The Equation: The Community Ties That Count

How community membership affects the allocation of trade credit

The Equation: The Community Ties That CountRegulators push banks to diversify their holdings, but they might want to reconsider, according to Chicago Booth’s Philip G. Berger and Michael Minnis and MIT’s Andrew Sutherland. The researchers find that a bank with lending concentration is able to develop valuable expertise that actually makes lending more efficient.

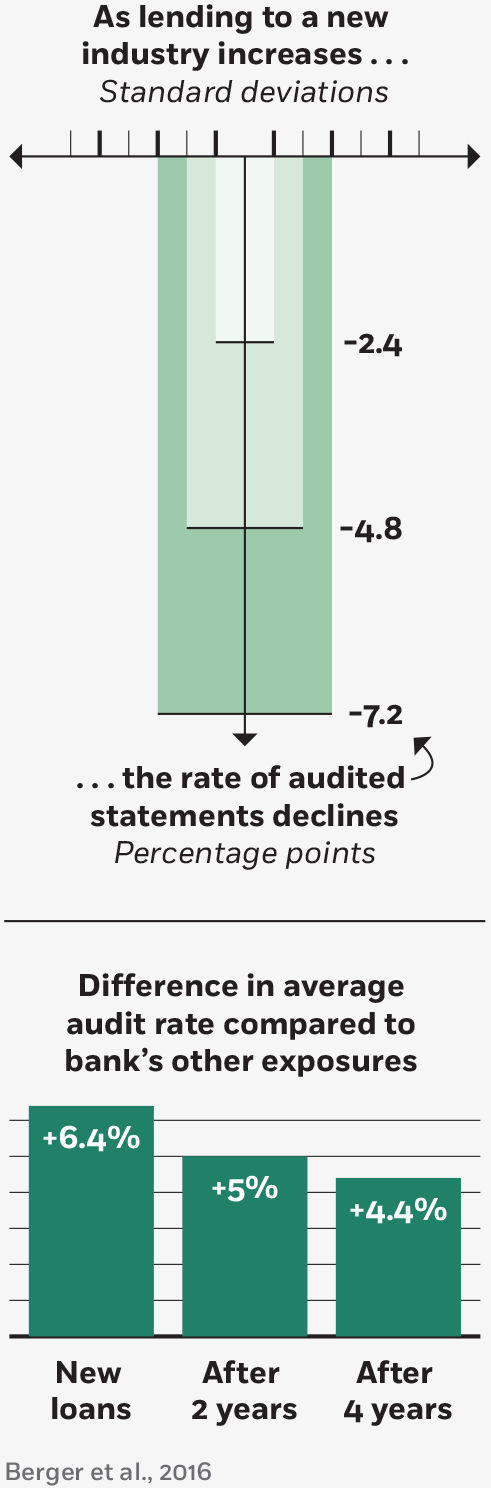

When a bank assesses potential borrowers, it can ask for any number of documents, including audited financial statements. The researchers find that the more concentrated a bank’s commercial loan portfolio, the less that bank collected audited statements. For every 1-standard-deviation increase in a bank’s exposure to an industry, the researchers saw a 2.4-percentage-point decline in the rate at which the bank collected audited statements from borrowers.

Building expertise

Banks become more-efficient lenders as they gain exposure to borrowers in a new industry.

But skipping audited statements didn’t lead to greater loan losses. The researchers conclude that specialized banks “are trading off alternative information sources rather than recklessly forgoing audit requests.”

Larger banks tend to collect more documented (or so-called hard) information while smaller banks rely more on conversations and personal relationships. But Berger, Minnis, and Sutherland say their findings are unrelated to the size of the bank or the borrower.

“An explanation consistent with our evidence is that concentration fosters lending expertise,” they write. “A bank with more exposure to an industry has better information about it, and, thus, less need to obtain high quality (and costly) financial performance information from borrowers in the industry.” Conversely, a bank with less concentration and experience needs to see audited statements. However, the researchers caution against extrapolating their findings too far. “Our findings do not support extreme concentration,” notes Minnis. “While on the margin, concentration fosters expertise, at some point the increasing risk of concentration surpasses the benefits of expertise.”

It generally takes a bank four-and-a-half years to accumulate enough information to make it knowledgeable, the researchers find. When a bank first lends to borrowers in a specific sector, the audit rate is over 6 percent higher than for the bank’s other loans, but it declines as the bank gains expertise in the area.

How community membership affects the allocation of trade credit

The Equation: The Community Ties That Count

SEC filings suggest the act's tax provisions were not material for most publicly traded US companies.

Who Benefited from CARES Tax Provisions?

Fewer audits of small- and medium-sized businesses may leave banks less willing to make loans.

Would More Corporate Tax Enforcement Lead to More Lending?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.