Why China’s Pandemic Stimulus Worked Better Than the US’s

Research finds China’s digital coupon programs were a cost-effective way to boost spending.

Why China’s Pandemic Stimulus Worked Better Than the US’s

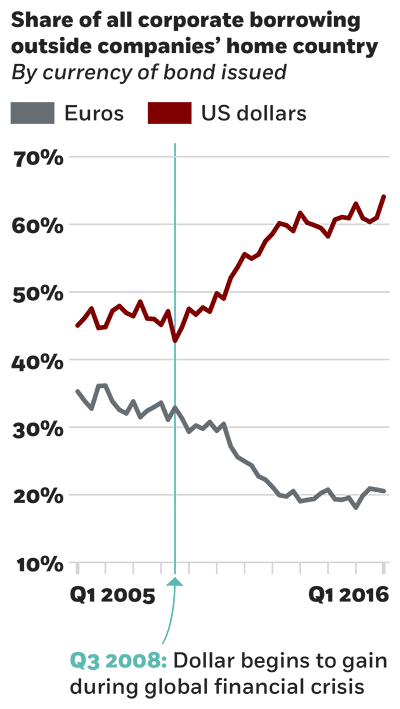

Bond investors looking abroad prefer their home currency, or US dollar

Matteo Maggiori, Brent Neiman, and Jesse Schreger, “International Currencies and Capital Allocation,” Working paper, February 2018.

Research finds China’s digital coupon programs were a cost-effective way to boost spending.

Why China’s Pandemic Stimulus Worked Better Than the US’s

The agency has signaled increased scrutiny of nonreportable mergers in healthcare.

Is the FTC Targeting ‘Stealth Consolidation’ by Private Equity?

Do your choices reflect the marginal utility of money for you?

One Factor You May Be Leaving Out of Your Financial Decision-MakingYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.