Infographic: How Demolishing Public Housing Increased Inequality

A study of demolitions in Chicago finds they raised housing costs, hurting renters.

Infographic: How Demolishing Public Housing Increased InequalityWhy antitrust regulators underestimate competition

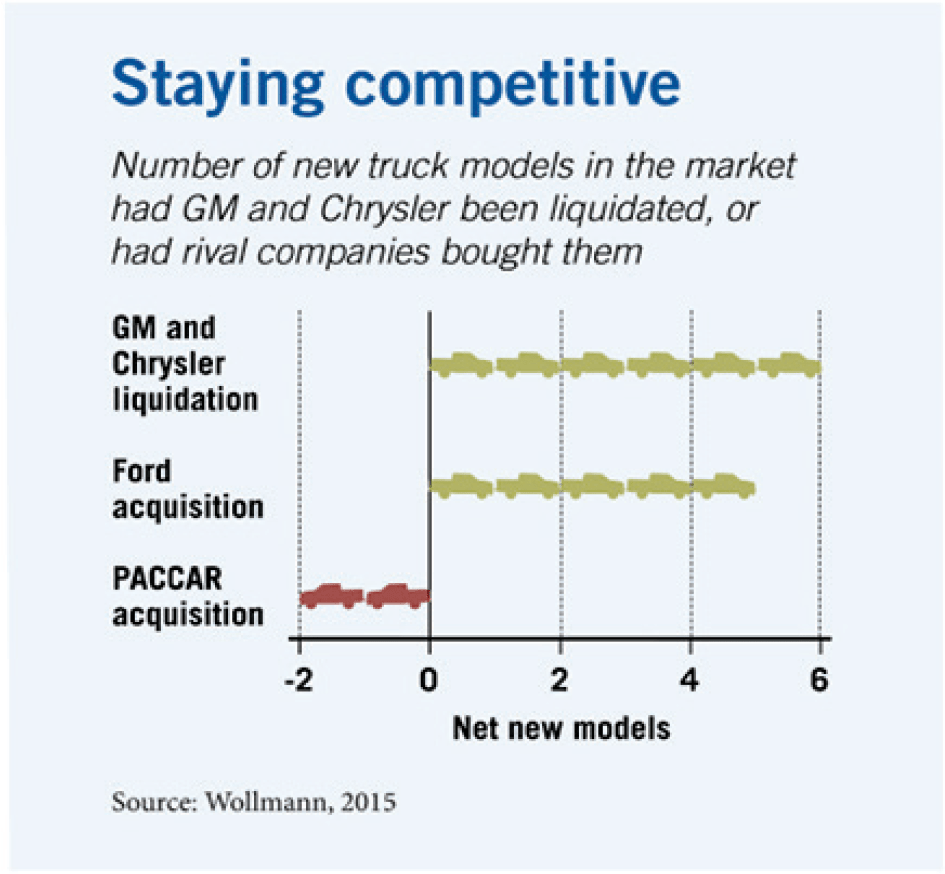

Increases in market power can raise incentives for rivals to offer new products

Markups would have increased by only 10–20 percent because of rivals’ new product offerings, in sharp contrast to a 70 percent increase, as the current approach predicts.

Thomas Wollmann, “Trucks without Bailouts: Equilibrium Product Characteristics for Commercial Vehicles,” Working paper, February 2015.

A study of demolitions in Chicago finds they raised housing costs, hurting renters.

Infographic: How Demolishing Public Housing Increased Inequality

Susan Athey, chief economist at the US DOJ’s antitrust division, joins hosts Bethany McLean and Luigi Zingales to discuss new draft merger guidelines.

Capitalisn’t: The Most Important Guidelines You Didn’t Know About

Elections, as well as state-specific and national events, also cause levels to rise.

Local COVID Lockdowns Fed Economic Policy UncertaintyYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.