A Blueprint for a Better Stock Exchange

With the transformation of asset markets over the past two decades, ‘flow trading’ could offer a more flexible and fairer way to trade.

A Blueprint for a Better Stock Exchange

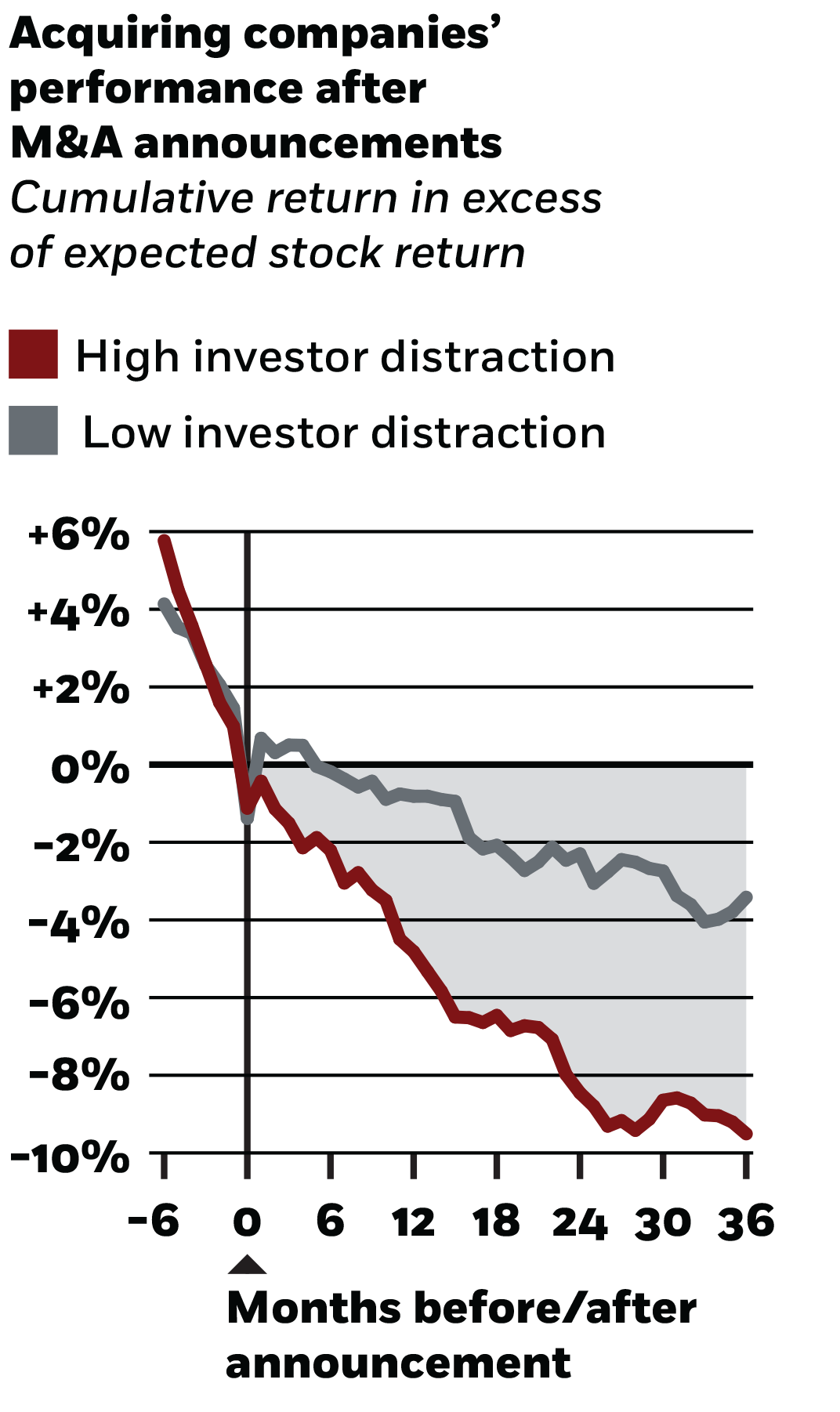

Corporate managers misbehave when shareholders aren’t paying attention.

Elisabeth Kempf, Alberto Manconi, and Oliver G. Spalt, “Distracted Shareholders and Corporate Actions,” Review of Financial Studies, May 2017.

With the transformation of asset markets over the past two decades, ‘flow trading’ could offer a more flexible and fairer way to trade.

A Blueprint for a Better Stock Exchange

Regulatory action unrelated to fair lending can nonetheless increase access to credit for historically disadvantaged categories of borrowers.

How Fixing Troubled Banks Can Help Minorities and Women

The banking sector’s swelling investment in information technology may reshape global credit markets.

How Is IT Spending Changing Banking?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.