A Market without HFT?

How choices in market design affect the fortunes of various types of investors.

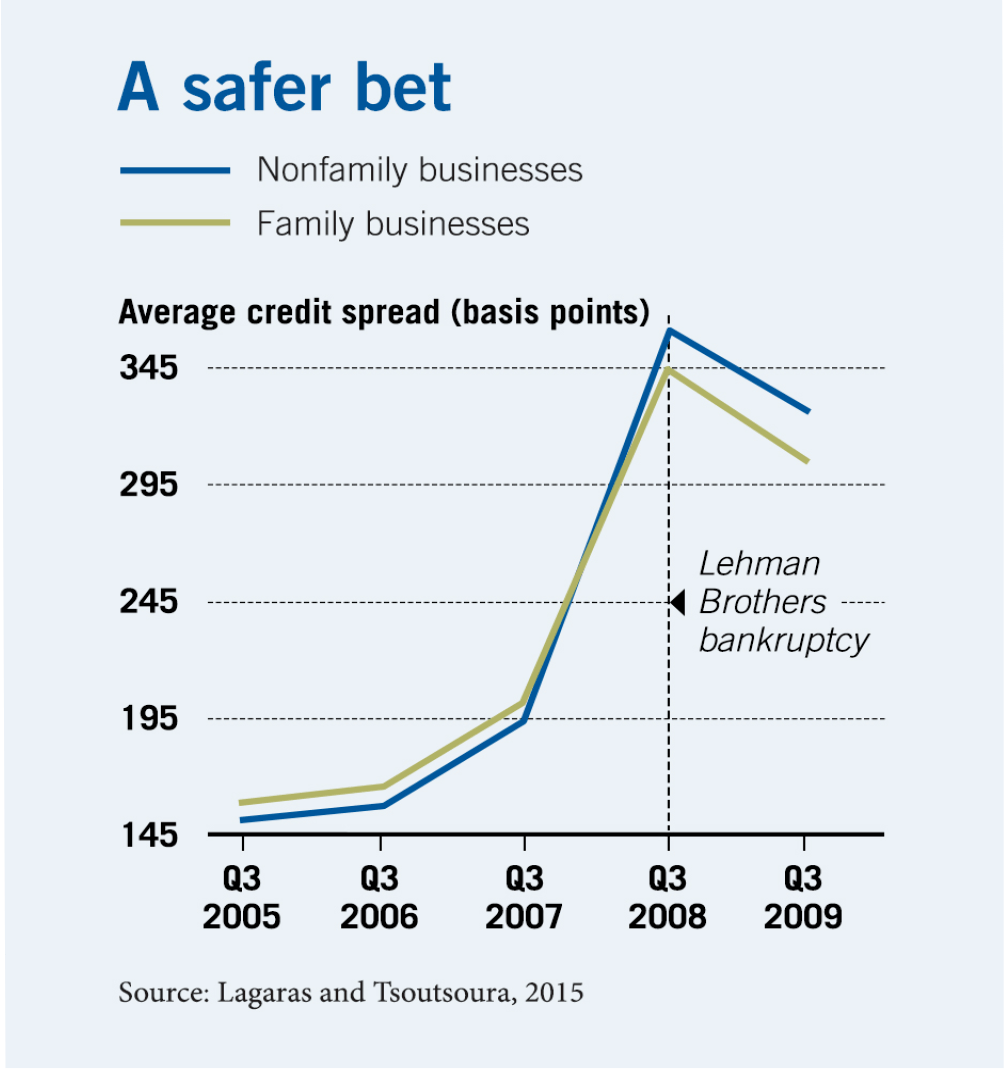

A Market without HFT?When times are tough, lenders prefer family businesses

Banks viewed family-owned companies as safer investments during the 2007–10 financial crisis

Average credit spreads increased for all companies around the time of the Lehman collapse, but the increase was larger for nonfamily businesses.

Spyridon Lagaras and Margarita Tsoutsoura, “Family Control and the Cost of Debt: Evidence from the Great Recession,” Working paper, June 2015.

How choices in market design affect the fortunes of various types of investors.

A Market without HFT?

Recognize the stressors inherent in business models.

Four Ways to Avoid the Next Silicon Valley Bank

Some degree of concentration in subprime credit markets could be good for consumers.

When It Comes to Subprime Car Loans, Competition Drives Rates UpYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.