Climate-Policy Pronouncements Boost ‘Brown’ Stocks

A US president’s comments tend to calm volatility around climate-related stocks and bolster asset prices by resolving uncertainty.

Climate-Policy Pronouncements Boost ‘Brown’ StocksHow investors act like speed daters

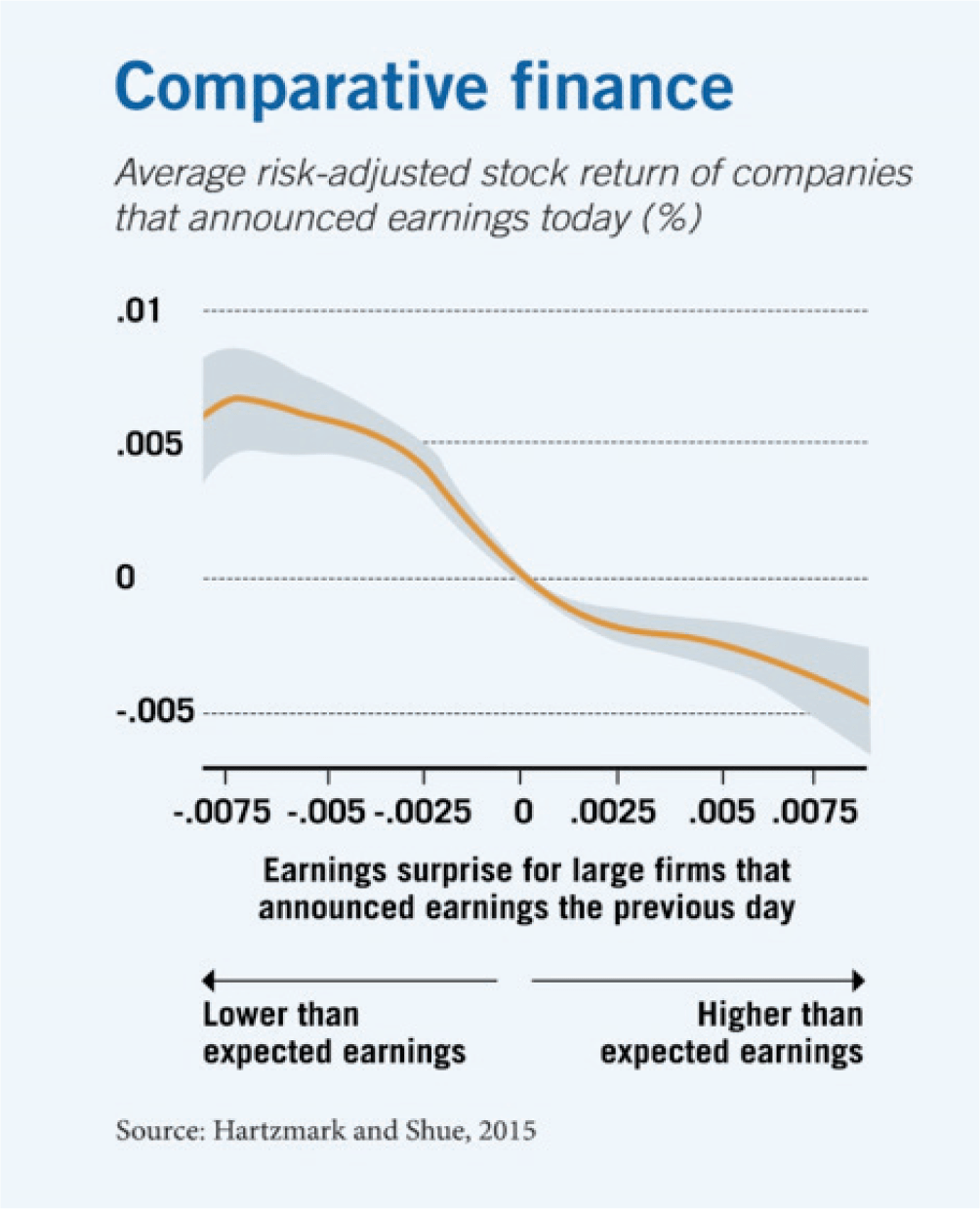

Investors contrast earnings announcements with the prior day’s earnings surprises

If yesterday’s earnings announcement was especially bad, today’s news will seem more impressive by comparison.

Samuel Hartzmark and Kelly Shue, “A Tough Act to Follow: Contrast Effects in Financial Markets,” Working paper, June 2015.

A US president’s comments tend to calm volatility around climate-related stocks and bolster asset prices by resolving uncertainty.

Climate-Policy Pronouncements Boost ‘Brown’ Stocks

Venture capitalists tend to rely too heavily on founders’ backgrounds.

How Startup Investors Could Back More Winners

Credit markets need intermediaries, but there are too many in the system now.

Too Many ‘Shadow Banks’ Can Limit Overall Access to CreditYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.