In Finance, Humans Were the First Machines

A Q&A with Chicago Booth’s Dacheng Xiu on the implications of machine learning for the financial markets.

In Finance, Humans Were the First MachinesHow investment funds disguise underperformance

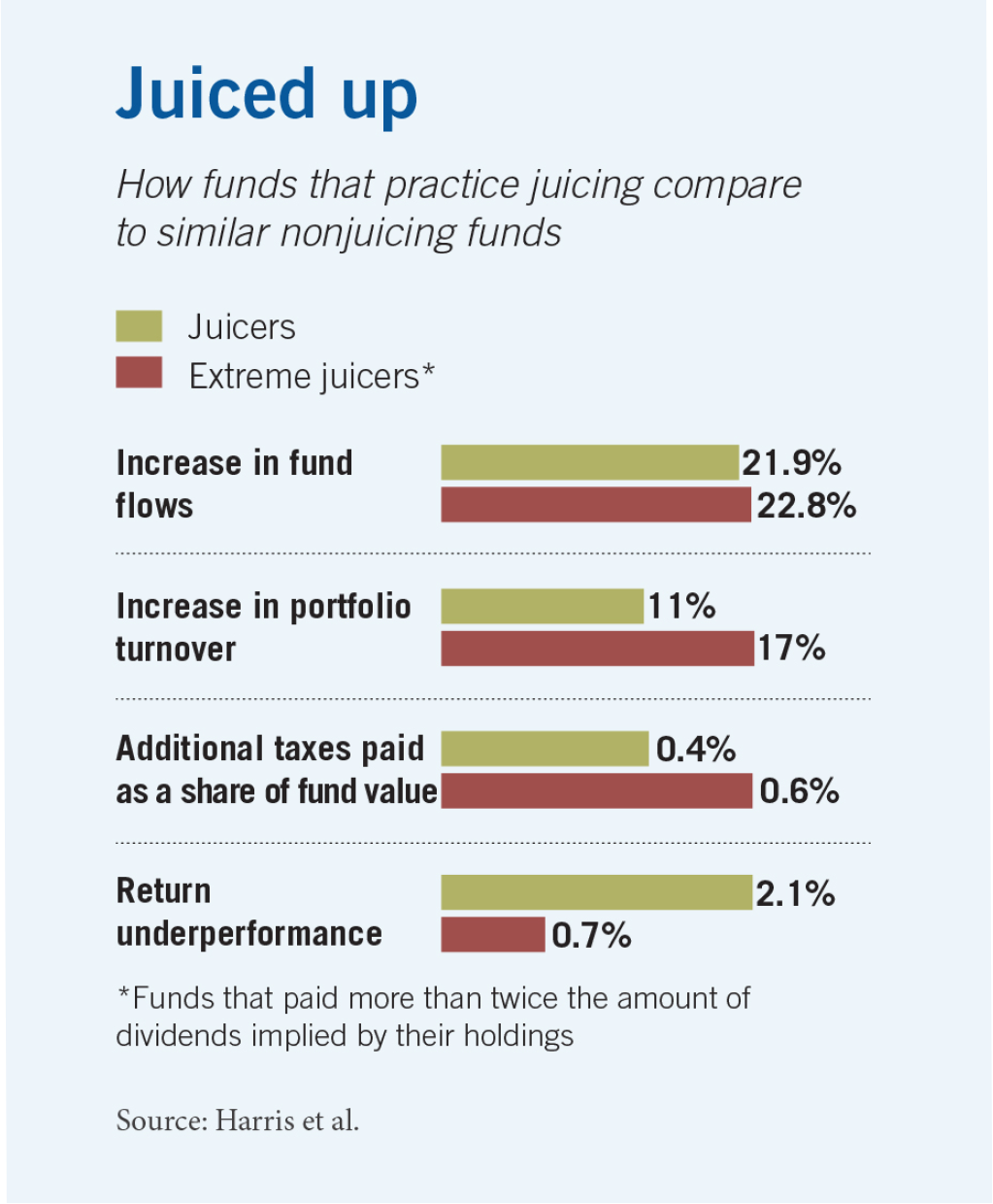

Equity mutual funds artificially boost their dividend yields to attract more investors.

‘Juicing’ is costly to investors.

Lawrence E. Harris, Samuel Hartzmark, and David H. Solomon, “Juicing the Dividend Yield: Mutual Funds and the Demand for Dividends,” Journal of Financial Economics, forthcoming.

A Q&A with Chicago Booth’s Dacheng Xiu on the implications of machine learning for the financial markets.

In Finance, Humans Were the First Machines

Research finds that banks prefer to issue mortgages for newer and more standardized housing stock.

Line of Inquiry: Anthony Lee Zhang on Why Buying Your Unique House May Be a Challenge

The simple financial instrument belies a complex process that makes it work.

Passive ETFs Are Surprisingly ActiveYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.