When Retail Discounts Encourage Customers to Buy Less

Merchants should be careful with the quantity limits they set on sale items.

When Retail Discounts Encourage Customers to Buy LessBuying a car, furniture, or big appliance? Chances are that you’ll be offered low- or no-interest credit—but only for so long. The catch is that the promotional rates usually disappear after some months and reset to a much higher level. If you aren’t paying attention, you could be surprised.

Lenders and retailers shouldn’t let that happen if their goal is to have the money repaid quickly, according to Shirley Zhang, a recent Chicago Booth PhD graduate, and Booth’s Abigail Sussman and Christopher K. Hsee. Their research suggests that creditors could benefit by letting consumers know just when the higher costs will kick in, a subtle way of encouraging them to pay up faster.

Consumers use the timing of an interest-rate jump as a decision point, the researchers suggest. Beating an increase by paying off the debt becomes a motivating goal. However, the goal-setting process emerges only when consumers believe it’s possible to repay the debt in time and when they know the deadline for the rate reset, the researchers find.

They conducted a series of experiments that mirrored real credit-card payment decisions and had consequential outcomes for the participants, who received both fixed and bonus compensation.

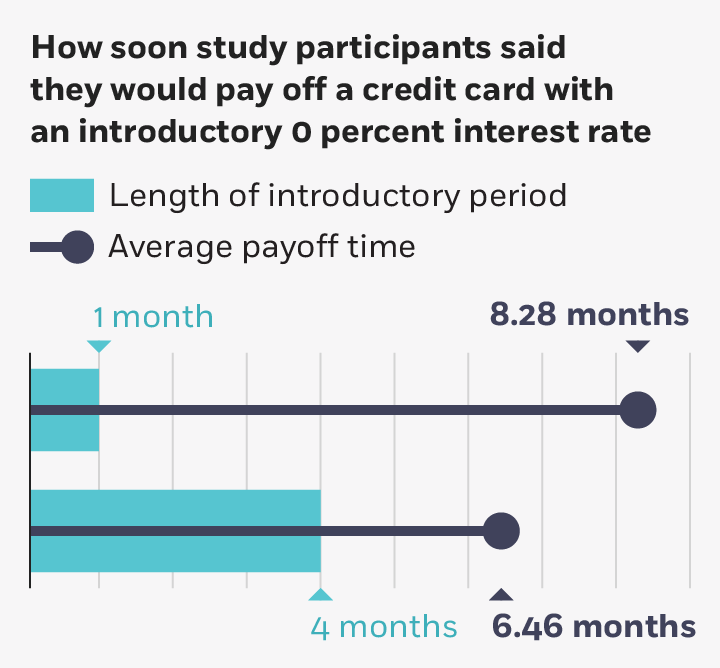

In one experiment, participants received a statement for a credit card with a 0 percent introductory rate. The researchers told the participants to imagine they had paid the minimum amount for five months, and then randomly assigned people to one of three groups. One group heard that the 0 percent rate had expired at the end of the previous month. Members of another group were told it would expire the next month, and those in a third learned they had five months before a higher rate would apply. Participants were asked to choose a monthly payment ranging from $200 to $1,000 a month.

Members of the five-month group said they’d pay much more every month than those in groups with the earlier expirations. The researchers explained to all participants the overall cost of the loan across all conditions as they were making their choices.

Study participants with a longer window before a rate hike paid off their debt faster.

Zhang et al., 2019

Zhang, Sussman, and Hsee label this repayment pattern the expediting effect―a rate increase in a more distant period expedited the decision to repay. People in the five-month group put themselves on faster payoff schedules even though their interest costs would still be the lowest.

“Rather than leveraging changes in interest rates as a hidden complexity intended to deceive consumers, lenders can use explicit changes in rates to encourage timely repayment,” the researchers write.

Money-management apps could help fill this role by setting calendar reminders well in advance of rate increases. These apps could calculate the ideal timing of such a reminder on the basis of a consumer’s financial circumstances, the researchers write. Debt Manager is one of the few available financial apps that lets consumers see all of the statistics for their debts if an interest rate were to change, although it doesn’t yet have the built-in calendar functionality the researchers suggest. Most money-management apps help consumers repay loans by organizing debt from highest to lowest interest rate and incorporating payment due dates, but don’t have explicit reminders for imminent changes in rates.

“Following these reminders, budget planning tools could go ahead recommending feasible repayment plans to those consumers, thereby helping consumers to save on interest costs,” the researchers write. Consumers who choose a payment plan and stick with it each month “may be particularly effective at reducing debt when rates are increasing in the future,” they write, adding that explicit reminders of changes in rates by credit-card companies or other lenders would also signal transparency as well as concern for their customer base, which could spur brand loyalty.

Shirley Zhang, Abigail Sussman, and Christopher K. Hsee, “The Expediting Effect: When Lower Interest Costs Lead to Faster Payment of Debt,” Working paper, February 2019.

Merchants should be careful with the quantity limits they set on sale items.

When Retail Discounts Encourage Customers to Buy Less

People’s fears of a dull conversation may be overrated.

You Have More to Say than You Think

The debate has raged for 300 years and counting.

What Is the Line Between Self-Interest and Selfishness?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.