Capitalisn’t: Manufacturing Influence

The podcast explores the economics surrounding social-media influencers.

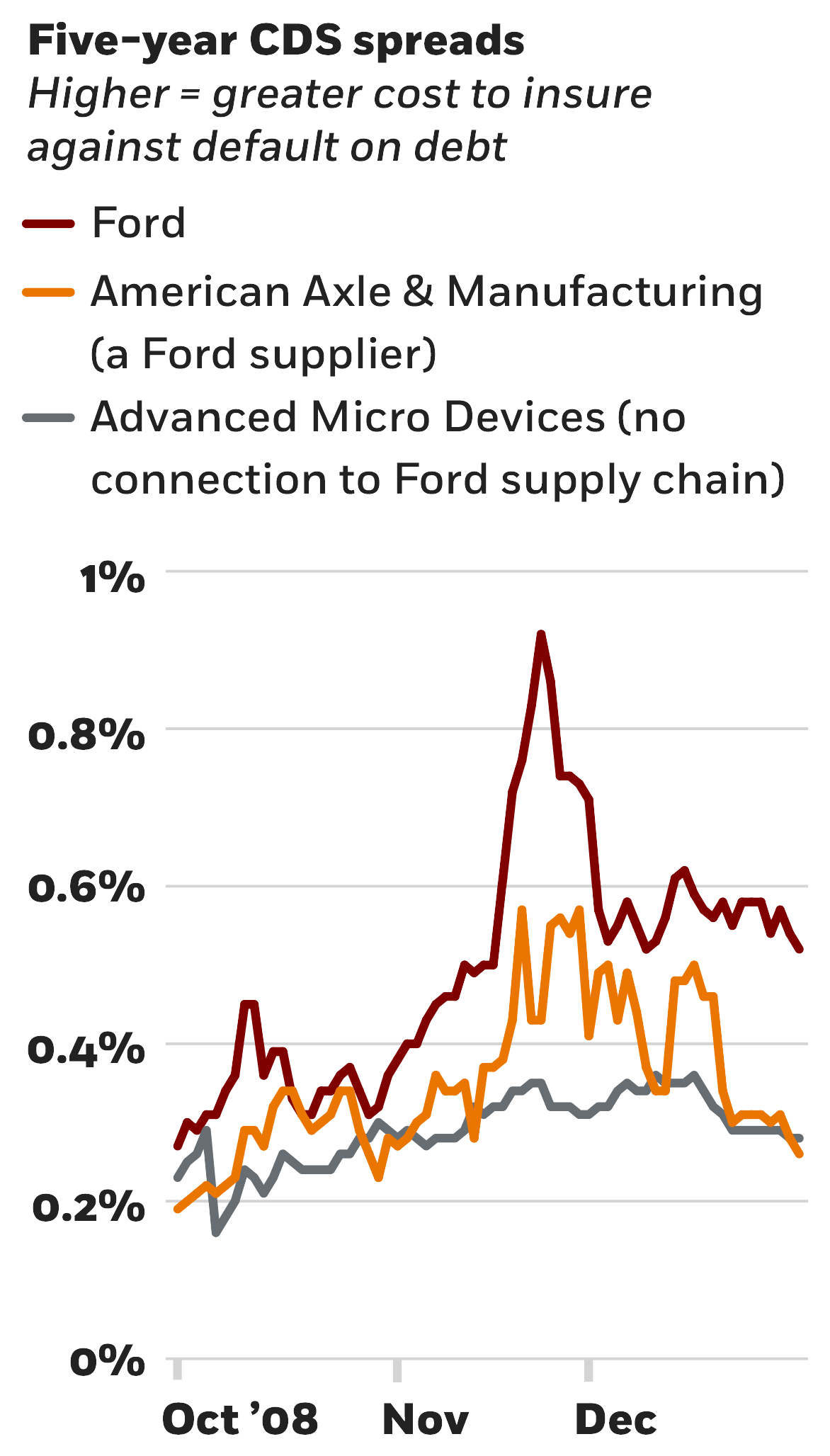

Capitalisn’t: Manufacturing InfluenceHow financial shocks can spread through supply chains

Şenay Ağca, Volodymyr Babich, John R. Birge, and Jing Wu, “Credit Risk Propagation along Supply Chains: Evidence from the CDS Market,” Working paper, June 2018.

The podcast explores the economics surrounding social-media influencers.

Capitalisn’t: Manufacturing Influence

Linkages have helped mitigate the effects of recent economic shocks.

In Praise of the Global Economy

What can capitalism do for society, what can’t it do, and what should it do?

What Are the Limits of Capitalism?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.