Infographic: In China, a Loophole Allowed Insider Trades

Research highlights the need for cross-border cooperation among securities regulators.

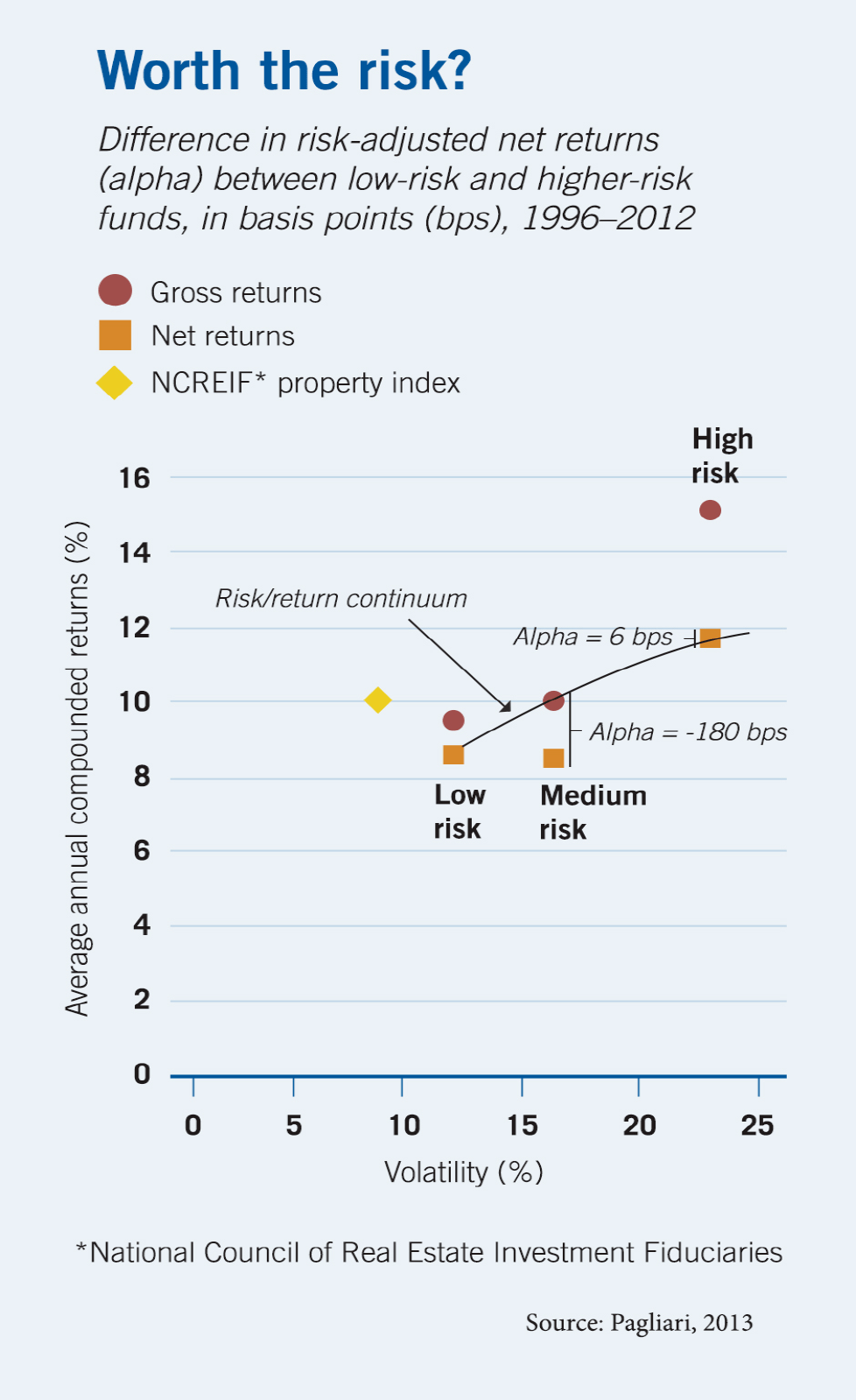

Infographic: In China, a Loophole Allowed Insider TradesIn commercial real estate, less risk could mean higher returns

Investors who buy distressed property add risk to their portfolios, but not much more in returns.

High-risk funds outperformed low-risk funds by only a few basis points per year, an advantage that may not be worth the danger to investors.

Joseph L. Pagliari Jr., “An Overview of Fee Structures in Real Estate Funds and Their Implications for Investors,” Research report for the Pension Real Estate Association, 2013.

Research highlights the need for cross-border cooperation among securities regulators.

Infographic: In China, a Loophole Allowed Insider Trades

A Q&A with Chicago Booth’s Robert W. Vishny on the legacy of the common-law tradition.

Robust US Innovation Is Rooted in Legal History

Global investors’ appetite for dollar-denominated assets has big implications for currency markets and the US economy.

How Much Does the US Dollar’s Primacy Depend on Investor Demand?Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.