Capitalisn’t: The Capitalisn’t of Crypto—SBF and Beyond

Reporter Zeke Faux discusses crypto and the conviction of FTX founder Sam Bankman-Fried.

Capitalisn’t: The Capitalisn’t of Crypto—SBF and BeyondWhy cash profits are the best predictor of stock performance

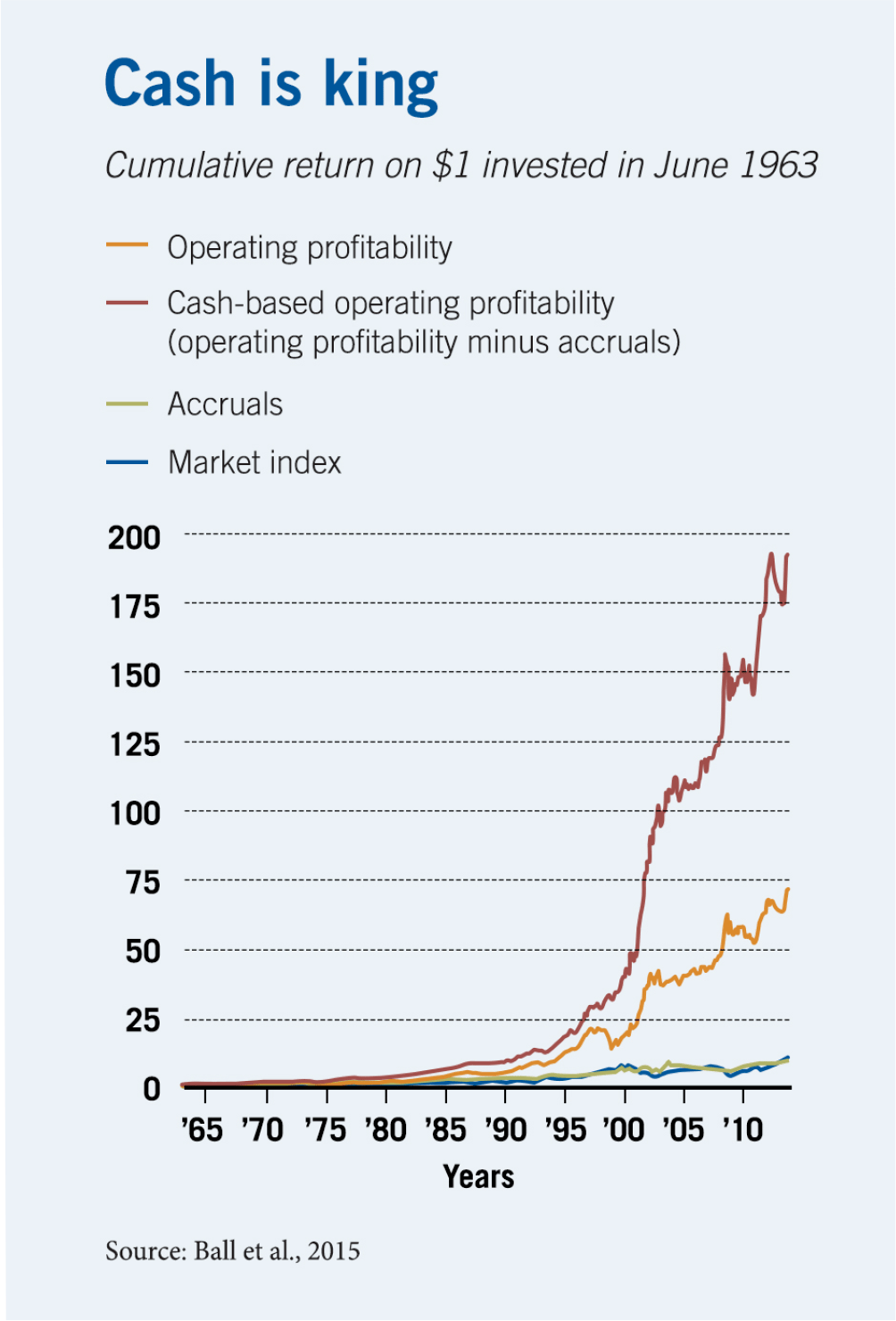

Firms that are more profitable today on a cash basis could earn higher future returns.

Returns for a portfolio of companies with strong cash-based earnings were more than double those for a portfolio based on operating profit or accruals.

Ray Ball, Joseph Gerakos, Juhani Linnainmaa, and Valeri Nikolaev, “Accruals, Cash Flows, and Operating Profitability in the Cross Section of Stock Returns,” Fama-Miller working paper, April 2015.

Reporter Zeke Faux discusses crypto and the conviction of FTX founder Sam Bankman-Fried.

Capitalisn’t: The Capitalisn’t of Crypto—SBF and Beyond

Policy makers trying to level the economic playing field need to understand the components of private wealth in order to establish taxes and rates that work as intended.

How Rich Are the Superrich, Exactly?

In areas lacking formal reporting and resolution systems, community-driven reciprocity may fill in and enable access to crwww.

In Some Places, Community Is Key to Who Gets Commercial CreditYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.