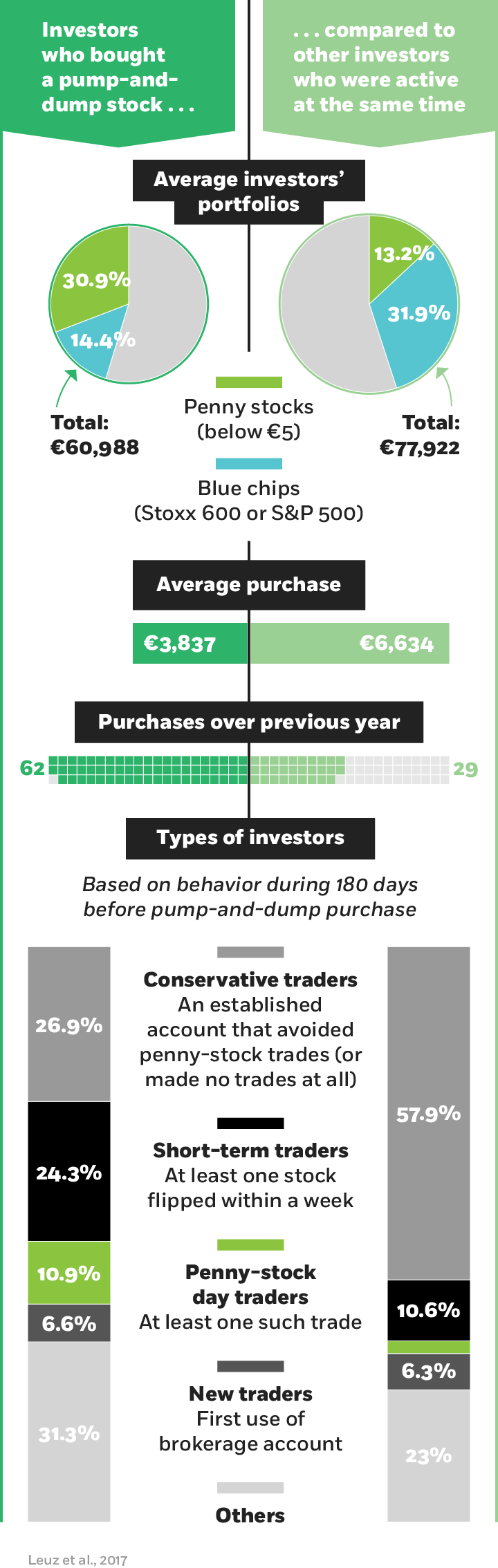

On average, each scheme reduced investors’ wealth by €800, generating losses of at least €1.2 million for German online investors. The average investor in tout schemes was an older, married male not residing in a big city, who had a high self-assessed risk tolerance, the researchers find. Blue-collar workers, retirees, and the self-employed were also more likely to invest in these schemes. But trading behavior, demonstrated by the composition of investors’ portfolios and their past trading patterns, was a better predictor than demographics of who participated: more than 35 percent of pump-and-dump investors were day-trading in penny stocks or were frequent traders with short-term horizons, taking substantial risks and trading aggressively before they participated in the schemes, the researchers find.

“The frequency with which some investors invest in touts as well as the composition of their portfolios suggests that not all tout investors are gullible or fall prey to pump-and-dump schemes,” the researchers write. The observation that some investors may actively search for pump-and-dump schemes underscores the need for regulators to better understand who actually buys touted stocks when they’re trying to design more-effective investor protections. Many pump-and-dump stocks trade on over-the-counter or alternative markets that are less regulated than the major exchanges.

For some investors, interventions—such as prompts to take more time before making investment decisions and to think about whether funds look suspicious—could decrease the likelihood of participating in pump-and-dump schemes. But the researchers warn that these techniques are less likely to work for the subset of investors who intentionally seek out such schemes for the sheer thrill of it and the possibility of big, quick gains.