How High Interest Rates Harm Innovation

Monetary policy decisions can have meaningful long-term effects.

How High Interest Rates Harm InnovationHow faster foreclosures worsened the Great Recession

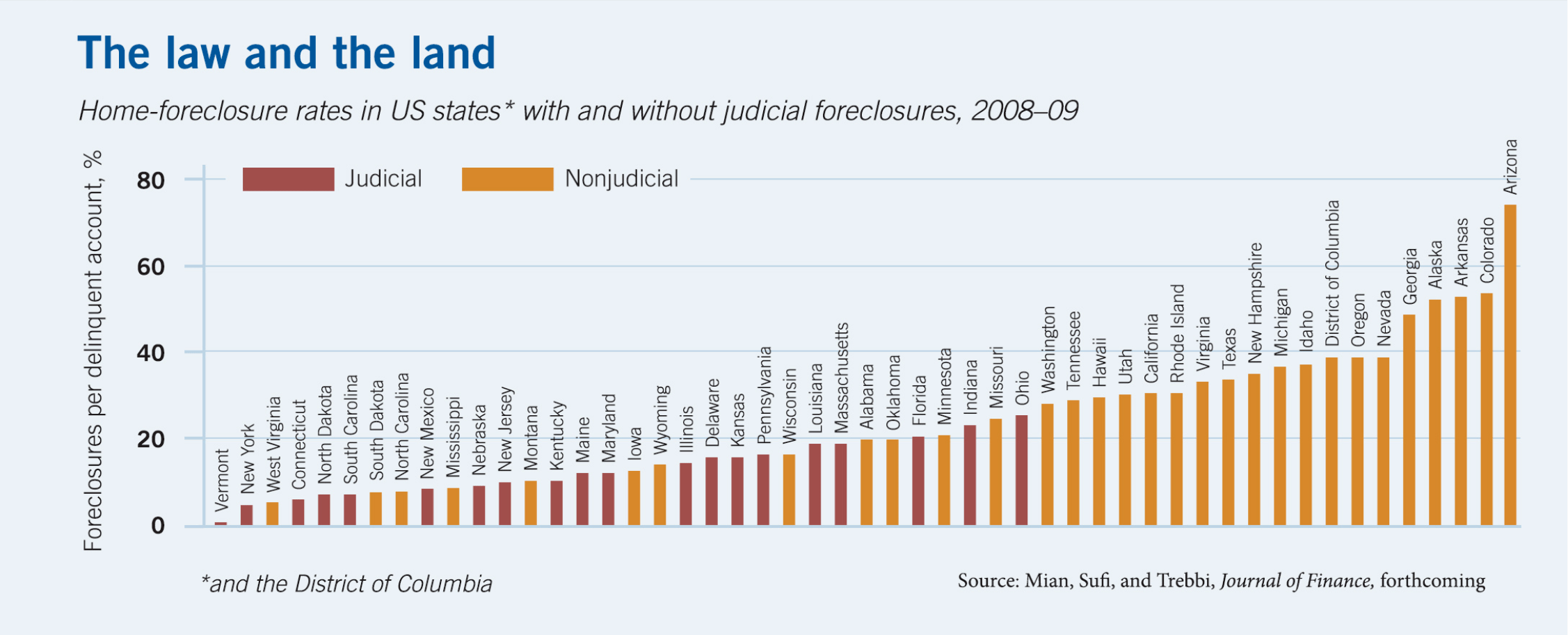

US states with quick foreclosures saw bigger plunges in home prices, new housing construction, and auto sales.

US states that don’t require foreclosures through courts suffered an inordinate amount of economic damage at the height of the recession.

Atif Mian, Amir Sufi, and Francesco Trebbi, “Foreclosures, House Prices, and the Real Economy,” Journal of Finance, forthcoming. Chart reprinted with permission from Wiley. Copyright 2014.

Monetary policy decisions can have meaningful long-term effects.

How High Interest Rates Harm Innovation

Capitalisn’t hosts Bethany McLean and Luigi Zingales spell out what a changing antitrust landscape could mean for us all.

Capitalisn’t: The Evolution of Antitrust—From Brandeis to Biden

Economists consider to what degree network effects will help Twitter as some users grow concerned about the platform.

Will Twitter’s Size Protect It from Defections?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.