Capitalisn’t: The Capitalisn’t of Banking

Stanford’s Anat Admati describes how we can build a better financial system.

Capitalisn’t: The Capitalisn’t of BankingWhy no news is news

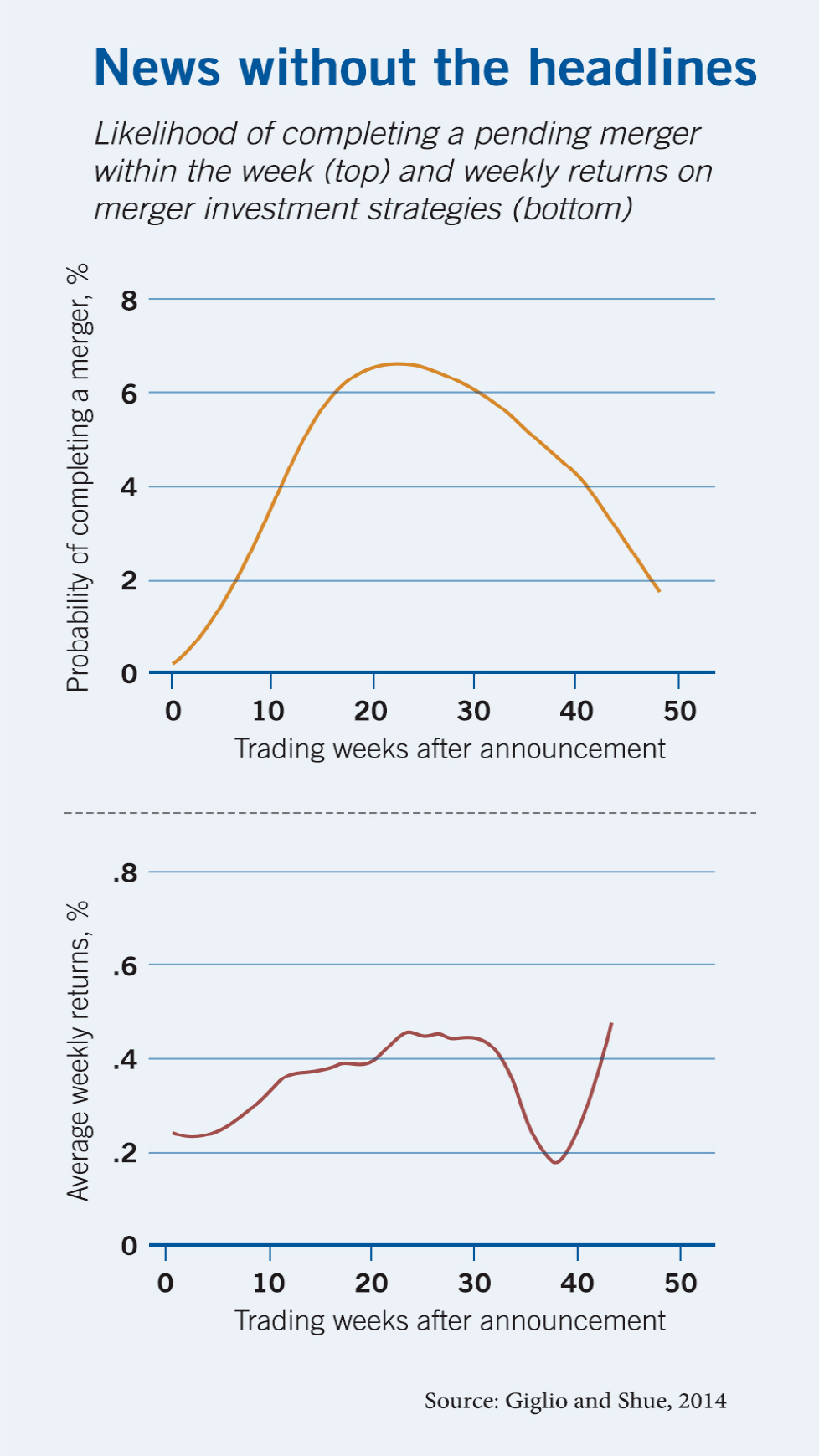

The absence of news reports and the passage of time often contain important information markets tend to overlook

Research suggests that investors, by underreacting to information tied to the passage of time, are ignoring potential profits.

Stefano Giglio and Kelly Shue, “No News Is News: Do Markets Underreact to Nothing?” Review of Financial Studies, August 2014. Chart reprinted with permission from Oxford University Press. Copyright 2014.

Stanford’s Anat Admati describes how we can build a better financial system.

Capitalisn’t: The Capitalisn’t of Banking

The growth of privately held businesses has some regulators and policy makers pondering whether to push for more financial transparency.

Is the US Economy ‘Going Dark’?

Big funds lead to big asset managers—and big has performance issues.

In Active Mutual Funds, Bigger Still Isn’t BetterYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.