In Informal Markets, Trustworthy Data Are Key

Reliable information, not financial literacy, is the main barrier to credit growth.

In Informal Markets, Trustworthy Data Are KeyHow trading more can lead to higher returns

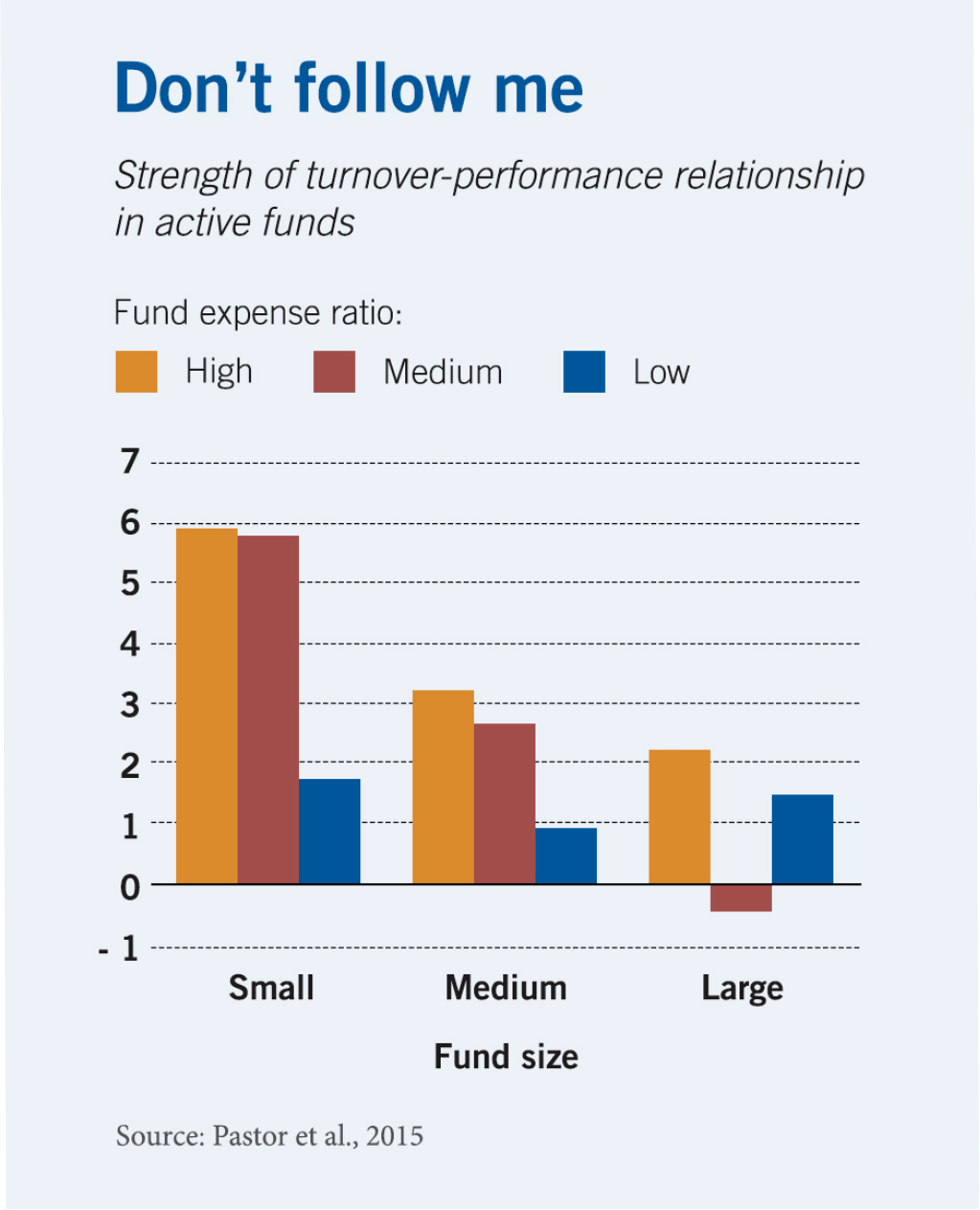

Active managers, particularly those running smaller or high-fee funds, are skilled at exploiting profit opportunities.

Funds that charge more—particularly smaller funds—earn higher returns from trading more.

Lubos Pastor, Robert F. Stambaugh, and Lucian A. Taylor, “Do Funds Make More When They Trade More?” Working paper, February 2015.

Reliable information, not financial literacy, is the main barrier to credit growth.

In Informal Markets, Trustworthy Data Are Key

The growth of privately held businesses has some regulators and policy makers pondering whether to push for more financial transparency.

Is the US Economy ‘Going Dark’?

Artificial intelligence is proving adept at technical investing.

How Self-Driving-Car Technology Can Help Machines Trade StocksYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.