A Market without HFT?

How choices in market design affect the fortunes of various types of investors.

A Market without HFT?When automotive supplier Clark-Cutler-McDermott declared bankruptcy in July 2016, it refused to deliver parts and inventory to General Motors. As CCM was GM’s sole supplier of certain insulation and acoustic components, the company’s financial troubles threatened to disrupt production at several GM plants and cost the automaker tens of millions of dollars.

The dispute highlights the interdependence of manufacturers in a production network, where companies can be hurt by others, particularly suppliers, in their network. Research by Chicago Booth PhD candidate Ben Charoenwong looks at the dynamics of these supply chains and finds that some companies are better able than others to manage these risks—but all can be affected.

Guarding against weak links

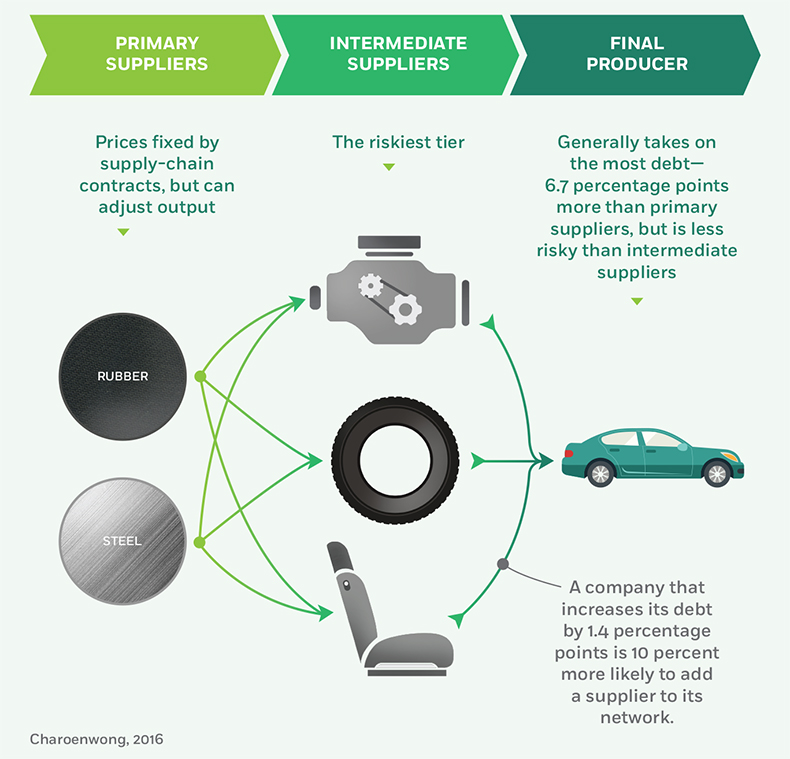

In an interdependent supply chain such as auto manufacturing, a company's ability to manage financial risks depends in part on its place in the chain.

When a company’s tax rate rises, it tends to take on more debt because it can deduct interest payments, Charoenwong finds. That higher debt represents additional financial risk. He analyzed a sample of 8,110 public companies that were customers or suppliers of other public firms between 1984 and 2014, looking at the responses of companies that experienced increases in their marginal corporate tax rate.

When companies took on more financial risk, they also took steps to diversify their supply chain, recognizing and potentially reducing the possibility of a supplier disruption. Overall, when a company increased leverage by 1.4 percentage points, it had a 10 percent higher chance of adding another supplier.

The risks that companies managed differed depending in part on their place in a supply chain. Primary producers, at the top of the chain, had prices fixed by supply-chain contracts, but could adjust their output if needed. Final producers had to rely on suppliers, but could adjust their final prices to meet consumer demand. For example, if a mining company had a shortage of silicon that would ultimately end up in phones, and a phone producer made fewer phones than intended, the producer could charge consumers more.

In Charoenwong’s research, final producers were able to take on the largest amount of debt: they had 6.7 percentage points more long-term book leverage compared with primary producers. But intermediate producers, subject to variability in both output quantity and price, comprised the riskiest tier in the network. And as GM experienced, risk at one company in a supply chain can spread—and affect the entire network.

How choices in market design affect the fortunes of various types of investors.

A Market without HFT?

Consumers underestimate how long debt will persist making only minimum payments.

How Automatic Minimum Credit Card Payments Cost Consumers—and How Regulators Could Help

Author Vivek Ramaswamy joins the Capitalisn’t podcast to discuss the roles of virtue, ethics, and politics in business and society.

Capitalisn’t: Is ‘Woke’ Capitalism a Threat to Democracy?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.