A Golden Age for Green Investment?

Some green projects are enjoying a boost thanks to unconventional cost-of-capital calculations.

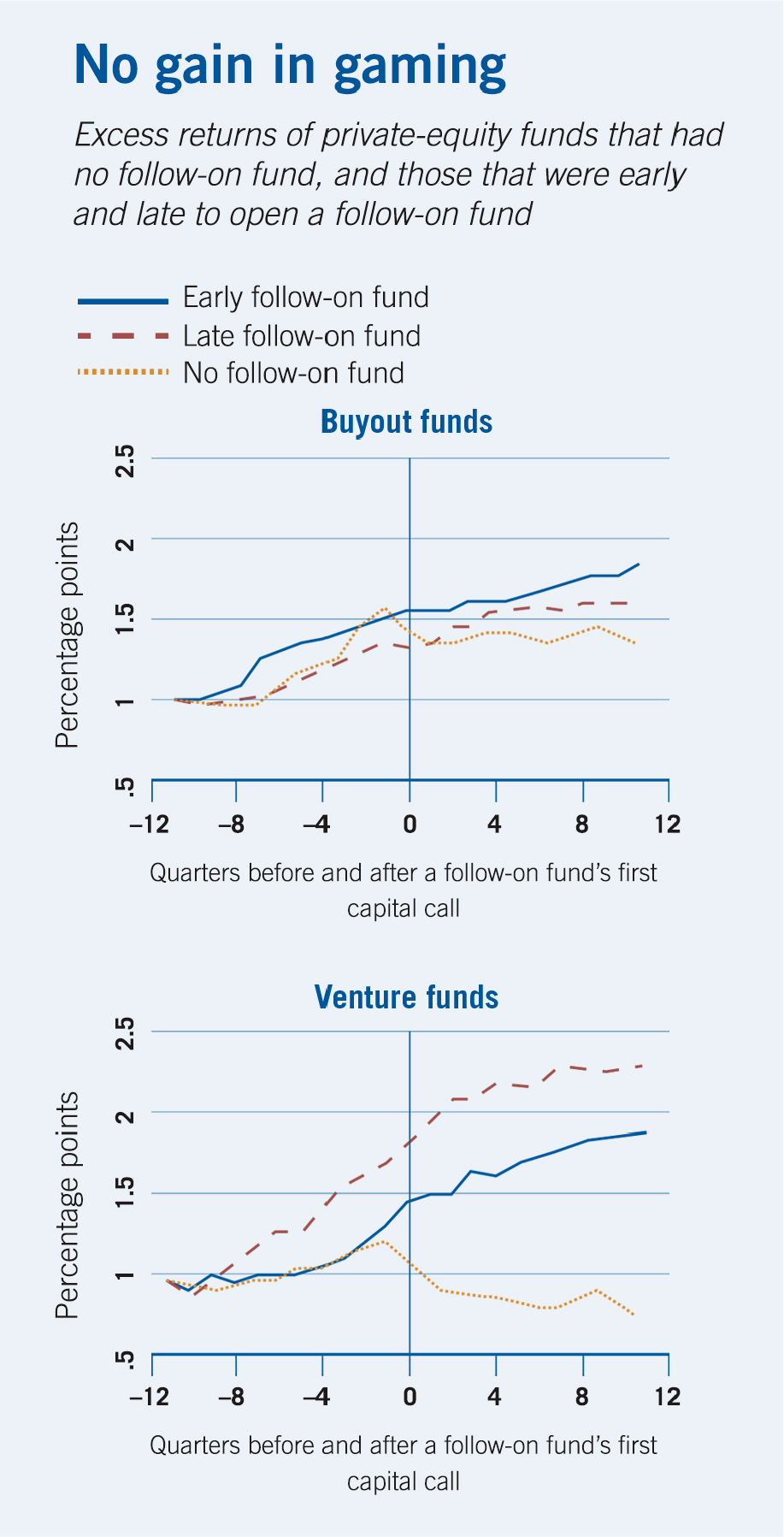

A Golden Age for Green Investment?How private-equity firms lose when they manipulate returns

Private-equity firms trying to raise new capital sometimes overstate fund returns, but investors aren’t fooled.

Research suggests that while some underperforming private-equity fund managers overstate asset values, managers at the best-performing funds tend to understate returns.

Gregory W. Brown, Oleg R. Gredil, and Steve Kaplan, “Do Private Equity Funds Game Returns?” The University of Chicago Booth School of Business working paper, October 2013.

Some green projects are enjoying a boost thanks to unconventional cost-of-capital calculations.

A Golden Age for Green Investment?

And stubborn inflation could make things a lot worse.

Rate Hikes Are Costing the Fed and the Treasury

When investors receive dividends, they often use the cash to buy more shares of stock—and not necessarily of the company that issued the dividend.

Dividend Payouts Lead to Stock-Price BumpsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.