What Explains the Volatility in Financial Markets?

How the inelastic markets hypothesis makes sense of seemingly inexplicable price movement

What Explains the Volatility in Financial Markets?

How the headline of a news or earnings report is worded affects who pays attention and how much attention they pay. Investors pay less attention to long and complex headlines, and that has an effect on markets, research suggests.

“Investors are significantly more attracted to short and simple titles,” writes Chicago Booth PhD candidate Tarik Umar, in a working paper. The effect is pronounced on slow news days, when the volatility index is low, and on afternoons and Fridays. “Cognitive effort affects market behavior, even for investors in a high-stakes setting with strong interests in stock specific news.”

Umar reveals these biases by studying investor responses to various titles given to stock reports published by Seeking Alpha. A crowd-sourced-investment-research firm, Seeking Alpha has 4 million registered investors and 85 million page views a month. Nearly 80 percent of its audience is made up of retail, or nonprofessional, investors.

In January 2016, Seeking Alpha began allowing analysts to write two versions of the titles of their investment reports. An analyst’s editor could propose a third title. The three titles were tested by random assignment on investors who had signed up for Seeking Alpha’s real-time alerts about the company covered by the report. In the email alerts, investors received only the headline and a link to the full report. Seeking Alpha tracked how much attention investors gave to each version based on how many people clicked on the link to read more, and on how much they read.

Less is more

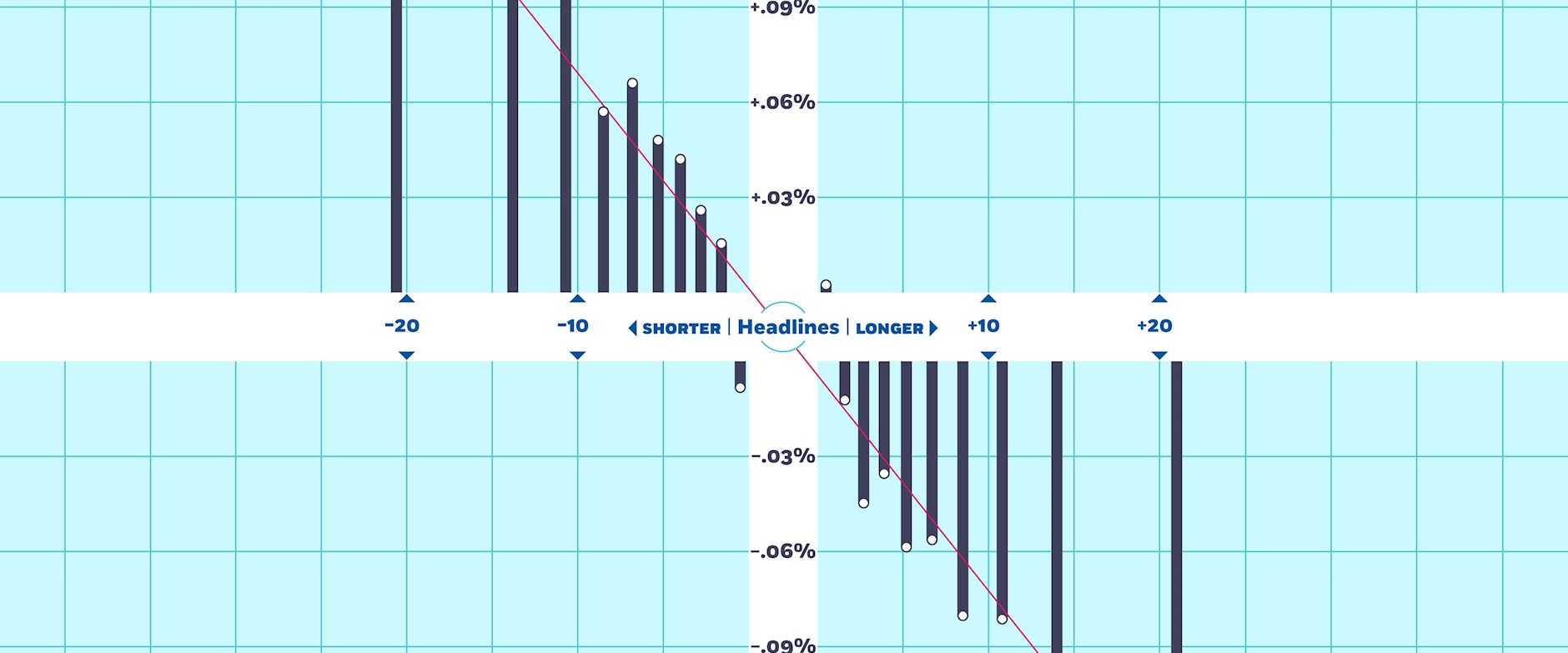

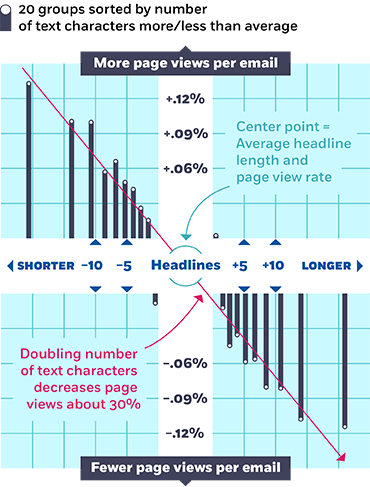

On a popular market-analysis website, investors were far more likely to read a stock report if it had a short headline.

Pageviews for stock reports, by length of headlines in promotional emails

Umar, 2016

Analyzing Seeking Alpha data, Umar noted the page views each title received and the number of investors who scrolled to the end of the report. He also used the comments that followed the stock report to measure variation in the sophistication of investors following the company—he assumes that commenters who also contributed their own reports to Seeking Alpha are more sophisticated than those who only read others’ submissions.

Investors, he finds, greatly prefer short, simple headlines. A title that was one standard deviation longer, about a third longer, received 12 percent fewer page views.

Seeking Alpha’s mainly retail-investor audience is less likely to have the time and resources to devote to learning about stocks like the pros. They are more likely to rely on heuristics: common shortcuts or mental models that guide human behavior. These models can be helpful, such as when emergency medics quickly diagnose life-threatening conditions from a handful of symptoms. But they can also be misleading, steering modern-day investors to devote undue attention to the negative slant of an investment report.

However, even highly educated academics paid less attention to longer titles. Umar finds that on the Social Science Research Network database, papers with twice the title length received 11 percent fewer views, 13 percent fewer downloads, and 4 percent fewer citations. Umar also finds a preference for negative titles.

These variations in attention translate into market dynamics. In a separate analysis, Umar examined 305,000 earnings press releases issued from 1992 to 2015. He finds that a longer title on a press release was correlated with less turnover, fewer trades, lower volatility, and temporarily lower returns in the shares of the company announcing the news. The effect on returns completely reversed within a month. Recognizing these predictable biases gives investors one more way to outwit the herd.

Tarik Umar, “Complexity Aversion When Seeking Alpha,” Working paper, February 2017.

How the inelastic markets hypothesis makes sense of seemingly inexplicable price movement

What Explains the Volatility in Financial Markets?

Capitalisn’t podcast hosts Luigi Zingales and Bethany McLean talk monetary policy with Stanford’s John H. Cochrane.

Capitalisn’t: A Different Story of Inflation

Artificial intelligence is proving adept at technical investing.

How Self-Driving-Car Technology Can Help Machines Trade StocksYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.