AI Reads between the Lines to Discover Corporate Risk

It’s even effective in identifying risks related to AI itself.

AI Reads between the Lines to Discover Corporate RiskHow investors respond to a longer-term view

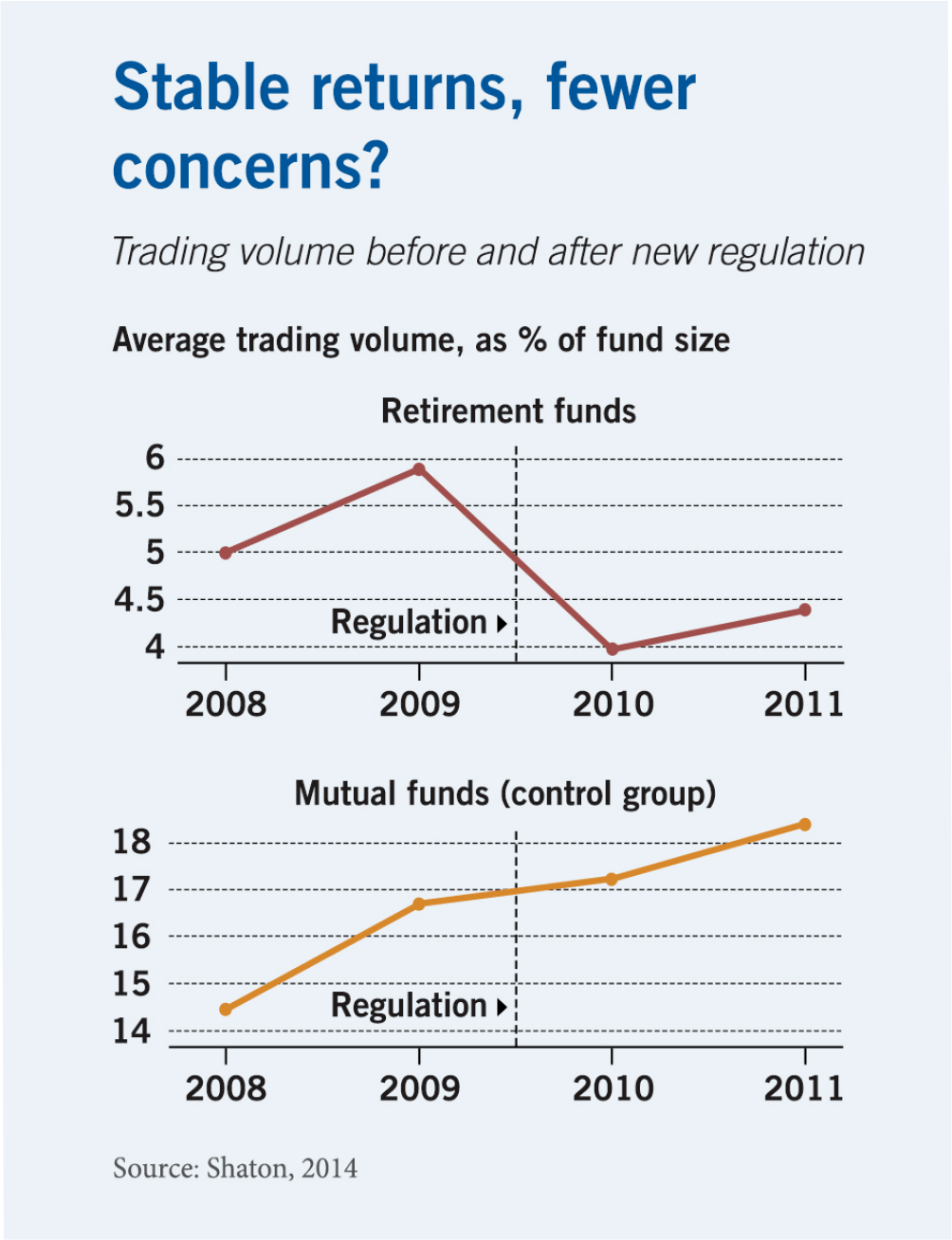

A small change in how retirement funds display past returns can prompt households to take more risk.

Research suggests investors are more likely to react to “attention-grabbing,” one-month returns than typically smoother 12-month returns.

Maya O. Shaton, “The Display of Information and Household Investment Behavior,” Working paper, November 2014.

It’s even effective in identifying risks related to AI itself.

AI Reads between the Lines to Discover Corporate Risk

Consumers underestimate how long debt will persist making only minimum payments.

How Automatic Minimum Credit Card Payments Cost Consumers—and How Regulators Could Help

Author Vivek Ramaswamy joins the Capitalisn’t podcast to discuss the roles of virtue, ethics, and politics in business and society.

Capitalisn’t: Is ‘Woke’ Capitalism a Threat to Democracy?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.