Two market scenarios frequently discussed by policymakers could cause a significant disruption in the auditing world.

- By

- January 28, 2014

- CBR - Accounting

Two market scenarios frequently discussed by policymakers could cause a significant disruption in the auditing world.

The five-year anniversary of Lehman Brothers’ collapse was remembered in September 2013 with TV shows, articles, and editorials. But the anniversary of another corporate crisis is now rarely mentioned: it has been 13 years since energy trading firm Enron imploded in an accounting fraud scandal. That was followed by the collapse of its auditor, Arthur Andersen, which reduced the number of large global audit firms from five to four. Ever since, those firms—Deloitte, Ernst & Young, KPMG, and PricewaterhouseCoopers—have dominated.

The best reporting system would combine rules-based and principles-based approaches.

A Guide for More Accurate, Transparent Financial Reporting

Worried about outsized executive pay, US regulators crafted rules aimed at driving down compensation. But research suggests the move had the opposite results—more disclosure led to higher executive pay.

How More Pay Disclosure Has Pushed Up Executive CompensationWhat would happen if another major audit firm exited the market? How bad would that be, and how much would it cost? The question has been raised in policy circles, most recently in 2008 hearings at the US Treasury, and by the United Kingdom’s Competition Commission during an investigation of audit market competition that began in 2011.

Research by Chicago Booth’s Joseph Gerakos, associate professor of accounting, and Chad Syverson, J. Baum Harris Professor of Economics, zeroes in on the two market scenarios frequently discussed by policymakers that could cause a significant disruption in the auditing world. The first would be the introduction of mandatory audit firm rotation. The other envisages a sudden market exit by one of the Big Four auditors because of regulation or legal action.

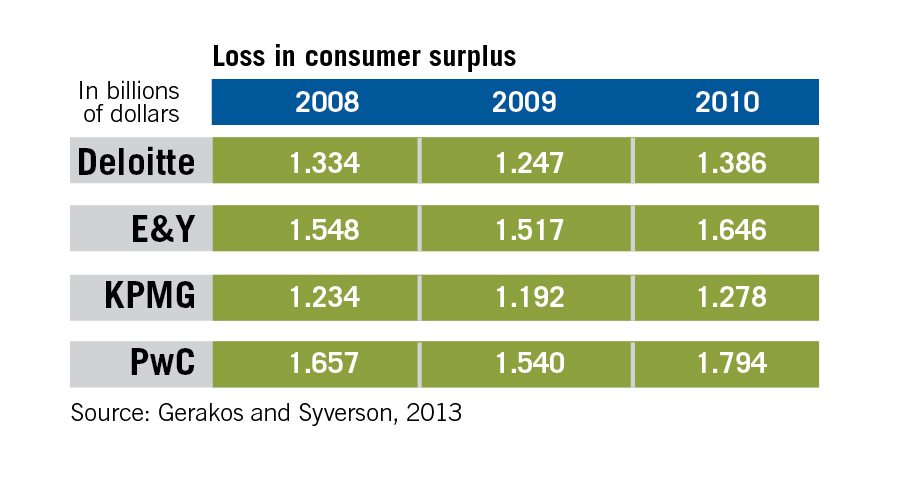

The researchers conclude that another failure would cost the US clients of the disappearing firm at least $1.2 billion–$1.8 billion per year in lost “consumer surplus.” That describes the net value lost by a company when forced to switch auditors, and the value a company places (if any) on an extended relationship with its audit firm.

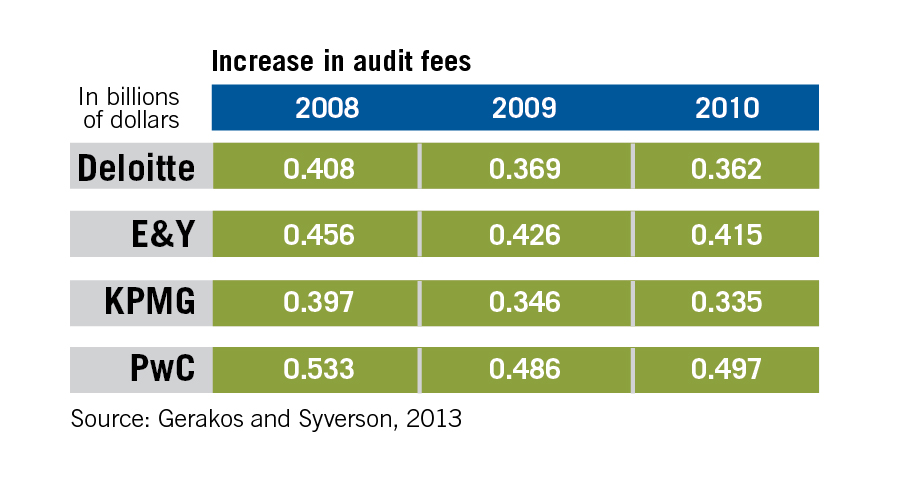

This estimate, made using an empirical model with parameters fit from data on audit relationships, reflects only the cost of losing the option to hire the disappearing auditor. If smaller firms don’t fill the vacuum, reduced competition among the remaining audit firms will also likely cause fee increases—and the researchers estimate those increases to be a collective $300 million–$500 million, depending on which Big Four firm goes down.

The researchers also see large impacts if regulators were to force companies to change public accounting firms periodically, known as mandatory auditor rotation, an idea US regulators have discussed several times. If US companies were required to rotate audit firms every 10 years, they would incur consumer surplus losses of $2.4 billion–$3.6 billion, Gerakos and Syverson estimate. If rotation were mandatory every four years, the researchers estimate it would cost US firms even more, $4.3 billion–$5.5 billion.

Audit firms are structured in the United States as private partnerships that, somewhat ironically, do not produce audited financial statements in the US (but do elsewhere, such as the United Kingdom). For that reason, verifiable public information is minimal about the firms’ US financial performance, whether for all business or only audit services. There is also no public information about the total legal contingencies faced by each firm and whether those firms have sufficient capital to withstand large legal judgments, especially if they come in rapid succession.

To measure the costs of an audit firm failure, Gerakos and Syverson analyze the consumer surplus impact to the firms’ clients. For example, Walmart uses Ernst & Young for auditing. As Ernst & Young has a long relationship and familiarity with the retailer’s operations, Walmart would be significantly inconvenienced if Ernst & Young were to fail.

Gerakos and Syverson use the exit of Arthur Andersen and increases of auditor capacity due to client mergers and acquisitions to estimate how a client such as Walmart would be willing to pay to keep from losing the ability to hire Ernst & Young as its auditor.

And which firm’s downfall would cause the most pain? As of fiscal 2012, PricewaterhouseCoopers was the biggest auditor, with the highest total global revenues and the highest audit revenues. The data suggest that the failure of PricewaterhouseCoopers would hurt its clients the most, costing them about $1.8 billion in lost consumer surplus. The second biggest global firm, in total and by audit revenues, is Deloitte, but the researchers calculate that an Ernst & Young failure would have a greater impact.

They say that clients such as Walmart and News Corporation stuck with the firm even when they likely could have obtained lower fees by defecting to a different auditor, demonstrating that Ernst & Young’s audit clients are loyal.

Auditors’ industry specialties would affect how much pain their failure would cause. PricewaterhouseCoopers dominates audits of global pharmaceutical companies; Ernst & Young has more software, hardware, and telecom clients; KPMG is the only auditor in Germany; and Deloitte audits many large US-listed Chinese companies. When Gerakos and Syverson hold a client’s size and tenure with its auditor constant, they find that the failure of an audit firm with industry specialization would have a greater effect on clients in such industries.

In addition to the consumer surplus impact, if one of the Big Four were to suddenly collapse, audit fees could also increase, as reduced competition would give the remaining firms a pricing advantage. To calculate this, Gerakos and Syverson use data that companies report to the SEC, as well as audit fee data obtained from the research firms Audit Analytics and Compustat.

The researchers estimate the size of these potential fee increases by considering the experience of firms audited by Arthur Andersen before its demise. They calculate that Andersen’s failure caused a 0.15% increase in audit fees for each one-percentage point of total industry assets audited by Andersen. This effect persisted at least through 2010.

Unless smaller audit firms, or a combination of firms, find a way to enter the market, annual audit fee increases could continue indefinitely, say the researchers. While the barrier to entry is low in terms of offering basic audit services, it seems impenetrable when it comes to offering audit services to global multinational companies. The experience of what happened after Arthur Andersen failed is instructive, say the researchers: no next-tier firm or combination of smaller firms emerged to successfully compete with the remaining four.

Gerakos and Syverson restrict their calculations to US public companies, and look at the impact of auditor failure on US-based publicly traded firms. They don’t examine whether a multinational company could be affected differently if an audit firm were to fail outside the US, or if a US firm failure would disrupt audit services for companies listed elsewhere.

In addition, Gerakos and Syverson limit their fee estimates to audit services and do not include nonaudit- and audit-related fees and services, which in 2012 were, on average, about 22% of total fees paid to the auditors, according to Audit Analytics. That’s down from about 51% in 2002, the last year before the Sarbanes-Oxley prohibitions on other consulting services to audit clients became effective. Their model also does not account for potential disruptions to the capital markets if the industry were unable to function properly with only three large audit firms.

Some firms, clients, and policymakers are calculating the likelihood of a legal claim that could take down another audit firm. In 2010 two industry trade associations filed a joint brief to support the auditors’ arguments in court cases against KPMG and PricewaterhouseCoopers. In it, they argued, “The biggest threat facing audit firms today is that a single megaclaim or several such civil claims in succession could destroy an audit firm.”

James Peterson, a lecturer at the University of Chicago Law School, a former inside counsel for Arthur Andersen, and a blogger, has calculated how big a legal judgment, fine, or settlement (or a combination of) would have to be to cause an audit-firm failure. His answer: the breakup threshold for any one of the Big Four firm’s litigation could be as low as $2.2 billion. (By comparison, Deloitte recently settled a $7 billion legal claim relating to its work auditing the bankrupt mortgage originator Taylor Bean & Whitaker, whose chairman and CEO are both in jail for fraud. The settlement amount is confidential.) Peterson’s methodology is based on a September 2006 report by the consulting firm London Economics, which modeled the threshold of financial pain for a Big Four–UK partnership. He applied this London methodology most recently to the firms’ fiscal year 2011 results.

That estimate is at a global level, and Peterson’s estimate for the litigious Americas region dips down to $675 million. That is not beyond the realm of possibility: in 2008 Ernst & Young paid $300 million to settle a case involving the now-defunct New York–based real estate and travel services company Cendant Corporation.

If Peterson’s estimates are accurate, pending court decisions could threaten to turn the Big Four into three. That makes Gerakos and Syverson’s exercise seem a lot less like theory, and more like preparation.

Joseph Gerakos and Chad Syverson, “Competition in the Audit Market: Policy Implications,” NBER working paper, 2013.

The Capitalisn’t podcast examines management consulting with Pulitzer Prize-winning investigative journalist Walt Bogdanich.

Capitalisn’t: The Capitalisn’t of Consulting—McKinsey and Beyond

An expert panel discusses challenges and strategies for corporate responses to racial injustice.

How Should Companies Respond to Black Lives Matter?

The solution is to incorporate more mathematical thinking in decision making.

Is Your Company's Narrative Stopping You from Planning Effectively?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.