Are US Banks Hiding Their Losses?

Assets marked as ‘hold to maturity’ don’t have to be marked down as they lose value.

Are US Banks Hiding Their Losses?

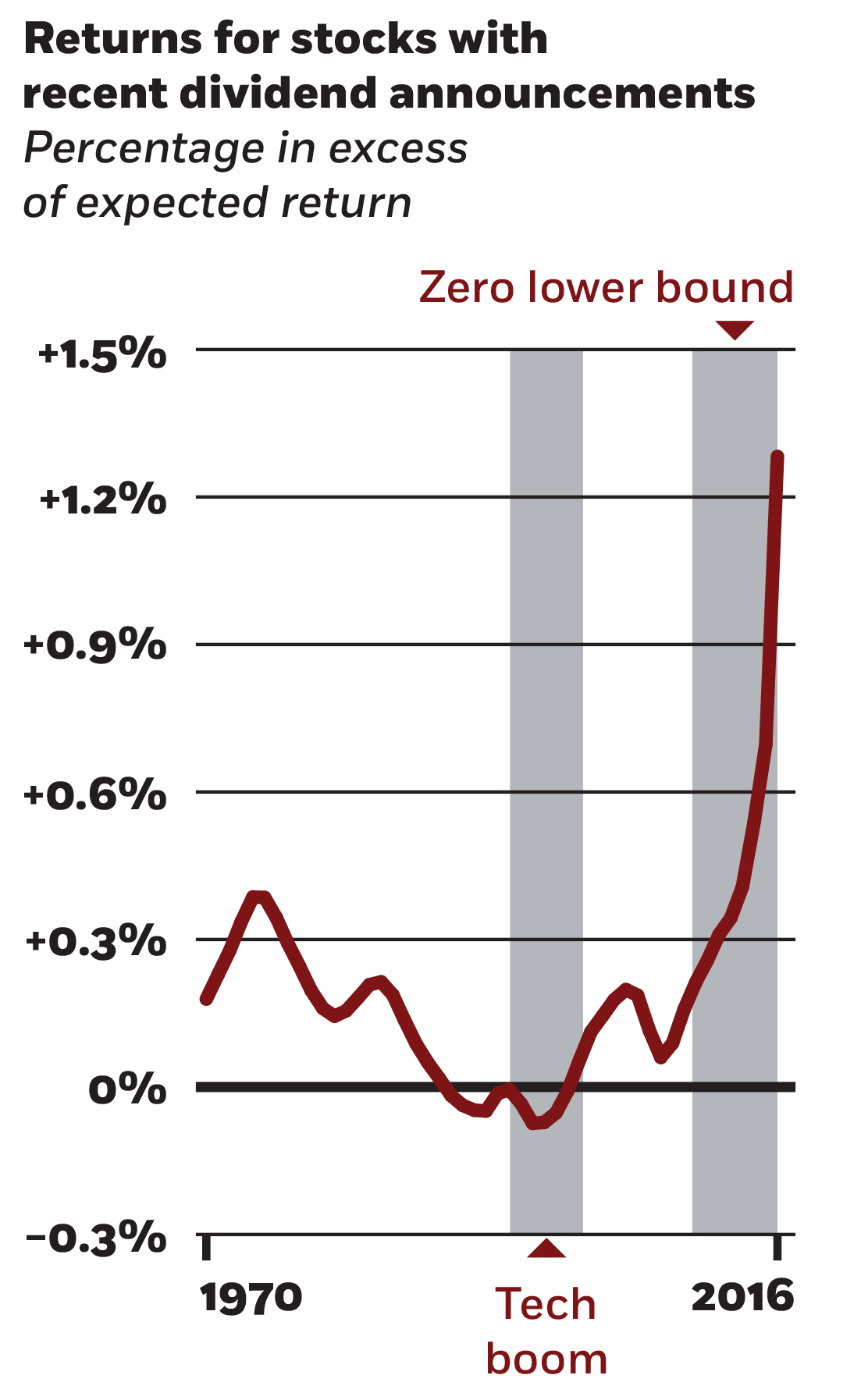

Big and small investors fall for the free-dividends fallacy.

Samuel Hartzmark and David H. Solomon, “The Dividend Disconnect,” Working paper, November 2016.

Assets marked as ‘hold to maturity’ don’t have to be marked down as they lose value.

Are US Banks Hiding Their Losses?

And stubborn inflation could make things a lot worse.

Rate Hikes Are Costing the Fed and the Treasury

In areas lacking formal reporting and resolution systems, community-driven reciprocity may fill in and enable access to crwww.

In Some Places, Community Is Key to Who Gets Commercial CreditYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.