Has Capitalism Moved On from ‘American Psycho’?

Chicago Booth’s John Paul Rollert reflects on the continuing relevance of Bret Easton Ellis’s 1991 novel.

Has Capitalism Moved On from ‘American Psycho’?How to spot risky investments

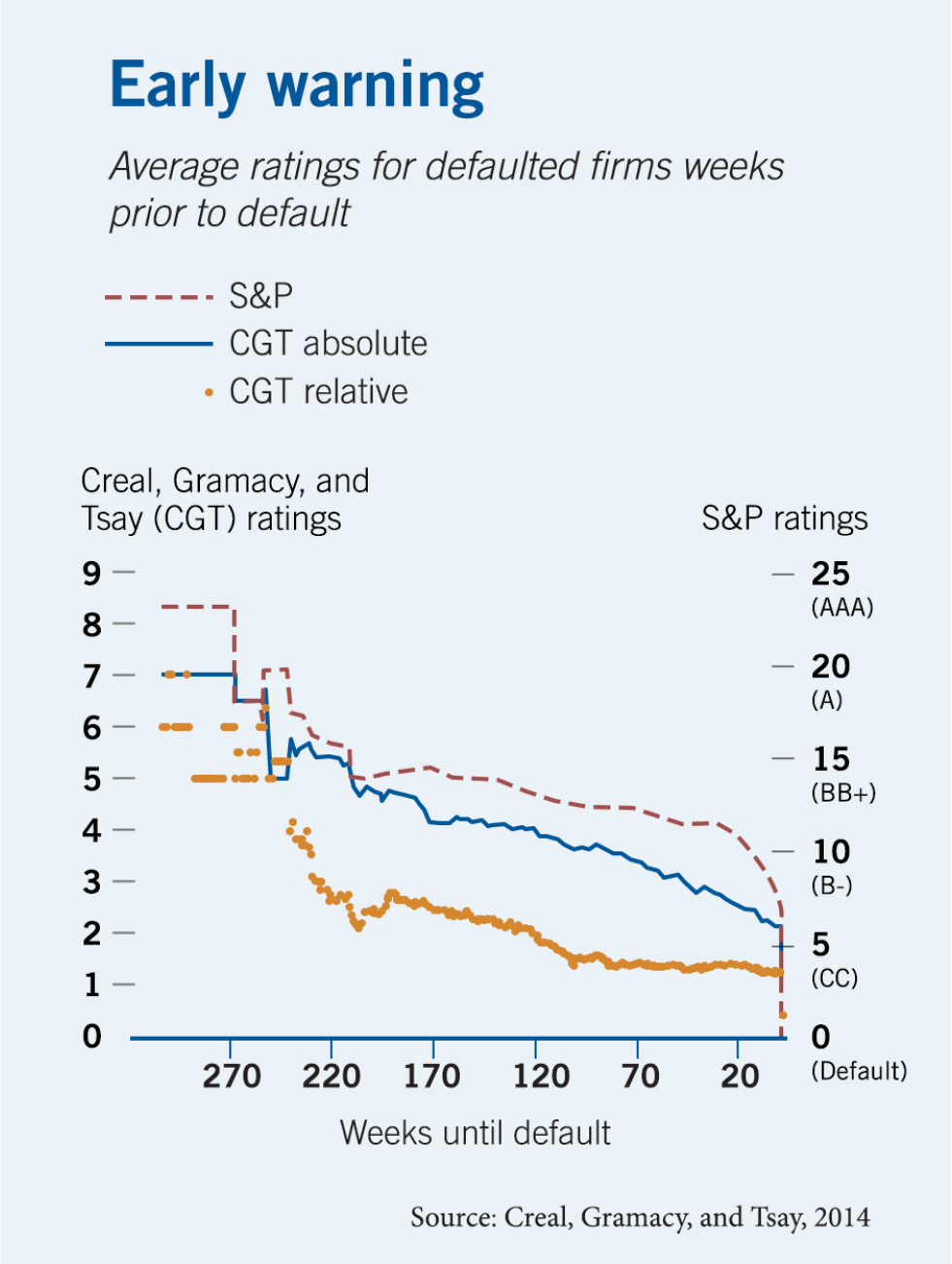

Credit ratings based on credit-default swaps can provide transparent and effective signals of default risk.

For firms that defaulted, relative ratings provided the clearest indication of trouble ahead.

Drew D. Creal, Robert B. Gramacy, and Ruey S. Tsay, “Market-Based Credit Ratings,” Journal of Business & Economic Statistics, July 2014. Chart reprinted with permission from Taylor & Francis. Copyright 2014.

Chicago Booth’s John Paul Rollert reflects on the continuing relevance of Bret Easton Ellis’s 1991 novel.

Has Capitalism Moved On from ‘American Psycho’?

Quantitative easing may have played a part in the US financial sector’s current instability.

Did the Fed Contribute to SVB’s Collapse?

The simple financial instrument belies a complex process that makes it work.

Passive ETFs Are Surprisingly ActiveYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.