Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?

The agency has signaled increased scrutiny of nonreportable mergers in healthcare.

Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?Why the ‘revolving door’ shouldn’t stop turning

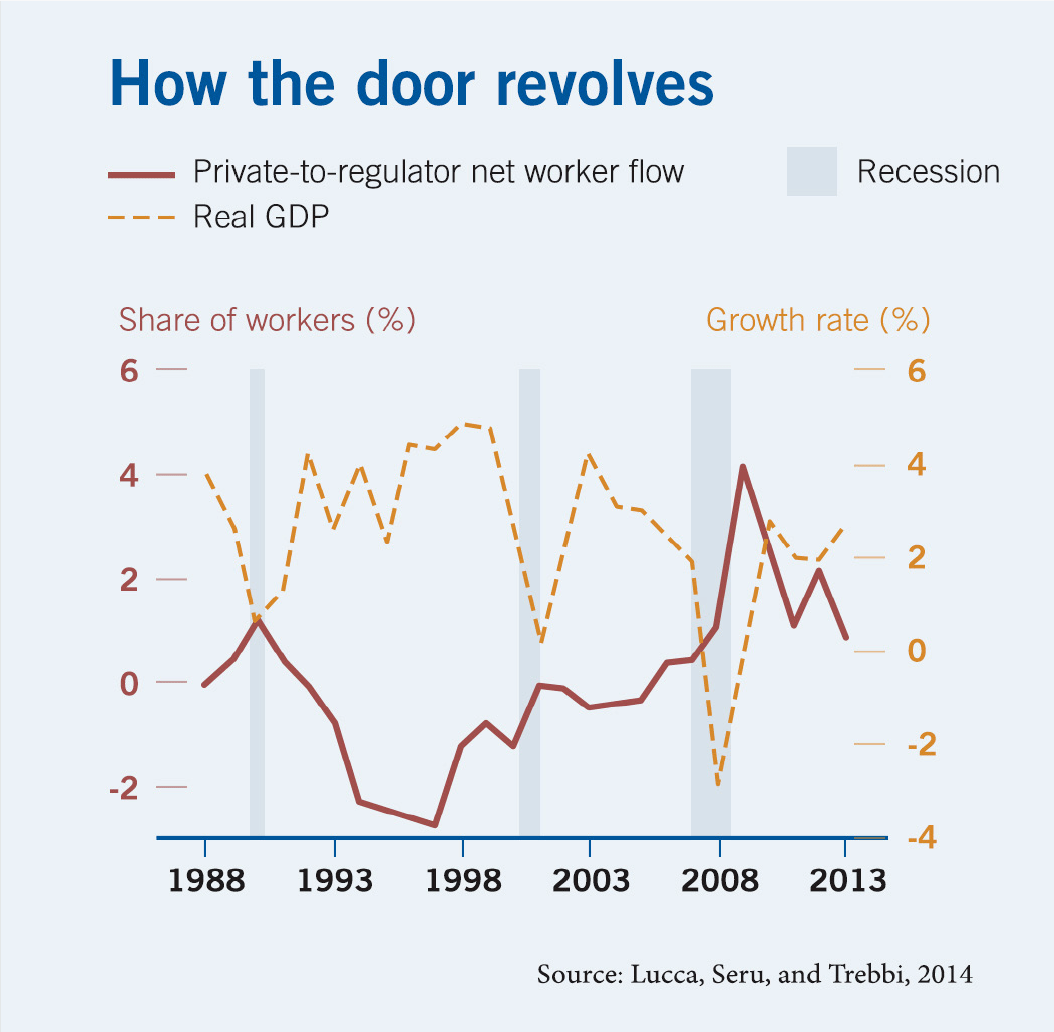

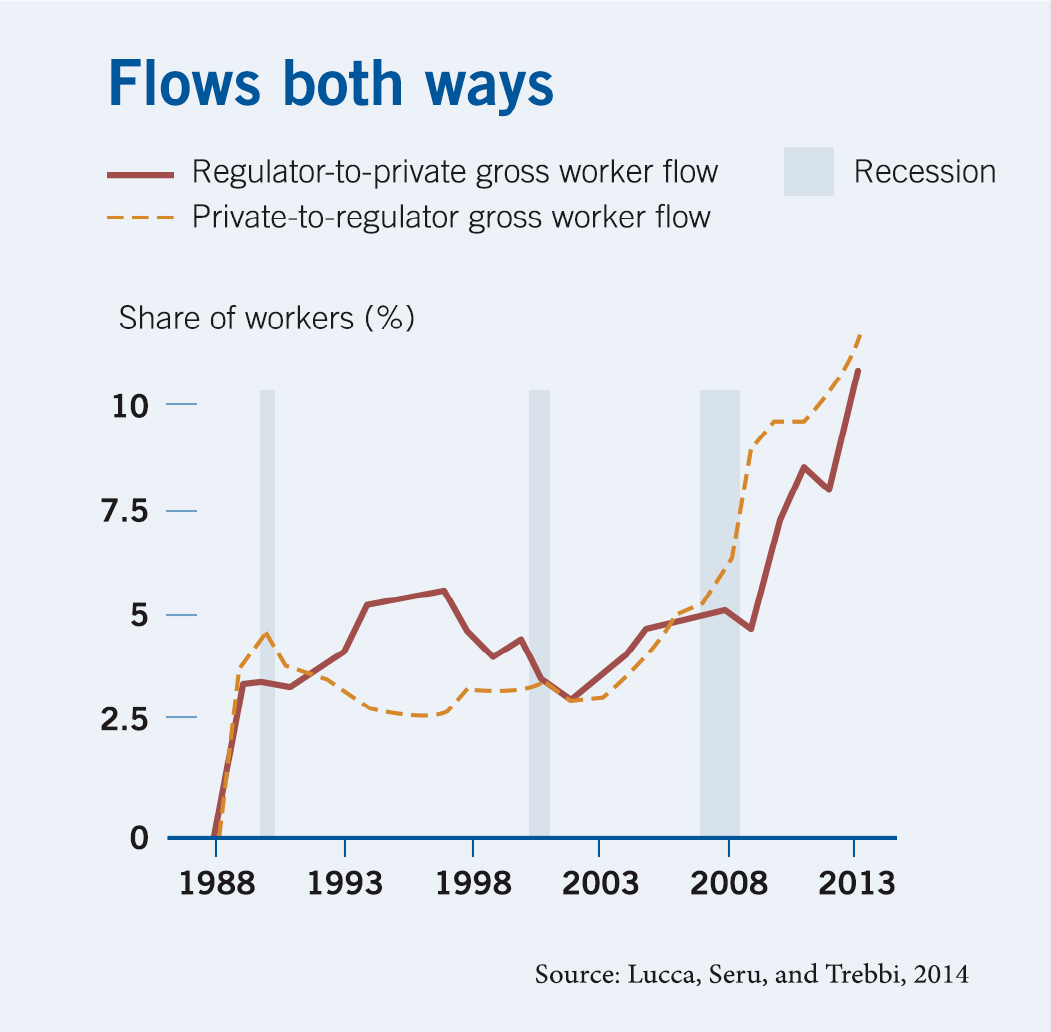

Popular wisdom says the flow of workers between regulatory agencies and Wall Street results in lax oversight. The data suggest it may help watchdogs attract talent.

Employee tenure in regulatory agencies has been declining, particularly among those with advanced degrees.

The agency has signaled increased scrutiny of nonreportable mergers in healthcare.

Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?

How the excess savings of the US’s wealthiest households may be feeding a cycle of inequality and instability.

Who Is Fueling America’s Debt Binge?

An expert panel discusses whether global institutions are still relevant, and how best to tackle global challenges.

Do We Need International Institutions?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.