On from ‘American Psycho’?

Removing key information from customers’ credit records can make a great deal of difference to individuals’ credit scores and their cost of borrowing.

Financial Data Privacy Could Help Fight Poverty

They’ve applied millions of ‘disaster flags’ to credit files, masking missing payments.

How Lenders Are Providing Natural-Disaster InsuranceYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.