Six Ways to Apply the Creative Process to Business

Dancers and managers have significant common ground.

Six Ways to Apply the Creative Process to Business

Javier Jaén

Meet Catherine—Cat for short. A composite character based on information about nearly 350 successful investment bankers, she represents the top 1 percent of earners at her large, global firm. Cat is friendly and highly regarded by her colleagues. She has an impressive educational pedigree as well as a large network of contacts. Yet so do many of her colleagues, who look just as good on paper and have similar networks. What is it that sets her apart?

For almost four decades, researchers have been studying why some people have an advantage that results from their social contacts and networks. Countless studies have established that it’s important to have valued contacts, and that it’s helpful to build networks that span organizational boundaries, across coworkers, clients, suppliers, and so on. Managers who build bridges rather than cliques earn more than their peers; they’re promoted faster and are happier at their jobs.

Dancers and managers have significant common ground.

Six Ways to Apply the Creative Process to Business

Researchers present a dynamic model of the caller-patience-and-decision process.

Tired of Waiting on Hold?

It’s fine to accumulate contacts, but notice how you network.

Networking Differently Could Increase Your SalaryCat followed researchers’ advice and built up a diverse network of important contacts. Many of her colleagues did the same. But Chicago Booth’s Ronald S. Burt and Tulane University’s Jennifer L. Merluzzi have identified a network pattern that contributes to Cat’s success, and is reflected in her pay. The pattern: “network oscillation.”

“NYSE President: I owe every job I’ve ever had to networking” reads a Fortune headline from 2015. “Your net worth is only as good as your network,” claims UK writer Rishi Chowdhury, in Business Insider. Many readers react to such headlines by accumulating more contacts on LinkedIn, exchanging more business cards, and setting up more luncheons.

Having a large network is one thing; the structure of that network, however, is even more important. “This is because not all connections are equally valuable,” Merluzzi explains. “Simply focusing on connection collection is incomplete.” The number of connections you have, online or in real life, is only one part of the story.

Another important part of networking is bridging, reaching people outside of your work silo. “Silo” is a sociology term, not one used by the researchers, but it’s instructive here. When employees are grouped together into silos—whether by project or department or location—they get better at what they do, require less instruction and supervision, and ultimately help the organization become more efficient. But there’s a cost to siloing. As people develop specialties, “information inside that group becomes very sticky and tacit—it is difficult to translate to others outside of the group,” says Merluzzi. When information gets stuck in one place, it can lead people at an organization to duplicate efforts—or even work against each other. “Imagine the success of a product line that was developed with little input from customer support, manufacturing, or marketing,” she says.

Burt, Merluzzi, and others have found that this disconnection creates an opportunity for people who can build bridges to and from these sticky clusters of information, bridging what Burt terms “structural holes.” Network brokers can bring together otherwise disconnected people who can share valuable and hard-to-get information. Moreover, because they know people in various silos, they can, more than others, identify and communicate where the information would be valuable.

Since the 1970s, researchers have been exploring what it means to bridge these gaps. “Relations with contacts in otherwise disconnected groups provide a competitive advantage in detecting and developing rewarding opportunities,” writes Burt, along with University College London’s Martin Kilduff and Erasmus University’s Stefano Tasselli, in a 2013 paper. Scores of studies have shown this to be true, including a global study involving stock analysts, investment bankers, and managers, in which Burt demonstrated that network brokers were paid more, were promoted more quickly, and were more likely to receive kudos.

But silos have advantages too, and they go beyond efficiency. As a participant in a “closed network structure,” in the parlance of sociology, you become deeply engaged, developing specialized expertise as well as strong connections with your closest colleagues. Because information moves quickly within these closed cliques, everyone in your group can readily identify a troublemaker or slacker, and as a result, you and your colleagues will be more careful about making trouble or slacking. Building a good reputation is also crucial in a closed-group environment and so, over time, and as you develop relationships, you take great efforts to become credible and trustworthy. While members of other departments may admire your work but quickly forget your name, your colleagues in a closed network have longer memories—their lasting opinions and those of your mutual acquaintances will further motivate you to maintain your reputation.

This silo effect can have economic benefits. Stanford’s Avner Greif suggested in a 1989 paper that trust and reputations established in closed networks helped pave the way for 11th century medieval trade. To expand their reaches, merchants employed individuals to serve as overseas agents, but it was tough to keep tabs on these agents or keep them from cheating. The merchants formed coalitions, shared information, and pledged to never hire an agent who cheated another coalition member. For a more modern example, Merluzzi suggests thinking about Amazon or eBay. Sellers earn reputation scores, and while a one-time seller might unload a faulty product on someone, an established seller with high scores wouldn’t want to risk the reputational hit. “In the same way, the risk of buying a used car from a close cousin is much reduced compared to buying from a stranger,” she says. “Imagine that cousin having to face not only you but all the other relatives, knowing he sold you a lemon. There is a big cost, not just to the cousin’s relationship with you but with all of your other mutual family members. Thanksgiving dinner would not be pleasant.”

These two networks may look the same, but . . .

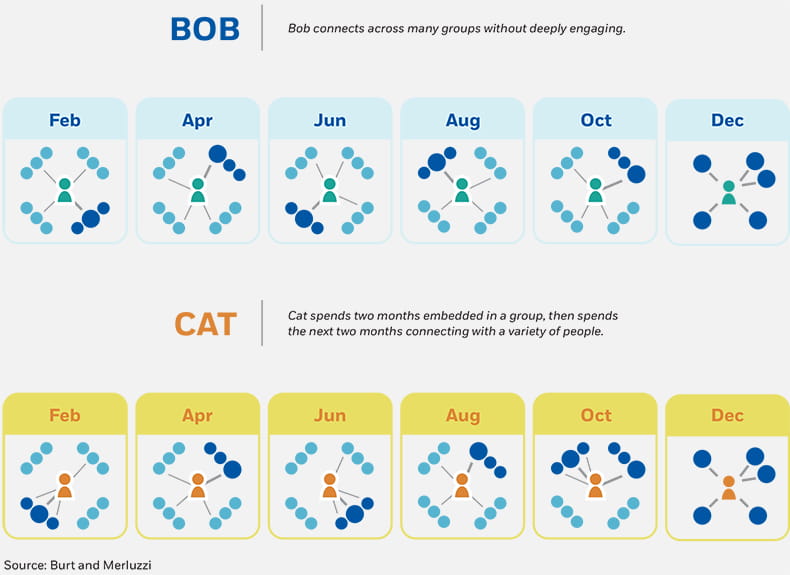

Researchers created composite characters, Bob and Cat, to illustrate what makes some people more successful. Bob and Cat are both bankers with identical networks, but they built their networks differently—and Cat’s network gives her a greater advantage.

Sociologists and management scholars have filled volumes comparing the two network structures they term “brokerage” and “closure,” popularly referred to as bridging and bonding. In these matchups, brokerage has tended to win out. Of course, this is context specific—a company that values innovation and new ideas will be more likely to value brokerage, and a company that prioritizes operational efficiency will prefer closure. Yet according to a variety of performance measures, people who can connect valuable, otherwise disconnected contacts in different areas of a firm—in other words, brokers—“tend to do better than people who only talk to the same set of people with the same set of knowledge,” says Merluzzi. “These brokers have gained valuable social capital.”

Burt has taught social capital of brokerage and closure to thousands of business-school students, as well as to corporate executives at companies all over the world, and he’s noticed that most students leave his class believing strongly in the power of brokerage. Yet when he looked at various measures of an executive’s performance—salary, promotions, job satisfaction, or something else—it became clear that not all brokers did well. Some excelled, and others failed to realize benefits from the same network structure.

Burt and Merluzzi’s study explains why. The short answer: the most-successful people take advantage of both systems—sometimes they broker, and other times they dive into closed networks. In fact, without this movement back and forth, their networks give them no advantage at all.

The researchers arrived at this conclusion by studying the networks of investment bankers. In the mid 1990s, an executive at a large global investment-banking firm asked Burt to help identify why its top women were leaving, and how to prevent it. The firm gave Burt access to a trove of proprietary data pertaining to about 350 of its top-tier investment bankers. These were senior people who were eligible for an annual bonus and whose compensation ranged from a few hundred thousand dollars to several million.

Every year, as part of the bonus evaluation process, the firm conducted a survey in which it asked bankers to identify people they had worked closely with in the prior year, and to anonymously rate their experiences with those colleagues as poor, good, very good, or outstanding. The ratings were translated into scores that were used to inform decisions about bonuses and promotions. Burt gathered four years’ worth of these annual ratings, as well as salary and bonus information for the bankers.

As this is sensitive data, the researchers don’t disclose the name of the bank in their findings, and all salary information is masked. (To obscure exact dollar amounts, Burt and Merluzzi standardized all salary data.) The researchers used the evaluation data to create sociograms, network maps showing the bankers’ connections and the strength of those connections.

Investment bankers proved ideal subjects for a study of brokerage and closure in networking. The bankers in the study typically worked in teams on discrete projects—while advising companies on potential mergers, for instance. In a textbook case of a closed network, team members generally worked closely while on a project, collectively logging long hours and even spending free time together at social or work-related events. When a project ended, the team broke up. Some bankers immediately found another project to work on, while others waited. In some cases, bankers worked part time within the firm or consulted while looking for their next assignment, Burt says. After a period of time, they found a team and devoted themselves to that project.

Analyzing salary and bonus packages as well as year-end performance surveys proved revealing for Burt and Merluzzi. Bankers who were able to move between brokering and working in closed networks during the year reaped the greatest rewards. These individuals formed ties across the organization, gaining access to new projects and opportunities. But once they found an opportunity, they quit brokering and engaged deeply in their new project. When that project ended, they once again tapped into their broad network of contacts at the firm to find the next interesting project. Swinging between working intensely on a project and networking more widely did have a cost: these bankers sometimes saw their reputations suffer while they were on the bench. But the hit was temporary. And the compensation data show that these oscillating bankers made the most money over time.

The researchers present the actions of two hypothetical executives, Catherine, whom we met earlier, and Robert (Bob). Bob is your classic network broker—he talks with different people every month, and his contacts don’t know each other. He learns a lot of information this way, and most people he meets develop a positive impression of him. Because he moves from one project to another, though, his colleagues do not know him as well. Nevertheless, he has the network that, as Burt noted, many students and executives think they should have. “The way Bob plays his job is with respect to a broad audience,” says Burt.

Cat, by contrast, spends two months in a tight-knit group working with other analysts, then spends two months connecting with a variety of people to find the next best project in the firm, and so on.

How to network: Three takeaways

Research has long established that a person can benefit from building a broad network, and from engaging deeply in a tightly connected group. But Burt and Merluzzi suggest that the most successful people are those who can move in and out of these two different networks over time. What this means for your career:

Spending time deeply engaged in a group allows you to develop specialized expertise and foster strong connections with colleagues, which in turn helps you build a positive reputation among a set of coworkers.

Regularly reaching out to new contacts outside of your close-knit group helps you gain access to new opportunities, projects, and ideas so that you stay relevant and continue to add value.

Reaching out to broader network connections also facilitates access to new groups, with which you can deeply engage in the future.

The annual survey conducted as part of the bonus evaluation process allowed the researchers to essentially map a network of the organization and show who was connected, and how. Doing this, they could recognize the Cats from the Bobs. At a single point in time, Cat may have a similar network to Bob’s; however, she builds hers differently. Cat gains the same information Bob has, but by engaging in closed networks, she also builds a strong reputation within those groups—a reputation that’s slower to evaporate than Bob’s. Because people she’s worked closely with have seen her work and contributions, they like and trust her. When she brings them new information, they listen—and they tell others about her.

Several other reasons could explain Cat’s advantage. Brokerage and closure make Cat more nimble, able to quickly respond to new information, with the benefit of insider knowledge.

Because Bob continually connects across groups without ever deeply engaging, he is a perpetual outsider. Cat, more accustomed to change, is constantly moving in and out of groups. This in turn can make her more flexible and able to adapt to new ideas. There’s another possibility: while both Bob and Cat have a large set of diverse contacts, Cat is better able to reanimate her wide-reaching contacts when the need arises. Because she spent time inside groups, her contacts are more likely to have mutual acquaintances, making it easier for Cat to call on them in the future.

It’s easy to see how Cat’s behavior could translate in different industries. Let’s say that Cat, instead of being an investment banker, is an engineer who worked on several teams within Apple, including the group that developed the iPhone 6s. That model set a first-weekend iPhone sales record at its debut, but at that point, Cat had already spent a few months talking to other group leads within Apple to find another project. By brokering with people in various other departments, and even outside of the company, Cat may know what other products are coming down the pipeline. And because she has worked closely with some of the people in those groups, she may have a well-developed understanding of those products, or relationships with people who can help educate her. Cat will bring an informed perspective to the next product meeting—and might come back with the next hit, earning her accolades, a spot on that product team, and a higher salary.

Employees of all kinds can take a lesson from Cat, by learning to move between networking broadly and diving deeply into teams over time. Companies can also learn from Cat, by encouraging employees to build Cat-like networks. Doing so could help individuals, and their employers, stay nimble.

What happens when a “perfect” job opportunity turns into a swirl of chaos and uncertainty?

How Community Helped a Leader Seize Opportunity at a Challenging Time

As life moves faster, everyone’s patience is wearing thin. Who gets to the head of the line quickest?

Secrets of Wait Loss

You and your coworker share similar career paths, but he’s earning significantly more.

Business Practice: Treating a Case of Salary EnvyYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.