- By

- December 10, 2013

- CBR - Finance

Hostel, a guts-and-gore-filled horror movie released in 2005, might seem to offer little insight into the financial markets. But Professor Luigi Zingales employs an innovative methodology—including showing scenes from Hostel—to quantify the extent to which fear caused investors’ risk aversion to spike after the 2008–09 financial crisis, impeding their ability to make smart investment choices.

To test the extent of this postcrisis risk aversion, Zingales, along with Luigi Guiso of the Einaudi Institute for Economics and Finance and Paola Sapienza of Northwestern University, used a survey of bank clients, and then tested a hypothesis about its psychological roots in an experiment that uses a particularly gruesome excerpt from Hostel.

In the initial survey, the researchers gave two identical questionnaires to clients of an Italian bank. Participants received the first in January 2007, well before the crisis, and the second in June 2009, when the financial crisis was still raging. About one-third of the clients agreed to be reinterviewed in 2009, resulting in a dataset of 666 investors across both questionnaires. To be included in the survey, customers had to have at least €10,000 deposited at the bank at the end of 2006.

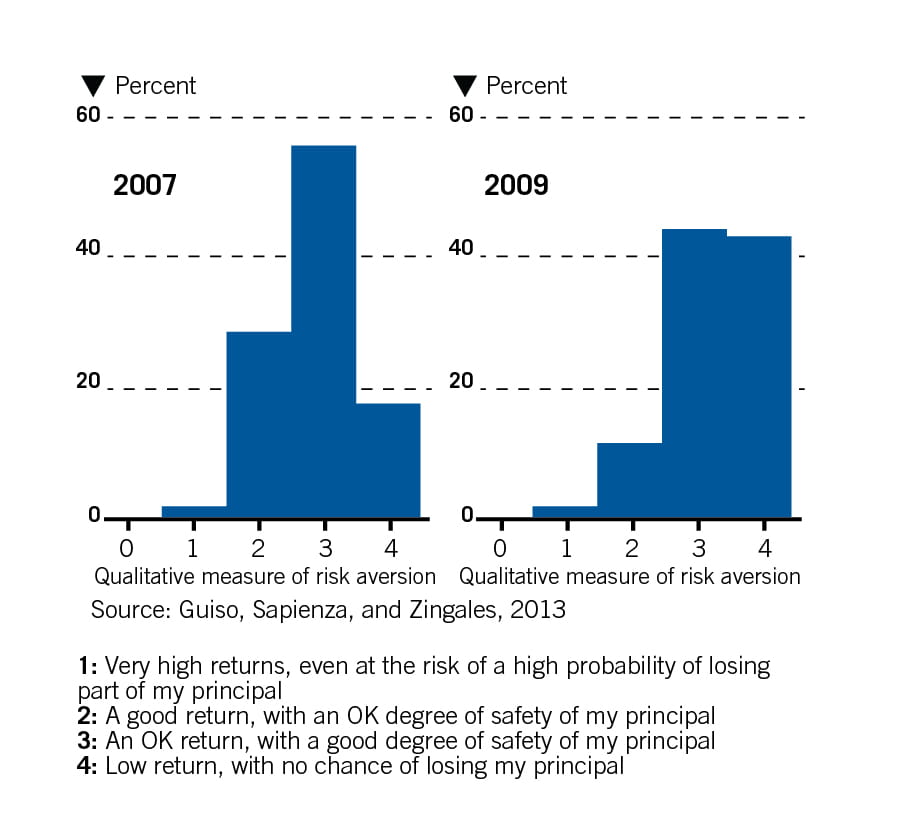

In both questionnaires, the first question, which the researchers call “the quantitative question,” reveals respondents’ confidence in winning €10,000 in a gamble, in which they have an equal probability of winning nothing. The second question, “the qualitative question,” illuminates investment objectives, such as whether respondents were looking for “very high returns, even at the risk of a high probability of losing part of the principal,” “an OK return with a good degree of safety on the principal,” or “low returns, but no chance of losing principal.”

On a scale of 0 to 4, where 4 indicates the highest level of aversion to risk, the qualitative measure of risk aversion jumped from 2.85 before the crisis to 3.28 during the crisis. The researchers find that none of the standard reasons for rises in aversion to risk, such as changes in wealth, spending habits, or background, can explain the increase.

Moreover, after a significant drop in stock prices, as was seen during the crisis, rational investors might be expected to buy now-undervalued stocks. But neither investors nor respondents to the survey did so. Rather, they sold stocks.

The researchers acted on a hunch that fear might be the driving force. They conducted a lab experiment to approximate in the general population the level of fear an investor might feel after a financial crisis as serious as the financial crisis. Of 249 participants, mostly undergraduate students, a random sample watched a five-minute scene from Hostel, depicting the graphic torture of a young man in a dark basement. The researchers then asked all participants the same questions contained on the bank questionnaire.

After watching the clip, viewers were markedly more risk averse, to a similar extent to respondents in the bank study, and they were 27% more risk averse than participants who did not view the film.

The researchers conclude that the most plausible hypothesis is that the behavior of investors during the financial crisis was driven by fear.

Luigi Guiso, Paola Sapienza, and Luigi Zingales, “Time Varying Risk Aversion,” NBER working paper, August 2013.

Stanford’s Anat Admati describes how we can build a better financial system.

Capitalisn’t: The Capitalisn’t of Banking

A Nobel winner explains his groundbreaking research.

Two Contracts That Are Central to the Financial System

Some degree of concentration in subprime credit markets could be good for consumers.

When It Comes to Subprime Car Loans, Competition Drives Rates UpYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.