Trust in money managers increases investors’ appetite for risk.

- By

- December 15, 2014

- CBR - Economics

Trust in money managers increases investors’ appetite for risk.

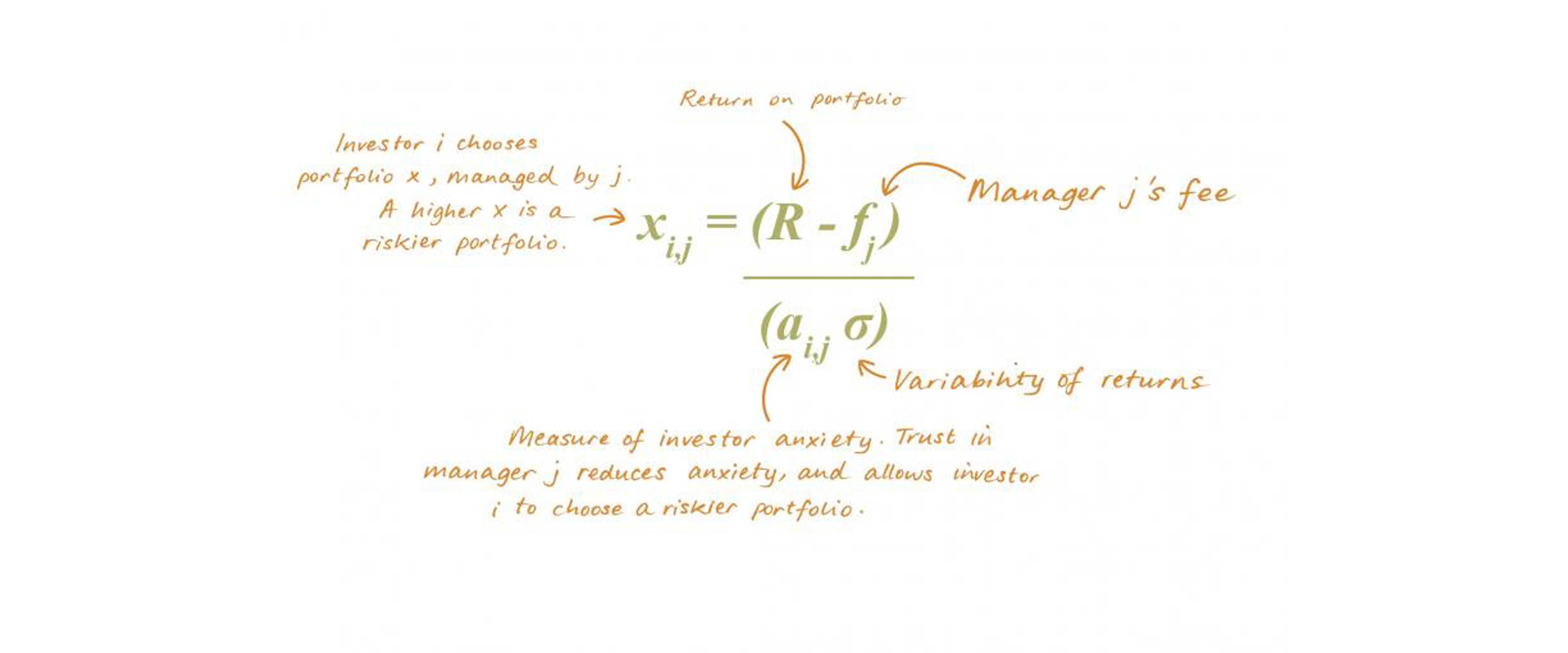

If you ask critics of today’s US financial sector why it got so big, they might say “greed.” But research by Chicago Booth’s Robert W. Vishny, Universita Bocconi’s Nicola Gennaioli, and Harvard’s Andrei Shleifer suggests a better answer would be “trust.” The researchers postulate that many people, lacking the skills and knowledge to invest on their own, hire money managers they trust, which reduces their anxiety about taking investment risks. That would explain why stock-market participation in the United States has been rising, and the share of riskier assets in financial portfolios has been growing.

Assets marked as ‘hold to maturity’ don’t have to be marked down as they lose value.

Are US Banks Hiding Their Losses?

The largest institutions have increasingly favored green stocks in recent years as small investors have done the opposite.

Big Finance Is Going Green. Smaller Finance, Not So Much

Research suggests frictions in the building industry could be slowing or halting projects.

US Construction Has a Productivity ProblemYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.