Infographic: In China, a Loophole Allowed Insider Trades

Research highlights the need for cross-border cooperation among securities regulators.

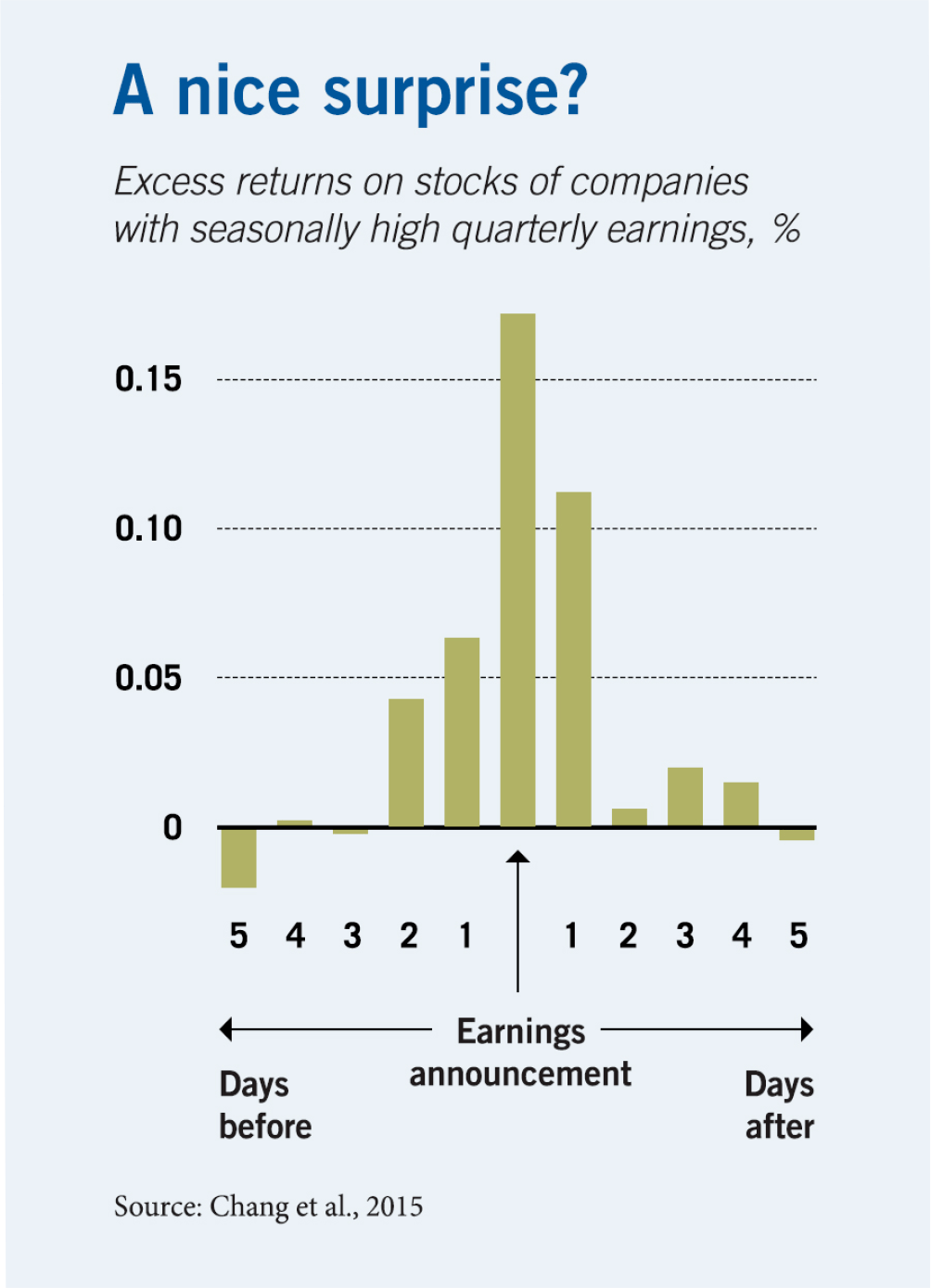

Infographic: In China, a Loophole Allowed Insider TradesWhy investors misprice cyclical stocks

Traders who account for seasonal earnings can make big profits.

Investors often seem to be surprised by seasonally strong earnings.

Tom Y. Chang, Samuel M. Hartzmark, David H. Solomon, and Eugene F. Soltes, “Being Surprised at the Unsurprising: Earnings Seasonality and Stock Returns,” Working paper, April 2015.

Research highlights the need for cross-border cooperation among securities regulators.

Infographic: In China, a Loophole Allowed Insider Trades

Rising rates have exposed landlords’ significant interest-rate risk.

Why South Korea’s Housing Market Is So Vulnerable

Research suggests HFT winners gain billions of dollars per year at the expense of other participants in global stock markets.

How to Calculate How Much High-Frequency Trading Costs InvestorsYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.