What Explains the Volatility in Financial Markets?

How the inelastic markets hypothesis makes sense of seemingly inexplicable price movement

What Explains the Volatility in Financial Markets?How to get big returns from a small-company portfolio

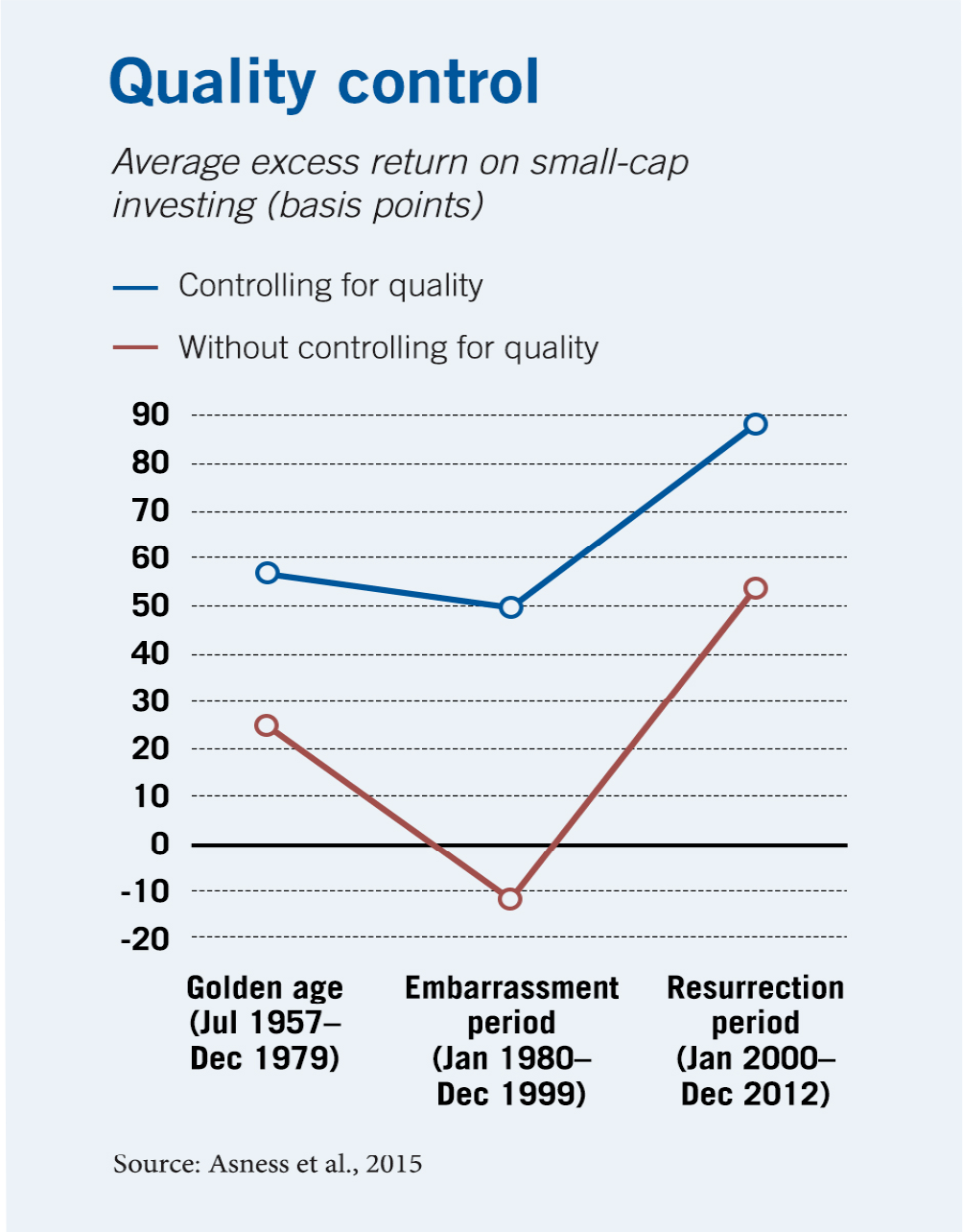

Sorting stocks based on quality and not just size delivers a consistent premium.

Had investors continued to control for quality, the “golden age” of US small-cap investing that characterized the 1960s and 70s would have continued.

Clifford S. Asness, Andrea Frazzini, Tobias J. Moskowitz, and Lasse H. Pedersen, “Size Matters, If You Control Your Junk,” Fama-Miller working paper, February 2015.

How the inelastic markets hypothesis makes sense of seemingly inexplicable price movement

What Explains the Volatility in Financial Markets?

Venture capitalists tend to rely too heavily on founders’ backgrounds.

How Startup Investors Could Back More Winners

When investors receive dividends, they often use the cash to buy more shares of stock—and not necessarily of the company that issued the dividend.

Dividend Payouts Lead to Stock-Price BumpsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.