Big Bank Profits Can Spell Big Risks Ahead

Return on equity measures bank risk in a way that’s simpler and more robust than complex regulatory models.

Big Bank Profits Can Spell Big Risks AheadWhy you might be overpaying for financial advice

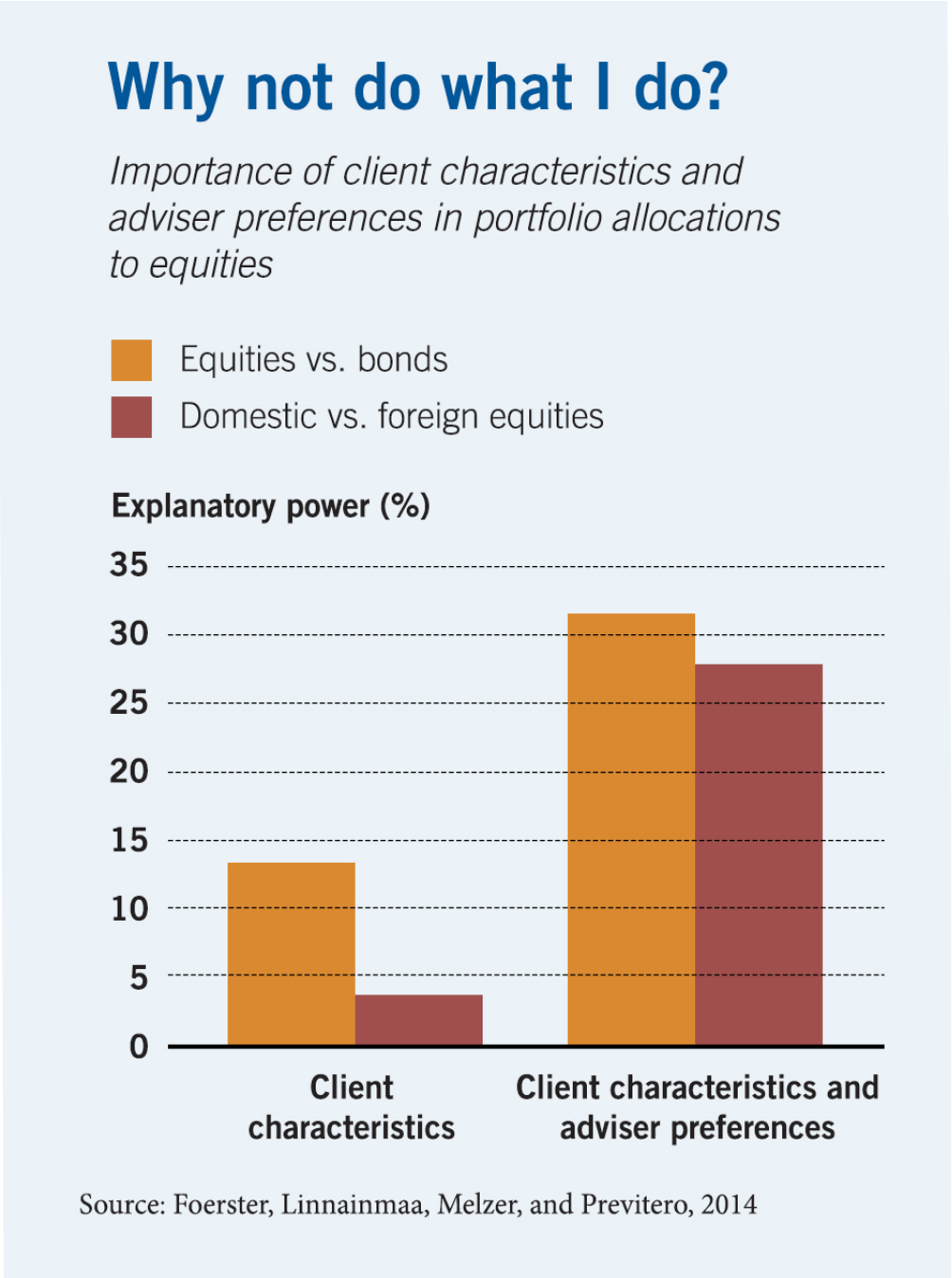

Financial advisers may not be providing the customized portfolio advice the industry advertises.

The added cost of the financial advice wipes out any gains.

Stephen Foerster, Juhani Linnainmaa, Brian T. Melzer, and Alessandro Previtero, “Retail Financial Advice: Does One Size Fit All?” Working paper, November 2014.

Return on equity measures bank risk in a way that’s simpler and more robust than complex regulatory models.

Big Bank Profits Can Spell Big Risks Ahead

A Q&A with Chicago Booth’s Zhiguo He on the idiosyncrasies of the Chinese property market

Expect a Slowdown for the Chinese Economy, but Not a Crash

The banking sector’s swelling investment in information technology may reshape global credit markets.

How Is IT Spending Changing Banking?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.