Climate-Policy Pronouncements Boost ‘Brown’ Stocks

A US president’s comments tend to calm volatility around climate-related stocks and bolster asset prices by resolving uncertainty.

Climate-Policy Pronouncements Boost ‘Brown’ StocksWhy no news is news

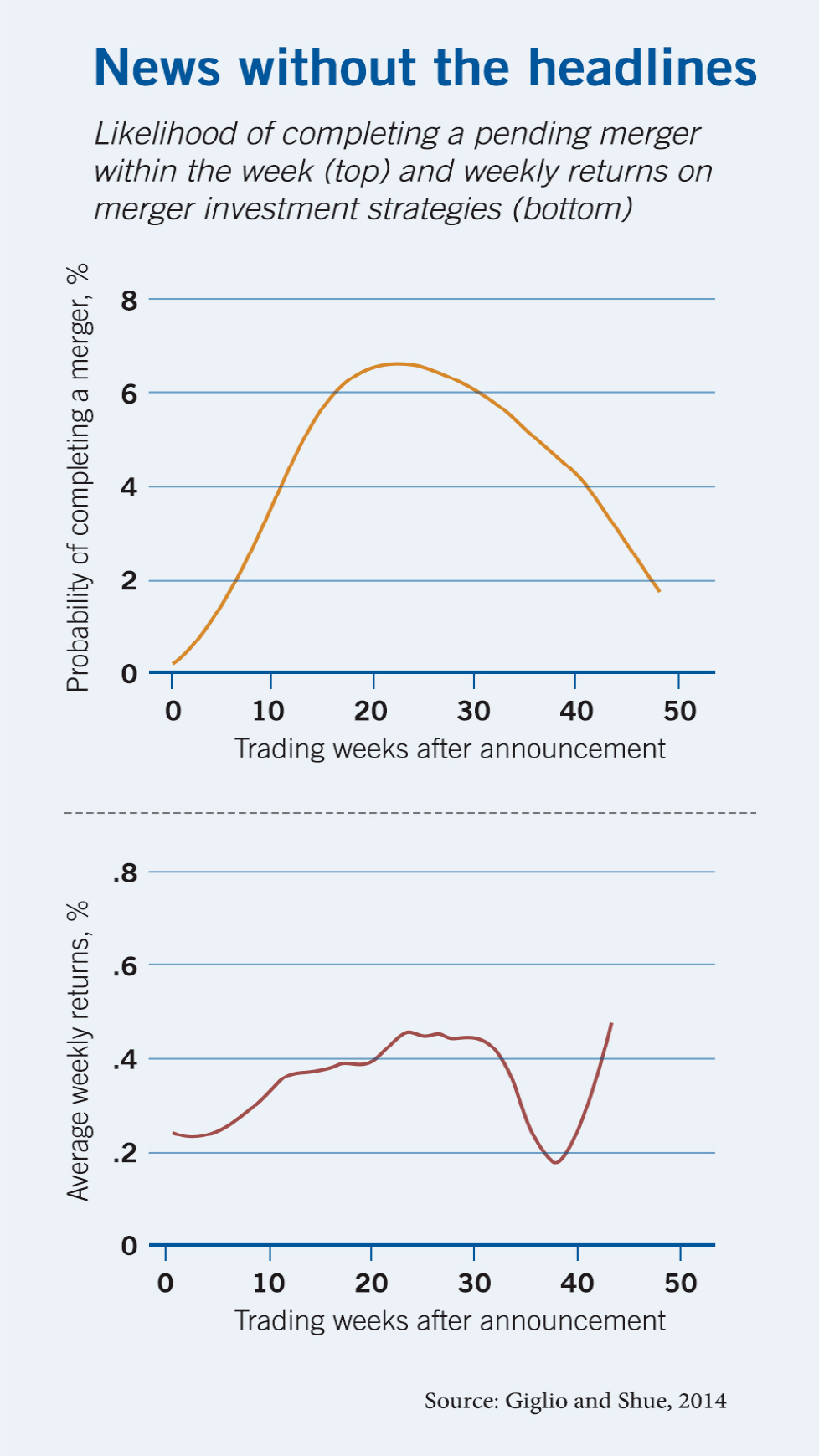

The absence of news reports and the passage of time often contain important information markets tend to overlook

Research suggests that investors, by underreacting to information tied to the passage of time, are ignoring potential profits.

Stefano Giglio and Kelly Shue, “No News Is News: Do Markets Underreact to Nothing?” Review of Financial Studies, August 2014. Chart reprinted with permission from Oxford University Press. Copyright 2014.

A US president’s comments tend to calm volatility around climate-related stocks and bolster asset prices by resolving uncertainty.

Climate-Policy Pronouncements Boost ‘Brown’ Stocks

When the pandemic hit the United States, medical debt appeared likely to soar. Instead, it fell.

The COVID Medical-Debt Bomb That Fizzled

How community membership affects the allocation of trade credit

The Equation: The Community Ties That CountYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.