Capitalisn’t: Is Discrimination Still Causing the Gender Pay Gap?

Harvard’s Claudia Goldin joins the Capitalisn’t podcast to discuss the drivers of gender pay disparities.

Capitalisn’t: Is Discrimination Still Causing the Gender Pay Gap?

John Kenzie

Peggy Mason, a renowned professor of neurobiology at the University of Chicago, set out to discover the biological basis of empathy. To do this, Mason and her team created a unique test for her lab rats, which started by placing two rats in a large box. The first rat was free to move about, and the other was placed in the middle of the box in a trap that could only be opened from the outside. Rats, in general, do not like to be out in open spaces, where they can be spotted by predators—but, astonishingly, the free rat risked its own exposure to rescue the rat in the trap. Mason had discovered empathy in rats.

Every discovery leads to more questions, and in this case, Mason wondered, how deep did the empathy go? She reasoned that her lab rats were familiar with each other—bunking and often learning new skills together. But would they rescue rats they had never met? Mason put newcomers into the traps. Lo and behold, her rats rescued the strangers.

Was the empathy linked to genetics? Scientific labs use white rats for their experiments, and most of these rats have been crossbred for generations. Mason brought in some genetically distant black rats, and when one of these was put into the trap, the result was dramatically different. The free white rat did not go to the black rat’s rescue.

Mason wondered if the white rats were racist, responding to a genetic call, or if the issue was familiarity. She had the white and black rats room together for a while and repeated the test. This time white rats rescued black rats—those with which they had bonded, and even black rats they’d never met.

As one further test to understand the role of genetic pull versus familiarity, Mason took newborn white rats, separated them, and raised each one in a litter of black rats. These little rats never saw other white rats; they only knew their black litter mates and packs. When one of these rats was placed in the box with a trapped white rat, it did not come to the rescue. The trapped white rat was as unfamiliar to the free one raised by black rats as the original black rat had been to the white rats who had never seen black rats before.

I have oversimplified the research, which is told in all of its scientific detail in the journals Science, elife, and Frontiers in Psychology. But it sheds light on the importance of familiarity—and by extension the problem that familiarity bias creates for human beings. We make assumptions about who is like us and who is different from us, and these assumptions affect behavior, and can be costly.

This issue of familiarity is an important one in venture capital, where one of the biggest stories right now is how little of VC funding goes to female founders. Fortune’s Valentina Zarya, drawing on data from PitchBook, a leading venture-finance research platform, reports that while nearly 5 percent of deals in 2016 went to companies with female founders—up from just under 3 percent a decade ago—the dollar amount going to these companies represented a paltry 2 percent of total investment, despite the fact that women represent a third of private-company owners in the United States. This 2 percent was the third lowest percentage in the last 10 years, behind 2008 and 2012. Not only do a tiny handful of women receive venture funding, the amount they are able to raise has fallen. The average amount of money invested in women-led deals fell from $6 million in 2015 to $4.5 million in 2016—compared to the average deal size for male entrepreneurs of $10 million in 2016.

Logic dictates that deploying only 2 percent of investment capital with female entrepreneurs means venture capitalists are missing opportunities. Six percent of the current crop of unicorns—private companies valued at over $1 billion—were founded by women. VC firm First Round Capital looked at its portfolio of 300-plus companies and 600 founders and discovered that investments with at least one woman on the founding team performed 63 percent better than all-male teams.

Many possible explanations have been proffered for the VC funding gender gap. One is that women don’t ask for VC money at the same rate men do, which is the case, but women ask for VC money far more than 2 percent of the time. One recent study by Malin Malmstrom, Jeaneth Johansson, and Joakim Wincent of Luleå University of Technology looked at 125 applications for venture money and found that 21 percent were led by women. Yet 53 percent of female-led start-ups were denied funding, compared to 38 percent for male entrepreneurs. Not only were female-led start-ups funded less often; the ones that were funded secured less money. The women received 25 percent of what they asked for, while the men got more than half of their requested amounts.

Out of proportion, but not everywhere

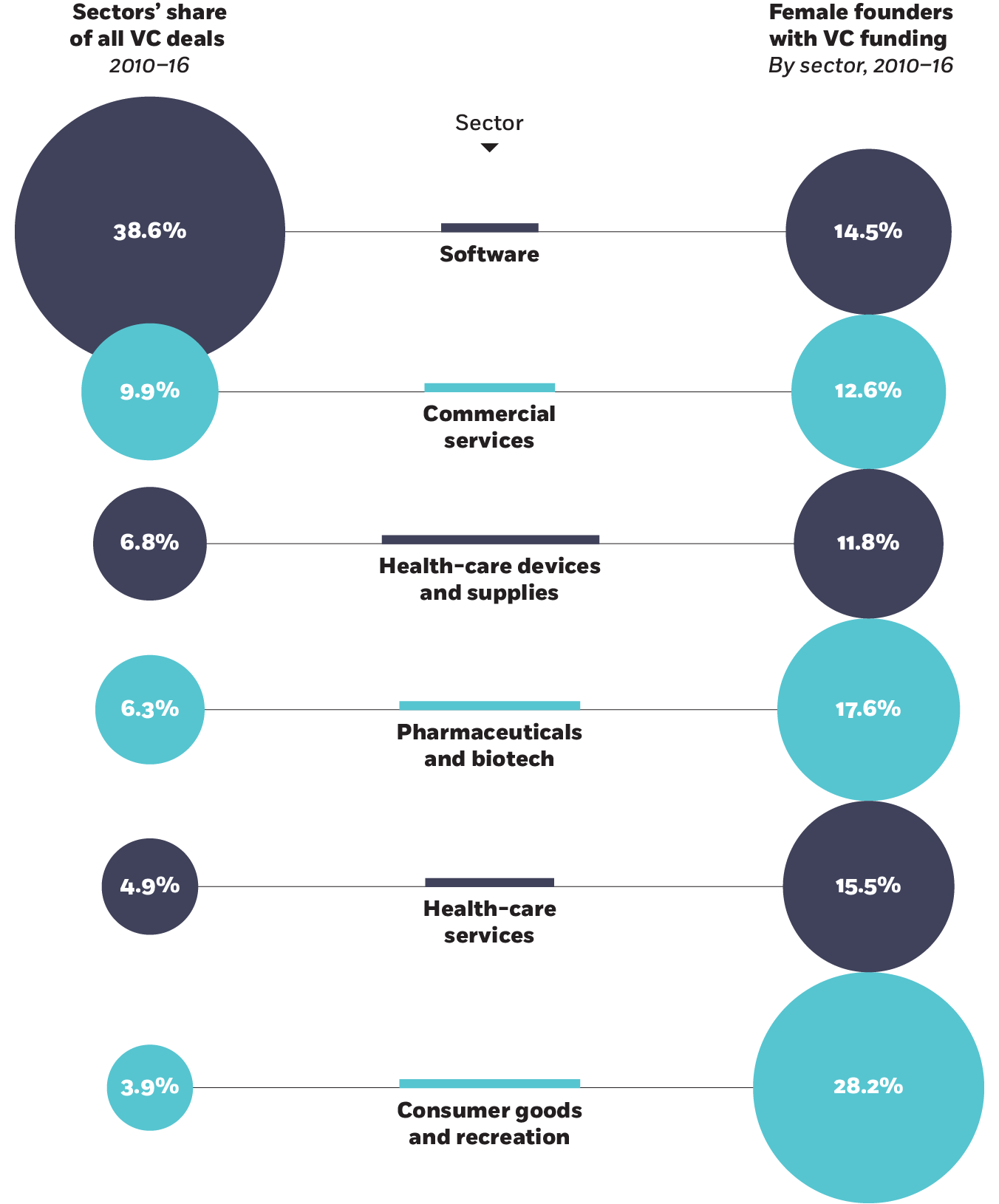

Women entrepreneurs are somewhat underrepresented in software—the biggest category for overall investment—and overrepresented in the consumer products sector. But they are well represented in other popular categories.

In another study, by Columbia’s Dana Kanze, Mark A. Conley, and E. Tory Higgins and University of Pennsylvania’s Laura Huang, 189 entrepreneurs pitched at the TechCrunch Disrupt event in New York. Their start-ups had been fully vetted and were of comparable quality, and 12 percent had been founded by women. Male-led start-ups raised five times the amount of capital the female-led ones did.

Another explanation for the gap: women tend to create businesses that do not fit the normal VC profile. That’s not completely true either. PitchBook data from 2010 to 2016 suggest that women entrepreneurs are somewhat underrepresented in software—the biggest category for overall investment, with 39 percent of all venture dollars—and overrepresented in consumer products and recreation, which represent a meager 4 percent of venture deals. But women entrepreneurs are well represented in the five other most popular segments for venture investment, including STEM-heavy fields.

Looking at the effect of homogeneity in the investment process—investors favoring those who are “like” themselves—is a fruitful line of research. A 2014 study by the late Ola Bengtsson and David Hsu of the University of Pennsylvania indicates that having a shared ethnicity nearly doubles the chances of getting an investment from a particular investor (even though the same research finds that shared ethnicity is associated with worse investment outcomes). This research has led many to call for the VC industry to hire more diverse employees, including women, who would presumably invest in women.

However, in a small industry such as venture capital, which employed 2,105 active investors in 2016, it is no easy task to radically change the number of women hired. Data from Crunchbase, a comprehensive database of venture deals, indicate that the pipeline of qualified candidates in the industry is relatively narrow, with only 22 percent of female VC employees on the investment side at the associate, vice president, and principal levels. And venture capitalists are slow to hire new partner-level employees.

There’s also no guarantee that women, once hired, will seek out female entrepreneurs to invest in. Research by University of Colorado’s Stephanie K. Johnson and David R. Hekman suggests that in the corporate world, there is a penalty for women and minority managers and executives who promote and advocate for people “like” themselves. The study used two techniques to isolate this risk: the researchers compared responses to surveys of 350 executives (with questions on topics that included diversity in hiring) with results of the same executives’ 360-degree-feedback reviews, and they ran an experiment in which businesspeople were asked to rate the competence of a hypothetical hiring manager. The research finds that female and minority managers who hired women and minorities were given substantially lower performance ratings, penalized by bosses and experiment participants, even though white men weren’t penalized for hiring white men. Might new female investment partners feel they risk similar penalties if they actively support women entrepreneurs?

Venture capitalists used different language to describe entrepreneurs who were, aside from gender, fairly similar.

The evidence suggests that the presence of a female investment partner at a VC firm does not dramatically alter that firm’s propensity to fund women entrepreneurs. A 2014 study by Harvard’s Alison Wood Brooks, Penn’s Huang, Sarah Wood Kearney of PRIME (a charity that directs investment to fight climate change), and MIT’s Fiona E. Murray finds that women and men were twice as likely to invest in males over females, and that the gender of the investor did not significantly affect this ratio. This held true even when men and women were pitching the same business.

More recently, Crunchbase’s Gené Teare and TechCrunch’s Ned Desmond find that 7 percent of female investment partners in top VC firms were women. Among the top 100 VC firms, 62 had no female investment partners at all, 28 had one, seven had two, and only three had more than that. The presence of female investors didn’t seem to significantly affect whether a firm had more than the average number of female founders in its portfolio. Similarly, Kanze, Huang, Conley, and Higgins find that 40 percent of investors at the TechCrunch Disrupt event were female, and the women entrepreneurs still raised less money than the men.

Venture capitalists, women and men, apply different standards and language to male and female entrepreneurs. Men are often promoted on their perceived potential, while women are promoted on their past performance, a 2011 McKinsey report on corporate promotions indicates. The study by Malmstrom, Johansson, and Wincent finds this effect exists in venture investing as well. By recording the sessions where two female and five male venture capitalists discussed potential investments, the researchers discover that the venture capitalists used different language to describe entrepreneurs who were, aside from gender, fairly similar. They described men as “young and promising,” “experienced and knowledgeable,” and “cautious, sensible and levelheaded,” while they described women as “young but inexperienced,” “experienced but worried,” or “too cautious and does not dare.”

Kanze, Huang, Conley, and Higgins’s study mirrors these findings, in a way: the researchers identify that two-thirds of the questions posed by investors to male entrepreneurs were promotion oriented, asking about the potential of the business and the entrepreneurs’ hopes. Meanwhile, two-thirds of the questions for the female entrepreneurs were prevention oriented, focusing on risk reduction and security. Questioners asked men about customer acquisition, but they asked women about retention; men about revenue growth and milestones, but women about time to breakeven; men about market-size potential, and women about defending market share. Entrepreneurs who fielded promotion-oriented questions were awarded $16.8 million on average, while those asked mainly prevention-oriented questions received an average of $2.3 million in funding. Investors want companies that have large exit potential, not those most likely to preserve capital, and the way the questions are phrased can push entrepreneurs into answering in a way that reinforces perceptions.

It may take some time to meaningfully increase the number of female investment partners in the VC industry, and for those women to feel empowered to champion female entrepreneurs, but research suggests that just having women on the investment team improves the performance of the women-led portfolio companies. University of Alberta’s Sahil Raina discovered that only 17 percent of female-led venture-backed start-ups had successful acquisitions or initial public offerings, versus 27 percent of the male-led companies. But when Raina controlled for the presence of a female investor on the funding team, the gap completely disappeared, which suggests that the relationship between the founder and her investors, who also serve as coaching and governance partners, makes a difference.

To build a pipeline of female employees, venture capitalists should implement a form of the Rooney Rule, which the National Football League uses to increase diversity in its hiring practices for head coaches. Proposed in 2002 by Dan Rooney, the late owner of the Pittsburgh Steelers, after two teams fired minority coaches who had winning records, the rule mandates that teams interview at least one minority candidate for their head-coaching vacancies. No requirements are placed on hiring, merely on increasing exposure to the minority applicant pool. By 2006, the percentage of minority head coaches in the league had jumped from 6 percent to 22 percent. Today, eight of 32 teams have minority head coaches. Northwestern PhD candidate CC DuBois finds that a minority candidate has a 20 percent better chance of being hired as a head coach in the NFL than at the college level or as an NFL coordinator, neither of which is subject to the same requirement.

Tech giants including Amazon, Facebook, and Intel, as well as several government agencies, have voluntarily implemented their own forms of the Rooney Rule. A similar effort could force venture capitalists to expand their networks and broaden their searches for talent, and could make women aware of these jobs.

What, besides hiring female investment partners, can venture capitalists do in the short run to find and fund more of the best female entrepreneurs? Looking back at our rats provides some clues. White rats only needed a short time living with the black rats to see them as fellow rats. Familiarity is a subtle thing. VC firms need to increase their level of exposure to women investors and entrepreneurs.

For starters, firms could hire men with teenaged daughters. Research from Harvard’s Paul Gompers and Harvard PhD candidate Sophie Q. Wang suggests that when venture capitalists hire male partners who have teenaged daughters, those firms hire more women and perform better—increasing deal success and internal rate-of-return metrics by 3 percent.

VC firms could also add women to their advisory boards. I work with OCA Ventures, a leading tech investor in Chicago, and the partners there will attest that I bring them investment candidates that feature female founders, and I make sure the issue of team composition and diversity is discussed. Seeking out and networking with the most-successful female entrepreneurs in your region can only expand the accessible pool of female talent in hiring, deal sourcing, due diligence, and portfolio support, and help identify promising female entrepreneurs.

Finally, being aware of internal bias can help investors better coach and mentor female entrepreneurs. These investors can avoid the promotion-versus-prevention-oriented bias effect, by consciously scripting their due diligence interviews, plus they can encourage female entrepreneurs to reframe interview questions themselves. One of the most interesting discoveries in Kanze, Huang, Conley, and Higgins’s study is that when the entrepreneurs who were presented with predominantly prevention-oriented questions chose to give promotion-oriented answers, effectively changing the question orientation, they mitigated the negative effects of the bias. This allowed them to raise about $8 million, while entrepreneurs who answered with prevention-oriented responses received $563,000.

Waverly Deutsch is clinical professor and academic director of university-wide entrepreneurship content at Chicago Booth.

Harvard’s Claudia Goldin joins the Capitalisn’t podcast to discuss the drivers of gender pay disparities.

Capitalisn’t: Is Discrimination Still Causing the Gender Pay Gap?

Chicago Booth’s Marianne Bertrand talks with Oxford’s Linda Scott about the roots and repercussions of the “Double X Economy.”

Why Is Gender Inequality So Widespread?

What good entrepreneurs have in common, and what all entrepreneurs should know before launching their first start-ups.

What Makes a Successful Entrepreneur?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.