Why Small Businesses Are More Reluctant to File for Chapter 11

They tend to struggle with debt instead, but research suggests two ways to change the situation.

Why Small Businesses Are More Reluctant to File for Chapter 11How momentum trading can go wrong

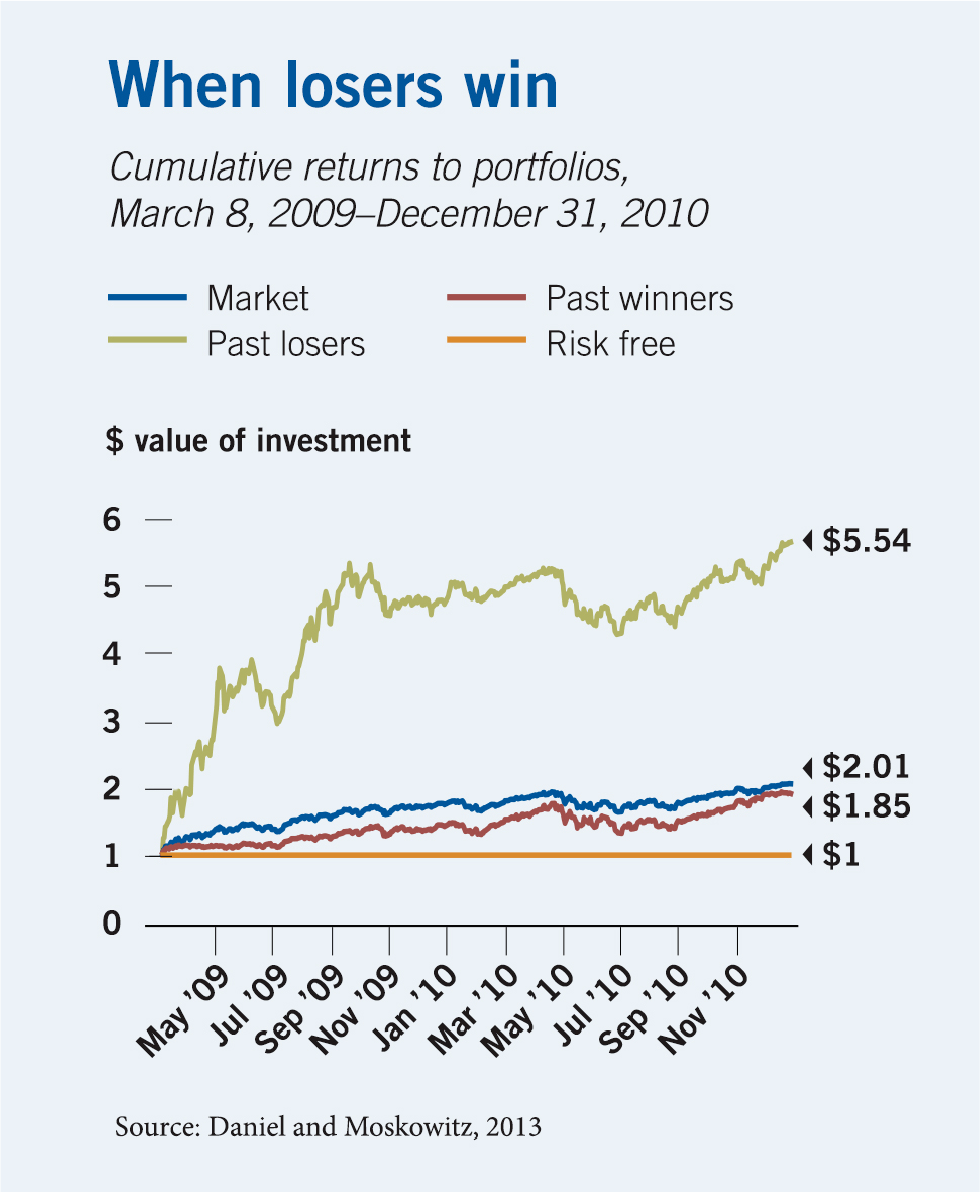

Buying winning stocks and betting against losing ones could be a poor strategy in a fast-rebounding market.

Last year’s losers perform well while the winners lag—the opposite of what a momentum trader would be betting on.

Kent D. Daniel and Tobias J. Moskowitz, “Momentum Crashes,” Working paper, March 2013.

They tend to struggle with debt instead, but research suggests two ways to change the situation.

Why Small Businesses Are More Reluctant to File for Chapter 11

A Q&A with Chicago Booth’s Robert W. Vishny on the legacy of the common-law tradition.

Robust US Innovation Is Rooted in Legal History

How can we contend with all we don’t know about the interplay of climate science and economics?

Confronting Uncertainty in Climate PolicyYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.