Are US Banks Hiding Their Losses?

Assets marked as ‘hold to maturity’ don’t have to be marked down as they lose value.

Are US Banks Hiding Their Losses?Corporate earnings announcements that come in below market forecasts typically spark a wave of selling in the company’s shares, just as positive earnings surprises often immediately drive up share prices. But the magnitude of these share price reactions may be tied to an outside factor: the previous day’s earnings announcements.

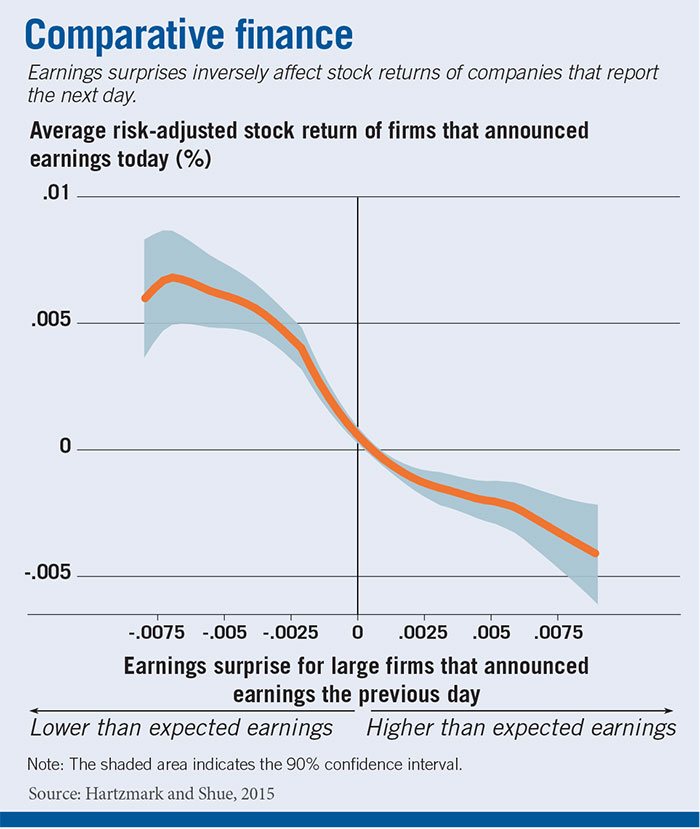

Earnings surprises inversely affect the level of returns of shares in companies that report the next day, according to research by Chicago Booth’s Samuel Hartzmark and Kelly Shue. For example, say Company A released earnings on Monday that greatly exceeded analyst forecasts. Regardless of what Company B reports for earnings on Tuesday, B’s returns will be lower than they would be if Company A had instead released a surprisingly negative report.

Why? Think of Shaquille O’Neal, the 7-ft.-1-in. retired basketball player. Next to most people on the planet, Shaq looks freakishly tall. But when he stood on the court next to fellow player Yao Ming, who is 5 in. taller, Shaq looked average, and maybe even a little bit short. “People often interpret information by contrasting it with what was recently observed,” write Hartzmark and Shue.

They reach their conclusions by analyzing earnings announcements that occurred between 1984 and 2013, calculating the size of companies’ earnings surprises (the difference between actual and analyst-forecasted earnings) as well as the change in share price that would be expected to occur with each earnings surprise. They subsequently looked at actual share-price changes when the announcement followed an earnings surprise for a large company the day before. (When more than one major company issued a surprise, the researchers averaged the surprises.)

The share-price changes created by the inverse relationship Hartzmark and Shue highlight are notable: the data show that the previous day’s large positive earnings surprises correspond to a drop of as much as 43 basis points in returns for investors in the current day’s reporting companies.

Take another example: say Company C made an earnings announcement on Wednesday that would ordinarily be expected to raise its stock price. It could be thrown off by a particularly positive earnings surprise the previous day, which would create a strong enough comparative effect to cause Company C’s stock price to fall on its earnings announcement instead. In the study, this effect was particularly pronounced for large companies whose reports followed other companies’ significant earnings surprises.

The research demonstrates that investors react to the relative content of news, not just the actual information it contains. The effect appears to cause an important, albeit temporary, mispricing and misallocation of capital in the markets.

Samuel Hartzmark and Kelly Shue, “A Tough Act to Follow: Contrast Effects in Financial Markets,” Working paper, June 2015.

Assets marked as ‘hold to maturity’ don’t have to be marked down as they lose value.

Are US Banks Hiding Their Losses?

How the excess savings of the US’s wealthiest households may be feeding a cycle of inequality and instability.

Who Is Fueling America’s Debt Binge?

Make rules that are simple and apply to all companies.

How Best to Report Carbon EmissionsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.