A Better Way for Finance (and Others) to Handle Missing Data

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing DataHow high-frequency traders get an edge

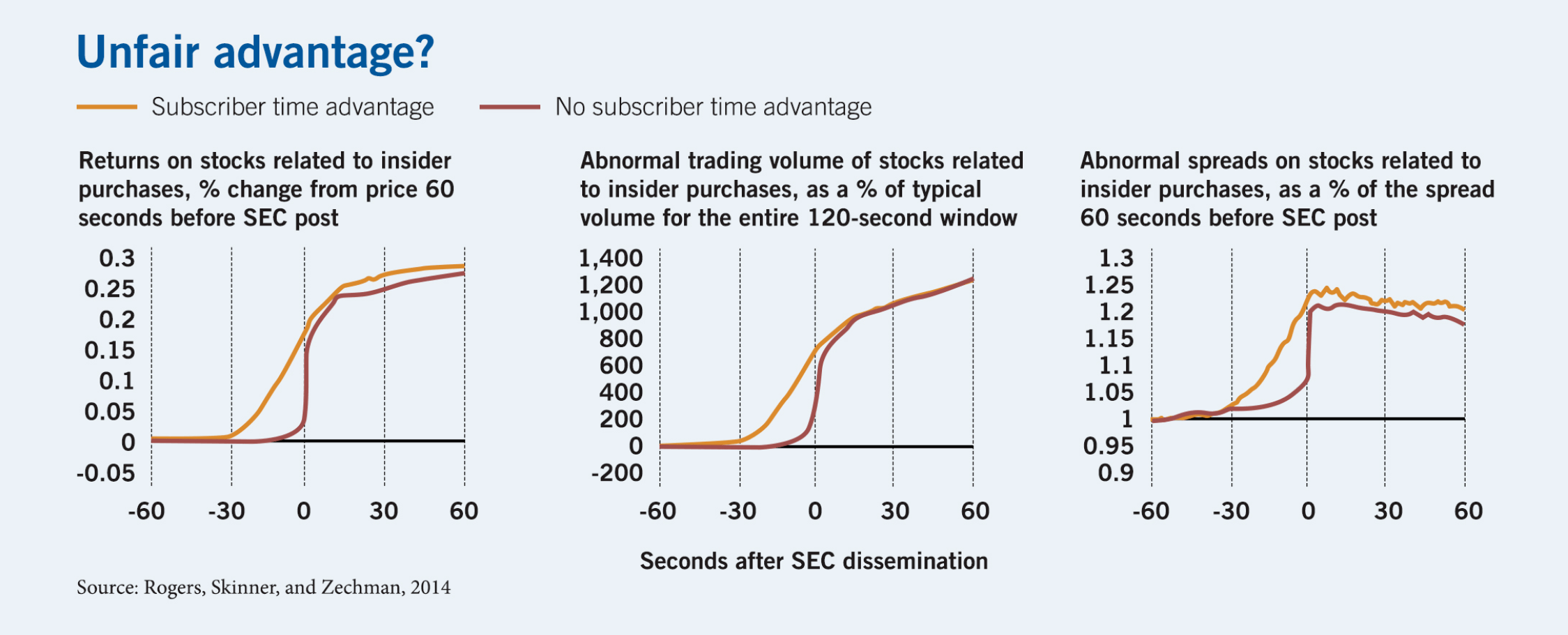

Ultrafast traders can exploit time delays in postings of company stock filings.

Jonathan L. Rogers, Douglas J. Skinner, and Sarah L.C. Zechman, “Run EDGAR Run: SEC Dissemination in a High-Frequency World,” Working paper, December 2014.

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing Data

When the pandemic hit the United States, medical debt appeared likely to soar. Instead, it fell.

The COVID Medical-Debt Bomb That Fizzled

How community membership affects the allocation of trade credit

The Equation: The Community Ties That CountYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.