Three Ways A.I. Can Improve Decision-Making

Researchers are using machine-learning models to improve how investors allocate their funds.

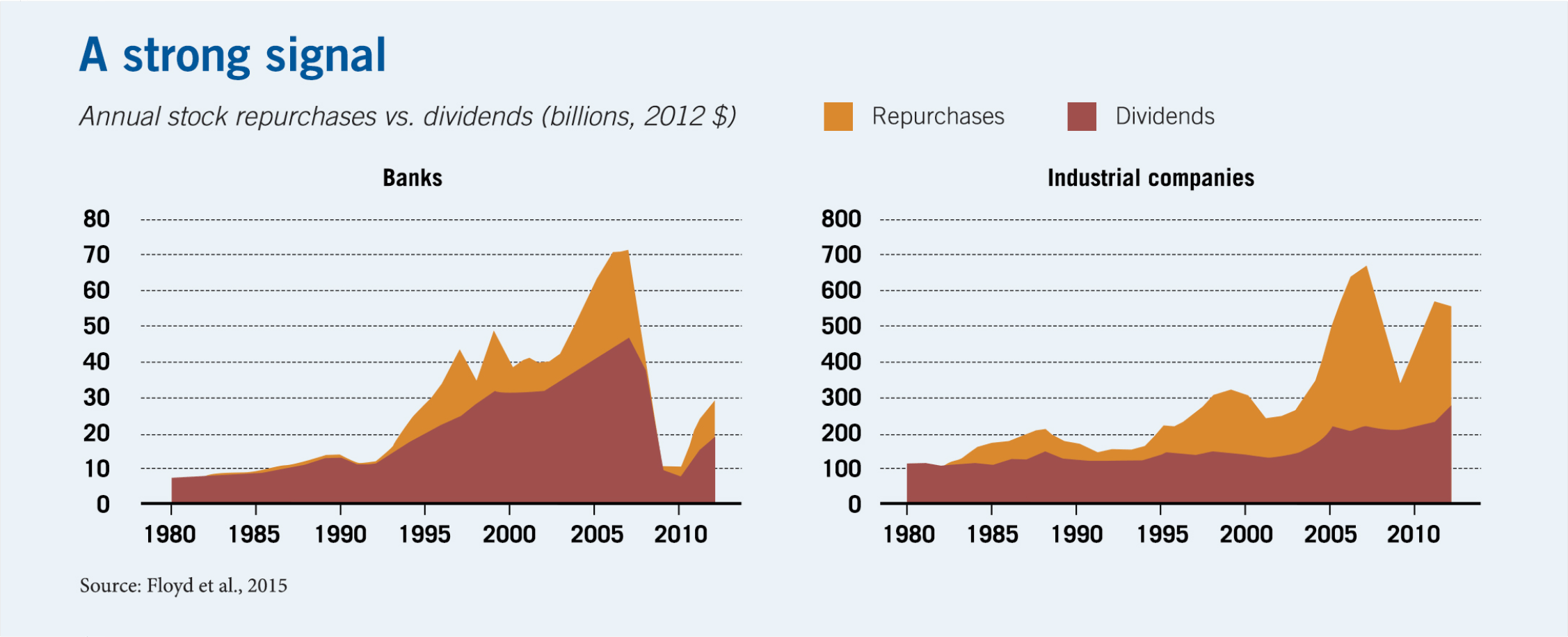

Three Ways A.I. Can Improve Decision-MakingWhy banks pay ever-larger dividends

Investors use the payments as a proxy for financial strength

Paying regular and increasing dividends allows banks to signal confidence about their solvency.

Eric Floyd, Nan Li, and Douglas J. Skinner, “Payout Policy through the Financial Crisis: The Growth of Repurchases and the Resilience of Dividends,” Journal of Financial Economics, November 2015. Chart reprinted with permission from Elsevier.

Researchers are using machine-learning models to improve how investors allocate their funds.

Three Ways A.I. Can Improve Decision-Making

The early-2000s market had a high level of speculation.

Is a Housing Bust Ahead? Look at Short-Term Sales

The Capitalisn’t podcast welcomes two experts with differing views on the performance of private equity.

Capitalisn’t: Is Private Equity a Good Investment?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.