Is There a Ceiling for Gains in Machine-Learned Arbitrage?

An analysis of stock returns tests the limits of A.I.

Is There a Ceiling for Gains in Machine-Learned Arbitrage?How investment funds disguise underperformance

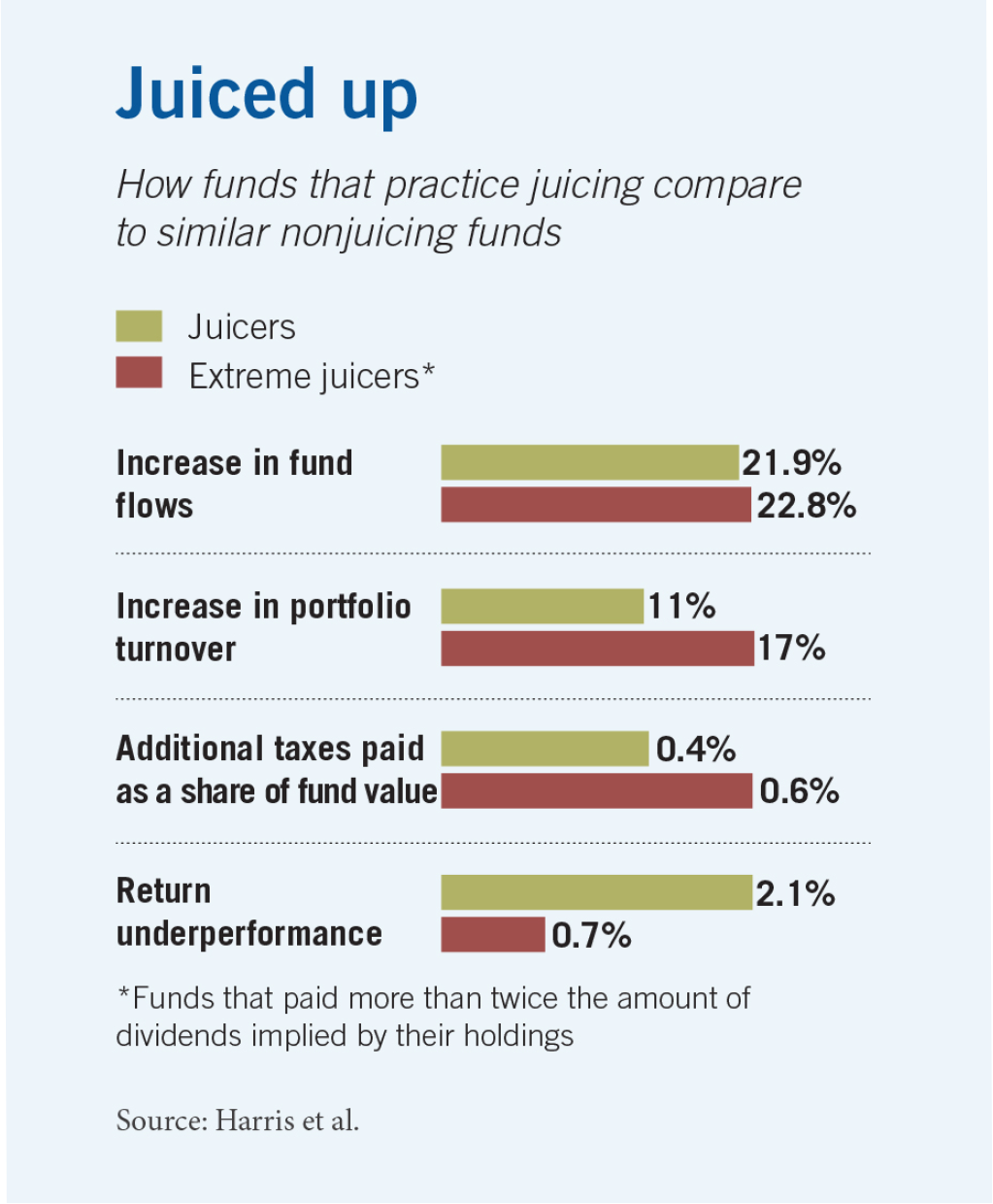

Equity mutual funds artificially boost their dividend yields to attract more investors.

‘Juicing’ is costly to investors.

Lawrence E. Harris, Samuel Hartzmark, and David H. Solomon, “Juicing the Dividend Yield: Mutual Funds and the Demand for Dividends,” Journal of Financial Economics, forthcoming.

An analysis of stock returns tests the limits of A.I.

Is There a Ceiling for Gains in Machine-Learned Arbitrage?

Private debt funds are filling a $1 trillion hole in the lending market for middle-market businesses that can’t get conventional bank financing.

With Business Loans Harder to Get, Private Debt Funds Are Stepping In

Economists consider the roots and possible consequences of crypto’s ups and downs.

Is Crypto’s Volatility Bad for the Financial System?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.