A Better Way for Finance (and Others) to Handle Missing Data

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing DataHow investors cope with losses

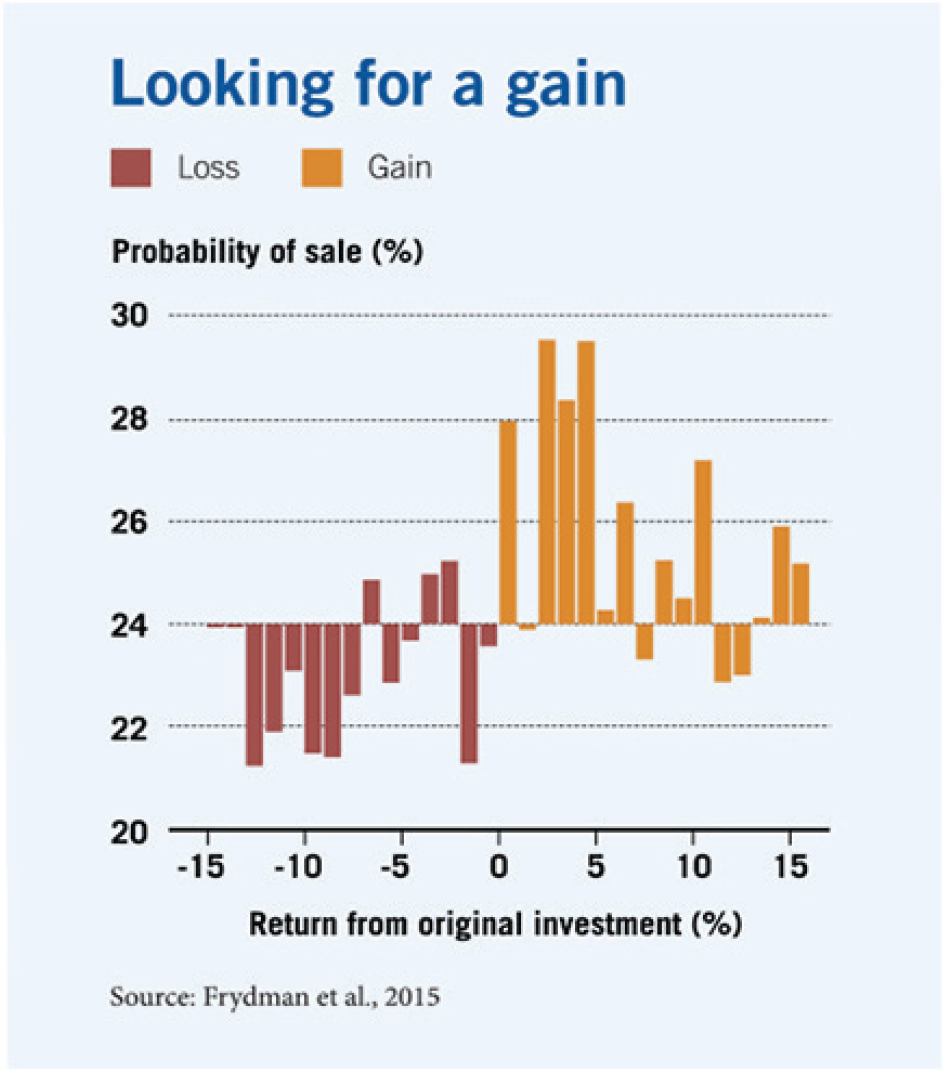

Rolling a losing position into a new stock can dull the pain of losing money.

Investors who have rolled proceeds from an investment into a new asset tend to use the amount paid for the original investment as a reference point to compute gains and losses for the new asset.

Cary D. Frydman, Samuel Hartzmark, and David H. Solomon, “Rolling Mental Accounts,” Working paper, November 2015.

As much as we’re awash in data, a huge problem for building predictive models is the information we don’t have.

A Better Way for Finance (and Others) to Handle Missing Data

A Q&A with Chicago Booth’s Robert W. Vishny on the legacy of the common-law tradition.

Robust US Innovation Is Rooted in Legal History

How can we contend with all we don’t know about the interplay of climate science and economics?

Confronting Uncertainty in Climate PolicyYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.