Growth Expectations Drive Stock Prices? It May Be the Other Way Around

Share-price changes may have less to do with fundamentals than conventionally thought.

Growth Expectations Drive Stock Prices? It May Be the Other Way AroundHow financial firms tolerate misconduct

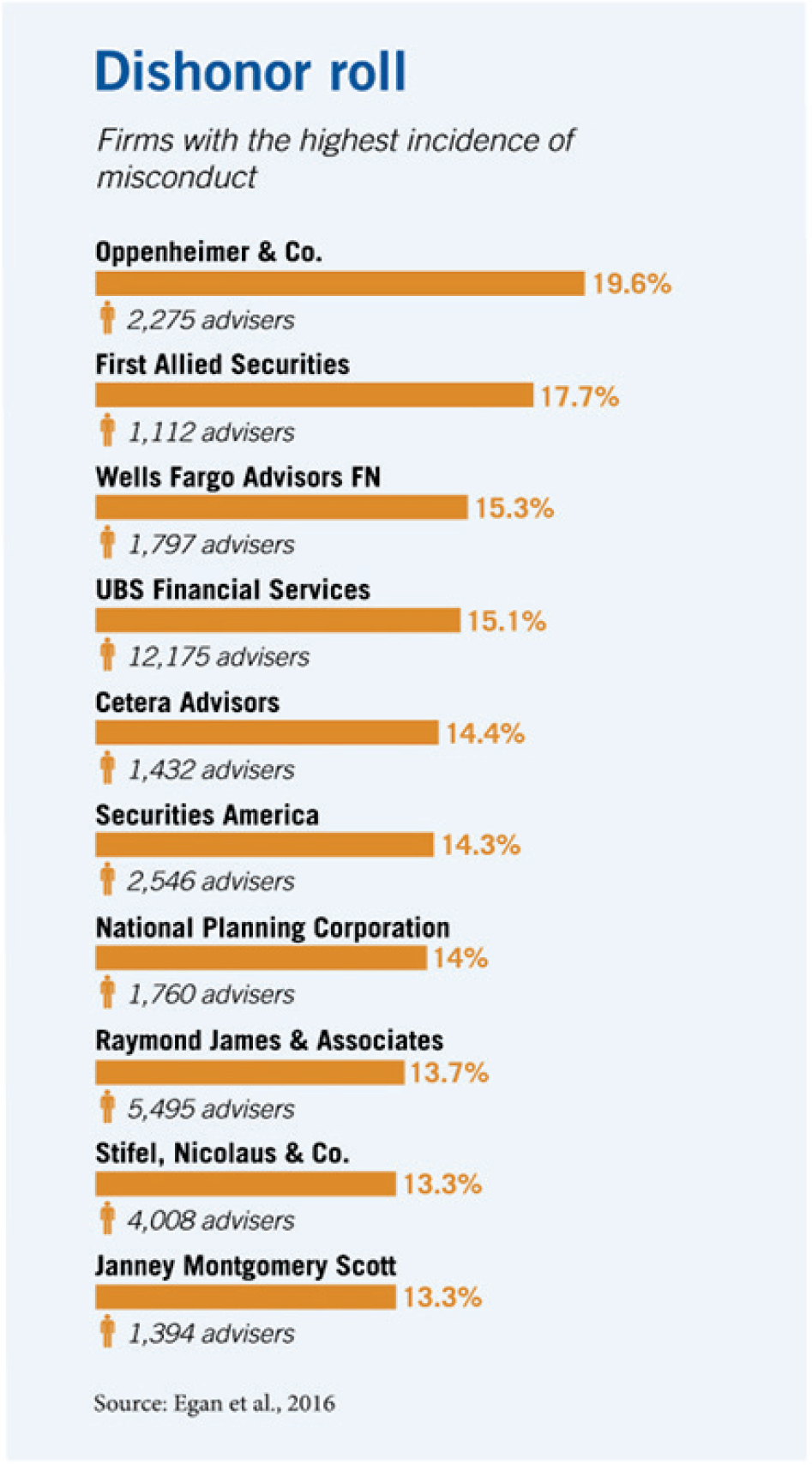

At some firms, more than 15 percent of advisers have a record of misconduct

Misconduct is concentrated in firms that cater to small retail investors.

Mark Egan, Gregor Matvos, and Amit Seru, “The Market for Financial Adviser Misconduct,” Working paper, March 2016.

Share-price changes may have less to do with fundamentals than conventionally thought.

Growth Expectations Drive Stock Prices? It May Be the Other Way Around

How the excess savings of the US’s wealthiest households may be feeding a cycle of inequality and instability.

Who Is Fueling America’s Debt Binge?

Author Vivek Ramaswamy joins the Capitalisn’t podcast to discuss the roles of virtue, ethics, and politics in business and society.

Capitalisn’t: Is ‘Woke’ Capitalism a Threat to Democracy?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.