Capitalisn’t: Manufacturing Influence

The podcast explores the economics surrounding social-media influencers.

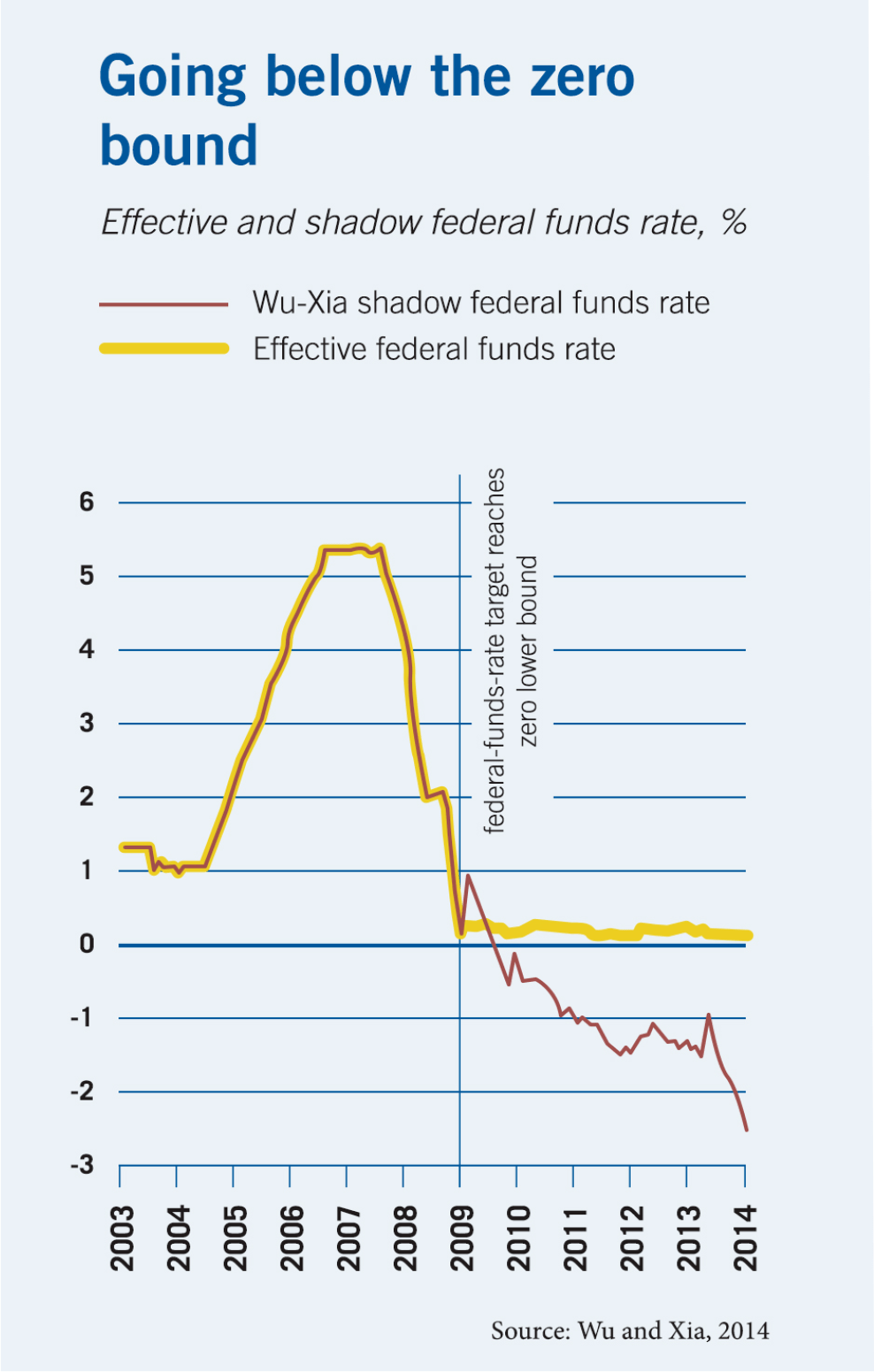

Capitalisn’t: Manufacturing InfluenceA new way to measure unconventional monetary policy

Substituting the ‘shadow’ rate for the federal funds rate helps economists better understand how Fed intervention at the zero lower bound affects the economy.

The ‘shadow’ federal funds rate, unlike the official rate, can move into negative territory.

The podcast explores the economics surrounding social-media influencers.

Capitalisn’t: Manufacturing Influence

Researchers piece together an explanation for the decline in US antitrust enforcement in recent decades.

What Made the Chicago School So Influential in Antitrust Policy?

Lawyer Dina Srinivasan joins the Capitalisn’t podcast to discuss the US Department of Justice’s lawsuit against Google.

Capitalisn’t: Google—The New Vampire Squid?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.